Overstock Results Presentation Deck

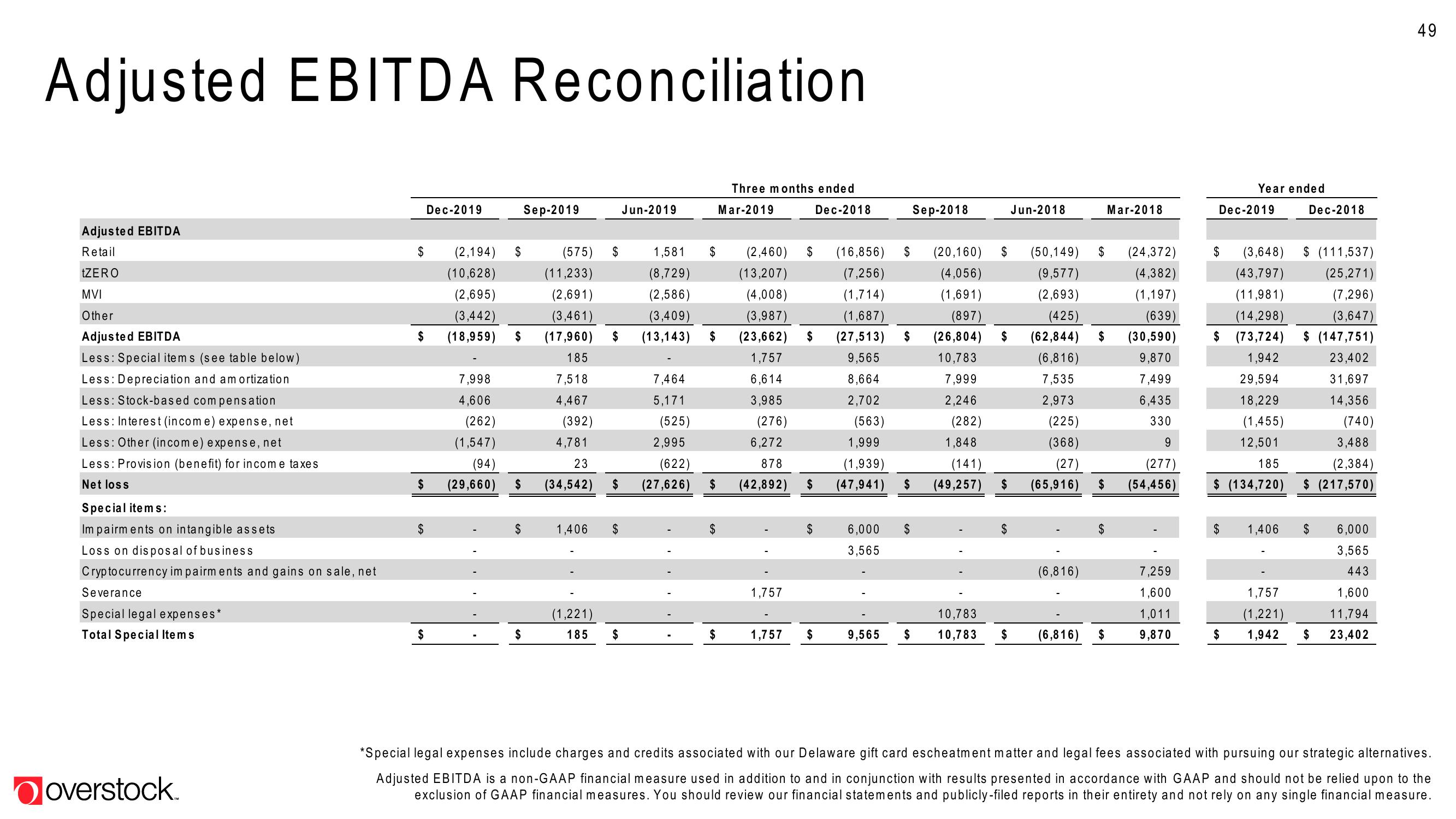

Adjusted EBITDA Reconciliation

Adjusted EBITDA

Retail

tZERO

MVI

Other

Adjusted EBITDA

Less: Special items (see table below)

Less: Depreciation and amortization

Less: Stock-based compensation

Less: Interest (income) expense, net

Less: Other (income) expense, net

Less: Provision (benefit) for income taxes

Net loss

Special items:

Impairments on intangible assets

Loss on disposal of business

Cryptocurrency impairments and gains on sale, net

Severance

Special legal expenses*

Total Special Items

overstock.

$

$

$

$

Dec-2019

,194

(10,628)

(2,695)

(3,442)

(18,959)

7,998

4,606

(262)

(1,547)

(94)

(29,660)

$

$

$

Sep-2019

$

(2,460 $ 16,856)

(13,207)

(7,256)

(57

(11,233)

(2,691)

(3,461)

(4,008)

(3,987)

(1,714)

(1,687)

(27,513) $

9,565

$ (17,960) $ (13,143) $ (23,662)

185

1,757

7,518

6,614

8,664

4,467

3,985

2,702

(392)

4,781

23

$

1,406 $

(1,221)

185

Jun-2019

1,581 $

(8,729)

(2,586)

(3,409)

$

7,464

5,171

(622)

(34,542) $ (27,626)

(525)

2,995

$

$

Three months ended

$

Mar-2019

(276)

6,272

878

(42,892)

1,757

1,757

$

$

$

Dec-2018

$

6,000

3,565

Sep-2018

9,565 $

(20

(4,056)

(1,691)

(897)

(26,804) $

10,783

7,999

2,246

(563)

1,848

1,999

(1,939)

(141)

(47,941) $ (49,257)

(282)

$

Jun-2018

0,14

(9,577)

(2,693)

(425)

(62,844) $

(6,816)

7,535

2,973

(225)

(368)

(27)

$ (65,916) $

(6,816)

$ (24,372)

(4,382)

(1,197)

(639)

(30,590)

9,870

7,499

6,435

330

9

(277)

(54,456)

10,783

10,783 $ (6,816)

Mar-2018

$

7,259

1,600

1,011

9,870

Dec-2019

Year ended

$

$ (111,537

(43,797) (25,271)

(11,981)

(7,296)

(14,298)

(3,647)

$ (73,724) $ (147,751)

1,942

29,594

23,402

31,697

14,356

18,229

(1,455)

12,501

185

$ (134,720)

$

Dec-2018

1,406

(740)

3,488

(2,384)

$ (217,570)

$

1,757

(1,221)

$ 1,942 $

6,000

3,565

443

1,600

11,794

23,402

49

*Special legal expenses include charges and credits associated with our Delaware gift card escheatment matter and legal fees associated with pursuing our strategic alternatives.

Adjusted EBITDA is a non-GAAP financial measure used in addition to and in conjunction with results presented in accordance with GAAP and should not be relied upon to the

exclusion of GAAP financial measures. You should review our financial statements and publicly-filed reports in their entirety and not rely on any single financial measure.View entire presentation