CorpAcq SPAC Presentation Deck

25

2B

Kol

O

✓

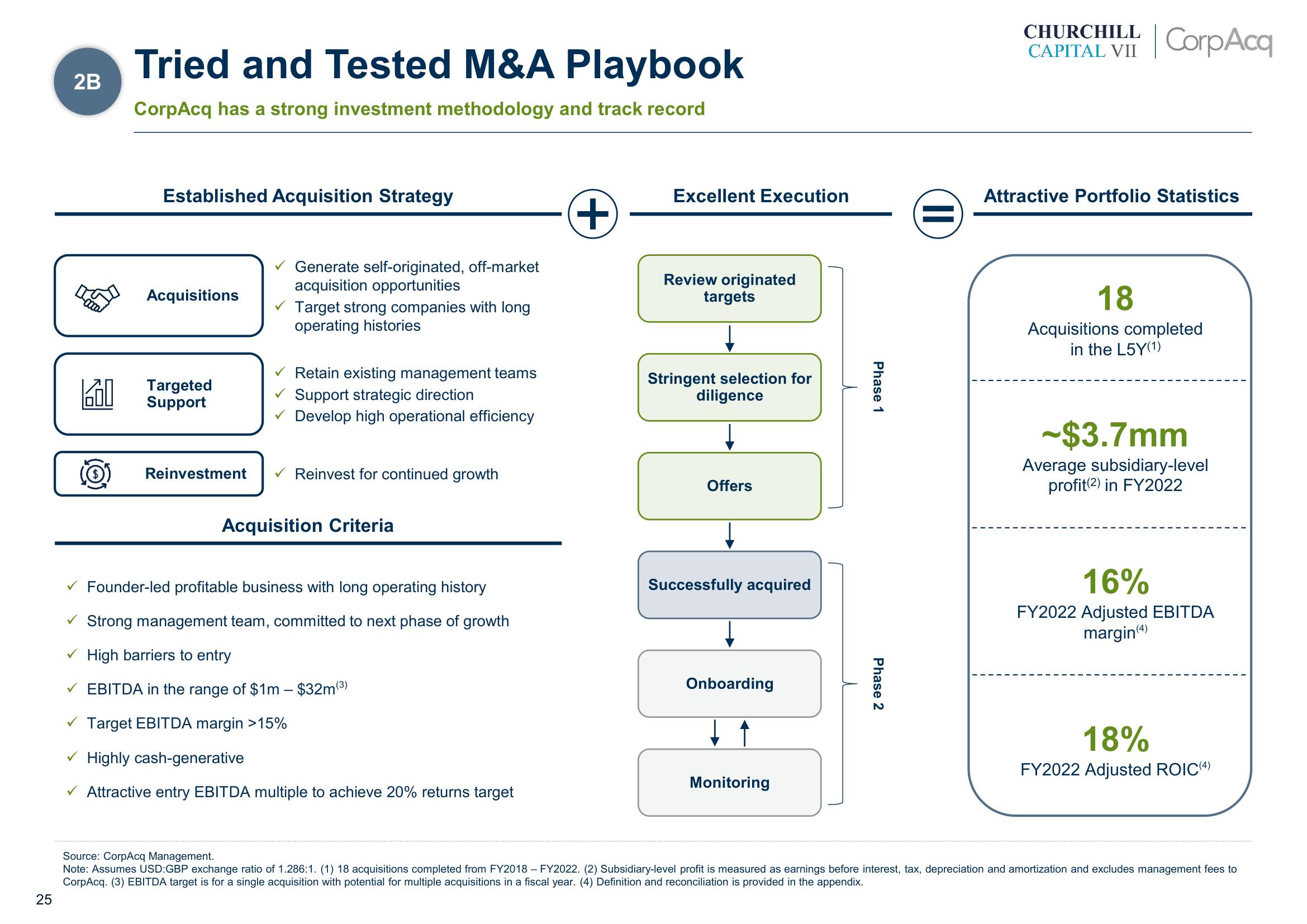

Tried and tested M&A Playbook

CorpAcq has a strong investment methodology and track record

Established Acquisition Strategy

Acquisitions

Targeted

Support

Reinvestment

Generate self-originated, off-market

acquisition opportunities

✓ Target strong companies with long

operating histories

Retain existing management teams

Support strategic direction

Develop high operational efficiency

Reinvest for continued growth

Acquisition Criteria

✓ Founder-led profitable business with long operating history

Strong management team, committed to next phase of growth

✓ High barriers to entry

EBITDA in the range of $1m - $32m (³)

✓ Target EBITDA margin >15%

Highly cash-generative

✓ Attractive entry EBITDA multiple to achieve 20% returns target

+

Excellent Execution

Review originated

targets

Stringent selection for

diligence

Offers

Successfully acquired

Onboarding

Monitoring

Phase 1

Phase 2

=

CHURCHILL

CAPITAL VII CorpAcq

Attractive Portfolio Statistics

18

Acquisitions completed

in the L5Y(1)

-$3.7mm

Average subsidiary-level

profit (2) in FY2022

16%

FY2022 Adjusted EBITDA

margin(4)

18%

FY2022 Adjusted ROIC(4)

Source: CorpAcq Management.

Note: Assumes USD:GBP exchange ratio of 1.286:1. (1) 18 acquisitions completed from FY2018 - FY2022. (2) Subsidiary-level profit is measured as earnings before interest, tax, depreciation and amortization and excludes management fees to

CorpAcq. (3) EBITDA target is for a single acquisition with potential for multiple acquisitions in a fiscal year. (4) Definition and reconciliation is provided in the appendix.View entire presentation