Spotify Results Presentation Deck

Operating Expenses

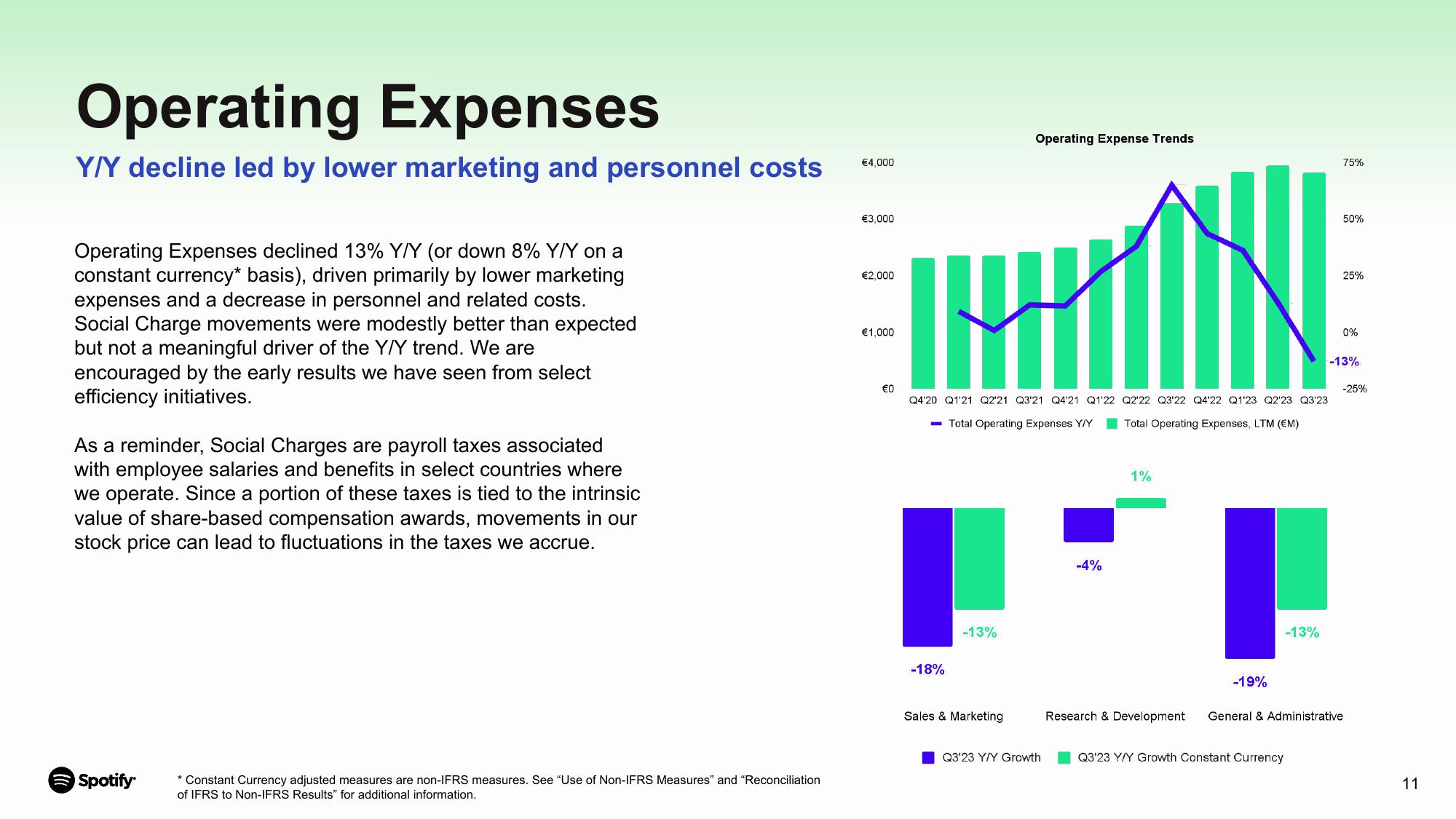

Y/Y decline led by lower marketing and personnel costs

Operating Expenses declined 13% Y/Y (or down 8% Y/Y on a

constant currency* basis), driven primarily by lower marketing

expenses and a decrease in personnel and related costs.

Social Charge movements were modestly better than expected

but not a meaningful driver of the Y/Y trend. We are

encouraged by the early results we have seen from select

efficiency initiatives.

As a reminder, Social Charges are payroll taxes associated

with employee salaries and benefits in select countries where

we operate. Since a portion of these taxes is tied to the intrinsic

value of share-based compensation awards, movements in our

stock price can lead to fluctuations in the taxes we accrue.

Spotify

* Constant Currency adjusted measures are non-IFRS measures. See "Use of Non-IFRS Measures" and "Reconciliation

of IFRS to Non-IFRS Results" for additional information.

€4,000

€3,000

€2,000

€1,000

€0

MI

Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22

- Total Operating Expenses Y/Y

-18%

-13%

Operating Expense Trends

Sales & Marketing

Q3'23 Y/Y Growth

-4%

TH

Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23

Total Operating Expenses, LTM (€M)

1%

-19%

-13%

Q3'23 Y/Y Growth Constant Currency

75%

50%

25%

0%

-13%

-25%

Research & Development General & Administrative

11View entire presentation