J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

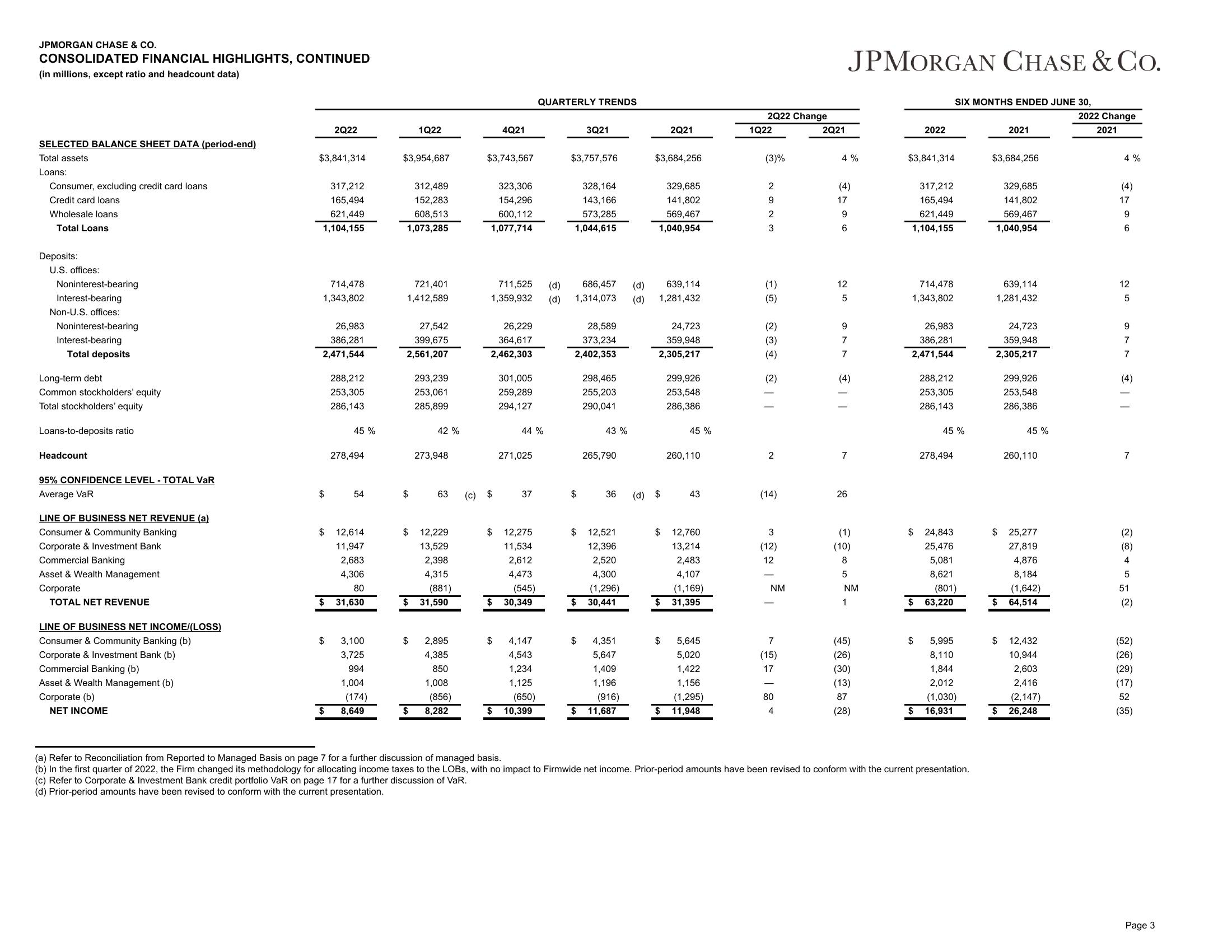

CONSOLIDATED FINANCIAL HIGHLIGHTS, CONTINUED

(in millions, except ratio and headcount data)

SELECTED BALANCE SHEET DATA (period-end)

Total assets

Loans:

Consumer, excluding credit card loans

Credit card loans

Wholesale loans.

Total Loans

Deposits:

U.S. offices:

Noninterest-bearing

Interest-bearing

Non-U.S. offices:

Noninterest-bearing

Interest-bearing

Total deposits

Long-term debt

Common stockholders' equity

Total stockholders' equity

Loans-to-deposits ratio

Headcount

95% CONFIDENCE LEVEL - TOTAL VAR

Average VaR

LINE OF BUSINESS NET REVENUE (a)

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

TOTAL NET REVENUE

LINE OF BUSINESS NET INCOME/(LOSS)

Consumer & Community Banking (b)

Corporate & Investment Bank (b)

Commercial Banking (b)

Asset & Wealth Management (b)

Corporate (b)

NET INCOME

$3,841,314

317,212

165,494

621,449

1,104,155

714,478

1,343,802

26,983

386,281

2,471,544

$

2Q22

$

$

$

$

288,212

253,305

286,143

45 %

278,494

54

12,614

11,947

2,683

4,306

80

31,630

3,100

3,725

994

1,004

(174)

8,649

1Q22

$3,954,687

312,489

152,283

608,513

1,073,285

721,401

1,412,589

27,542

399,675

2,561,207

$

293,239

253,061

285,899

42 %

273,948

$ 12,229

13,529

2,398

4,315

(881)

$ 31,590

2,895

4,385

850

1,008

63 (c) $

(856)

$ 8,282

$3,743,567

323,306

154,296

600,112

1,077,714

4Q21

26,229

364,617

2,462,303

$

711,525 (d) 686,457 (d)

1,359,932 (d) 1,314,073 (d)

$

301,005

259,289

294,127

44%

271,025

37

12,275

11,534

2,612

4,473

(545)

$ 30,349

4,147

4,543

QUARTERLY TRENDS

1,234

1,125

(650)

$ 10,399

$3,757,576

3Q21

328,164

143,166

573,285

1,044,615

28,589

373,234

2,402,353

$

$

298,465

255,203

290,041

43 %

265,790

36

$ 12,521

12,396

2,520

4,300

(1,296)

$ 30,441

4,351

5,647

1,409

1,196

(916)

$ 11,687

$3,684,256

329,685

141,802

569,467

1,040,954

639, 114

1,281,432

2Q21

24,723

359,948

2,305,217

(d) $

$

$

$

299,926

253,548

286,386

45 %

$ 12,760

13,214

2,483

4,107

(1,169)

31,395

260,110

43

5,645

5,020

1,422

1,156

(1,295)

11,948

2Q22 Change

1Q22

(3)%

2

9

2

3

(1)

(5)

(2)

(3)

(4)

(2)

| |

2

(14)

3

(12)

12

NM

I

7

(15)

17

80

4

2Q21

4%

(4)

17

9

6

12

5

216

| | ê

7

JPMORGAN CHASE & Co.

26

(1)

(10)

8

5

NM

1

(45)

(26)

(30)

(13)

87

(28)

$3,841,314

317,212

165,494

621,449

1,104,155

714,478

1,343,802

2022

26,983

386,281

2,471,544

$

$

$

$

288,212

253,305

286,143

45 %

278,494

24,843

25,476

5,081

8,621

SIX MONTHS ENDED JUNE 30,

(801)

63,220

5,995

8,110

1,844

2,012

(1,030)

16,931

(a) Refer to Reconciliation from Reported to Managed Basis on page 7 for a further discussion of managed basis.

(b) In the first quarter of 2022, the Firm changed its methodology for allocating income taxes to the LOBS, with no impact to Firmwide net income. Prior-period amounts have been revised to conform with the current presentation.

(c) Refer to Corporate & Investment Bank credit portfolio VaR on page 17 for a further discussion of VaR.

(d) Prior-period amounts have been revised to conform with the current presentation.

2021

$3,684,256

329,685

141,802

569,467

1,040,954

639,114

1,281,432

24,723

359,948

2,305,217

$

299,926

253,548

286,386

45 %

260,110

$ 25,277

27,819

4,876

8,184

(1,642)

64,514

12,432

10,944

2,603

2,416

(2,147)

$ 26,248

2022 Change

2021

4%

(4)

17

9

6

12

5

9

7

7

(4)

| |

7

(2)

(8)

4

5

51

(2)

(52)

(26)

(29)

(17)

52

(35)

Page 3View entire presentation