AeroFarms SPAC Presentation Deck

Models 6 & 7 Financial Performance Pathways: CapEx, Revenue

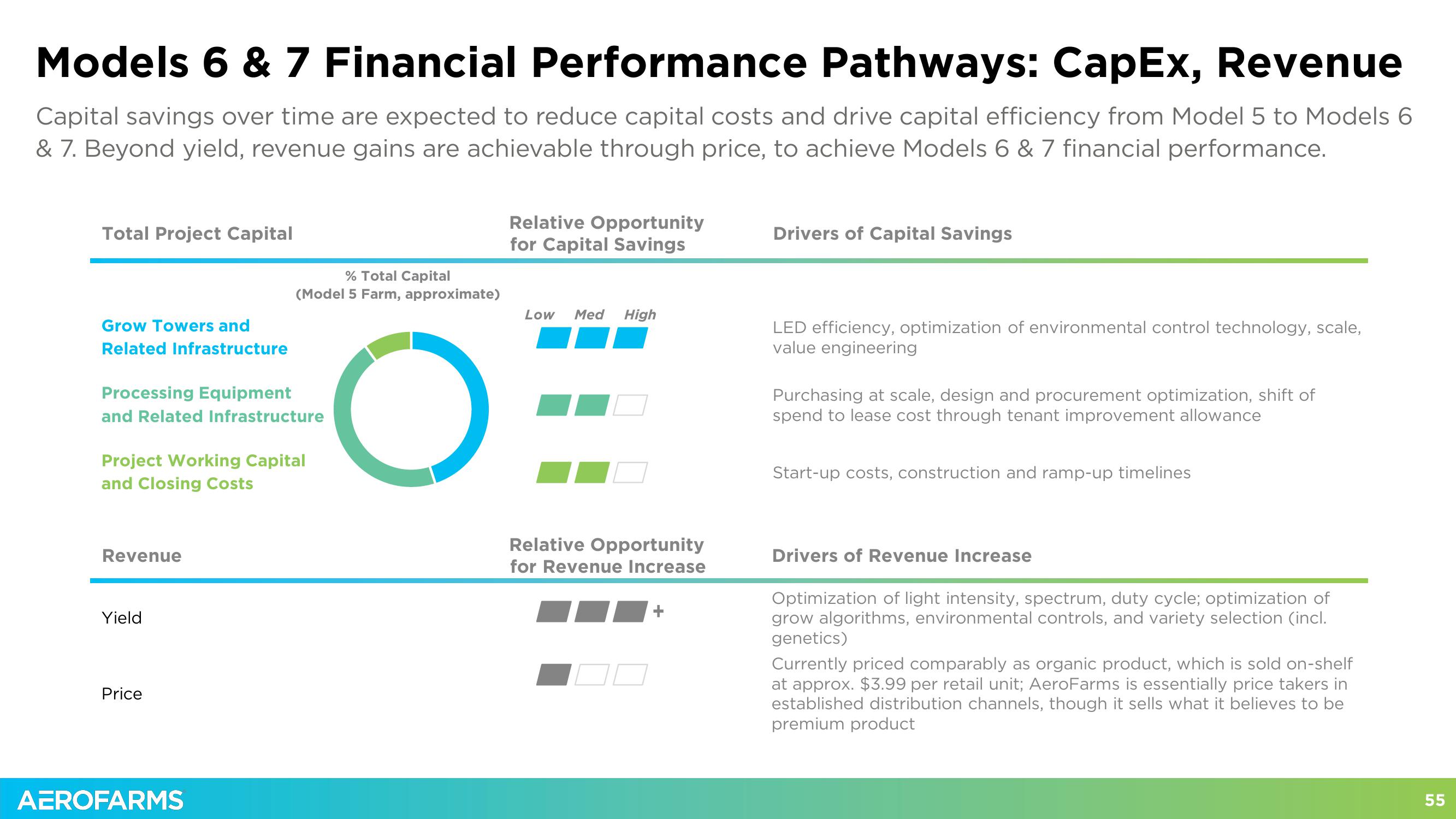

Capital savings over time are expected to reduce capital costs and drive capital efficiency from Model 5 to Models 6

& 7. Beyond yield, revenue gains are achievable through price, to achieve Models 6 & 7 financial performance.

Total Project Capital

Grow Towers and

Related Infrastructure

Processing Equipment

and Related Infrastructure

Project Working Capital

and Closing Costs

Revenue

Yield

% Total Capital

(Model 5 Farm, approximate)

O

Price

AEROFARMS

Relative Opportunity

for Capital Savings

Low Med High

Relative Opportunity

for Revenue Increase

Drivers of Capital Savings

LED efficiency, optimization of environmental control technology, scale,

value engineering

Purchasing at scale, design and procurement optimization, shift of

spend to lease cost through tenant improvement allowance

Start-up costs, construction and ramp-up timelines

Drivers of Revenue Increase

Optimization of light intensity, spectrum, duty cycle; optimization of

grow algorithms, environmental controls, and variety selection (incl.

genetics)

Currently priced comparably as organic product, which is sold on-shelf

at approx. $3.99 per retail unit; AeroFarms is essentially price takers in

established distribution channels, though it sells what it believes to be

premium product

55View entire presentation