Bunzl Investor Day Presentation Deck

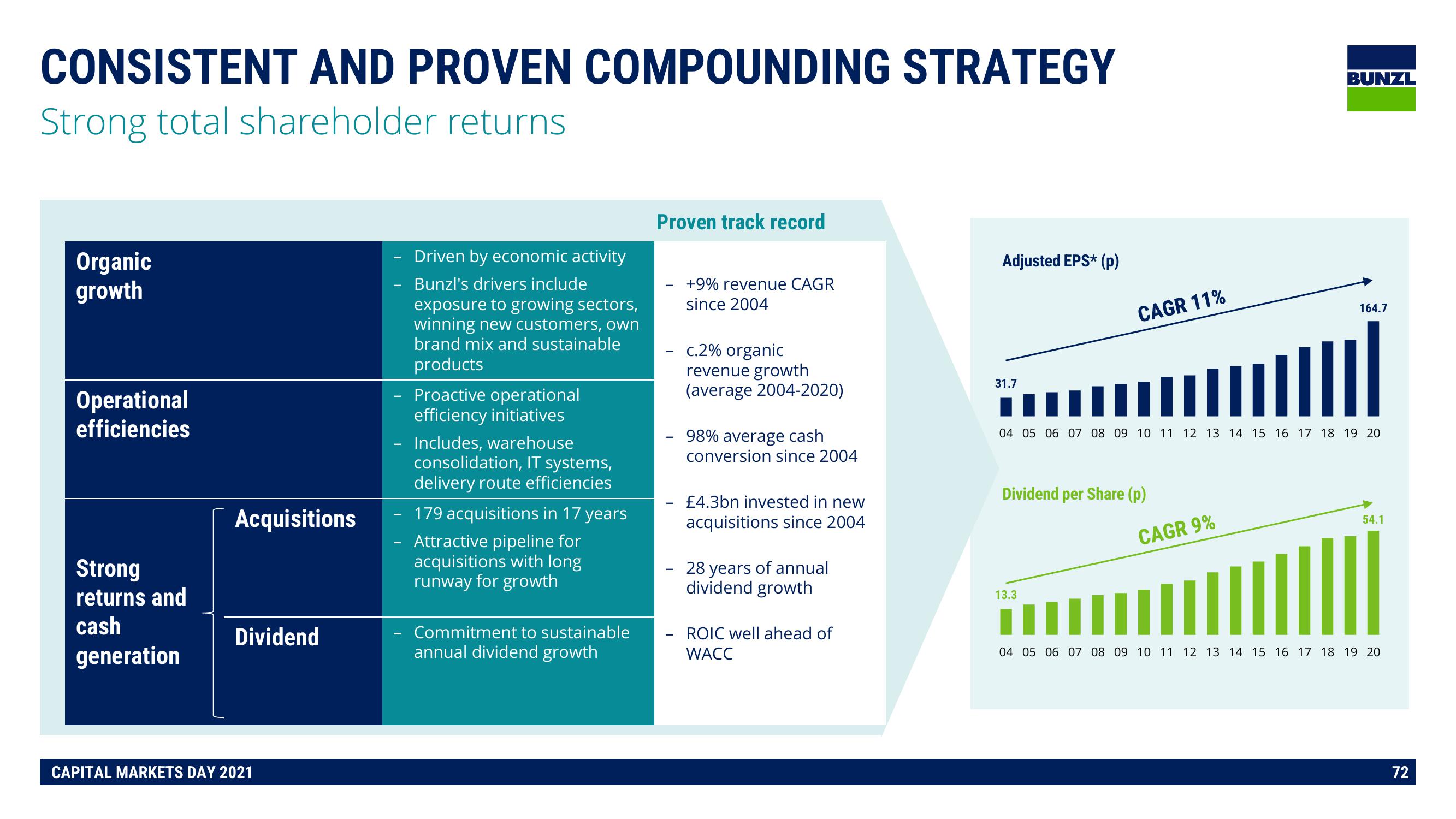

CONSISTENT AND PROVEN COMPOUNDING STRATEGY

Strong total shareholder returns

Organic

growth

Operational

efficiencies

Strong

returns and

cash

generation

Acquisitions

Dividend

CAPITAL MARKETS DAY 2021

Driven by economic activity

- Bunzl's drivers include

exposure to growing sectors,

winning new customers, own

brand mix and sustainable

products

Proactive operational

efficiency initiatives

- Includes, warehouse

consolidation, IT systems,

delivery route efficiencies

-

179 acquisitions in 17 years

Attractive pipeline for

acquisitions with long

runway for growth

Commitment to sustainable

annual dividend growth

Proven track record

-

- 98% average cash

conversion since 2004

-

+9% revenue CAGR

since 2004

-

c.2% organic

revenue growth

(average 2004-2020)

£4.3bn invested in new

acquisitions since 2004

28 years of annual

dividend growth

ROIC well ahead of

WACC

Adjusted EPS* (p)

31.7

CAGR 11%

Dividend per Share (p)

13.3

04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20

BUNZL

CAGR 9%

164.7

54.1

04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20

72View entire presentation