Innovid SPAC Presentation Deck

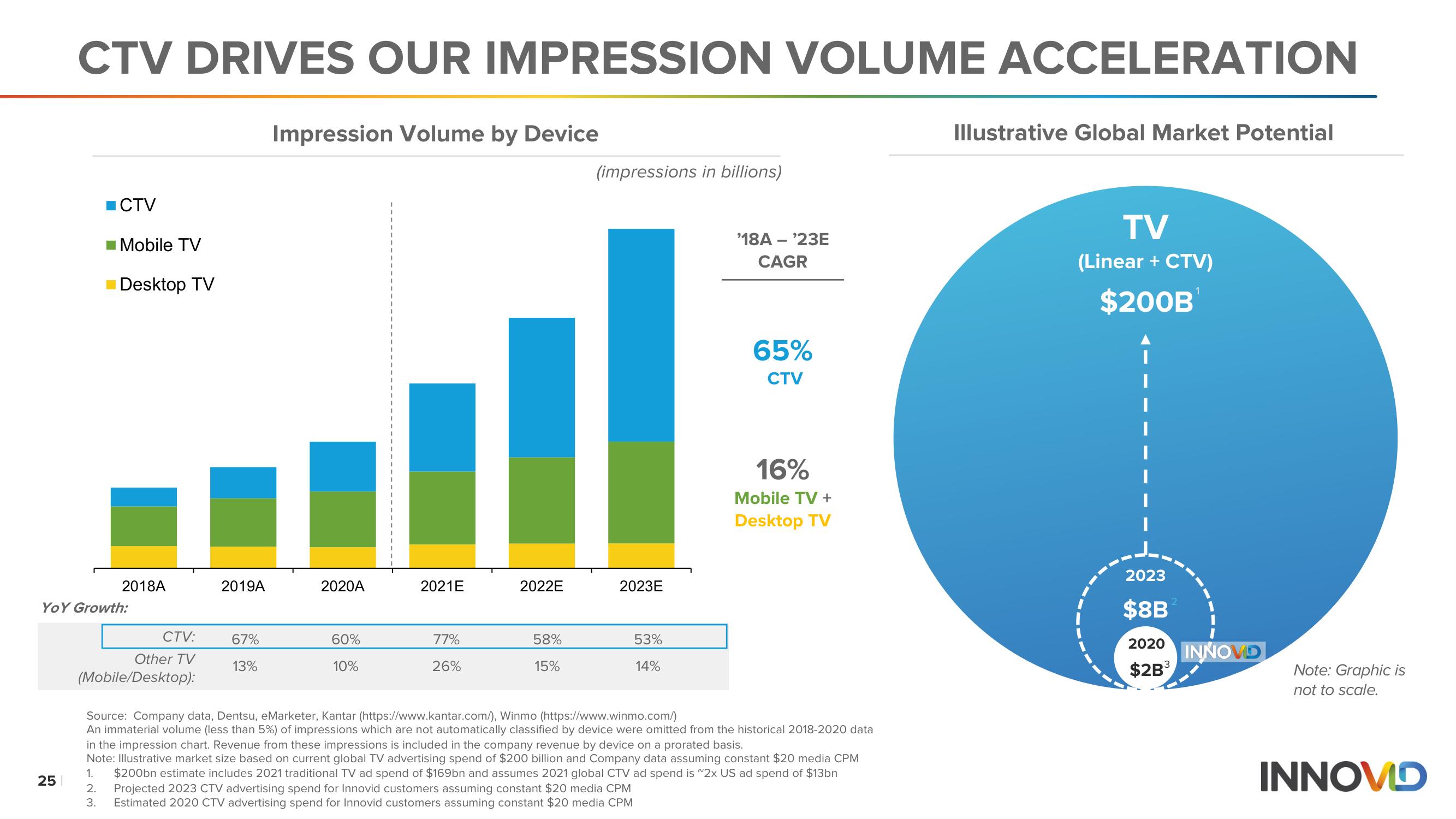

CTV DRIVES OUR IMPRESSION VOLUME ACCELERATION

25

CTV

■Mobile TV

Desktop TV

2018A

YOY Growth:

CTV:

Other TV

(Mobile/Desktop):

2019A

67%

13%

Impression Volume by Device

2020A

60%

10%

2021E

77%

26%

■

2022E

58%

15%

(impressions in billions)

2023E

53%

14%

'18A - ¹23E

CAGR

65%

CTV

16%

Mobile TV +

Desktop TV

Source: Company data, Dentsu, eMarketer, Kantar (https://www.kantar.com/), Winmo (https://www.winmo.com/)

An immaterial volume (less than 5%) of impressions which are not automatically classified by device were omitted from the historical 2018-2020 data

in the impression chart. Revenue from these impressions is included in the company revenue by device on a prorated basis.

Note: Illustrative market size based on current global TV advertising spend of $200 billion and Company data assuming constant $20 media CPM

1. $200bn estimate includes 2021 traditional TV ad spend of $169bn and assumes 2021 global CTV ad spend is "2x US ad spend of $13bn

2. Projected 2023 CTV advertising spend for Innovid customers assuming constant $20 media CPM

3.

Estimated 2020 CTV advertising spend for Innovid customers assuming constant $20 media CPM

Illustrative Global Market Potential

TV

(Linear + CTV)

$200B

2023

$8B

2

2020

$2B³

INNOVD

Note: Graphic is

not to scale.

INNOVDView entire presentation