IGI SPAC Presentation Deck

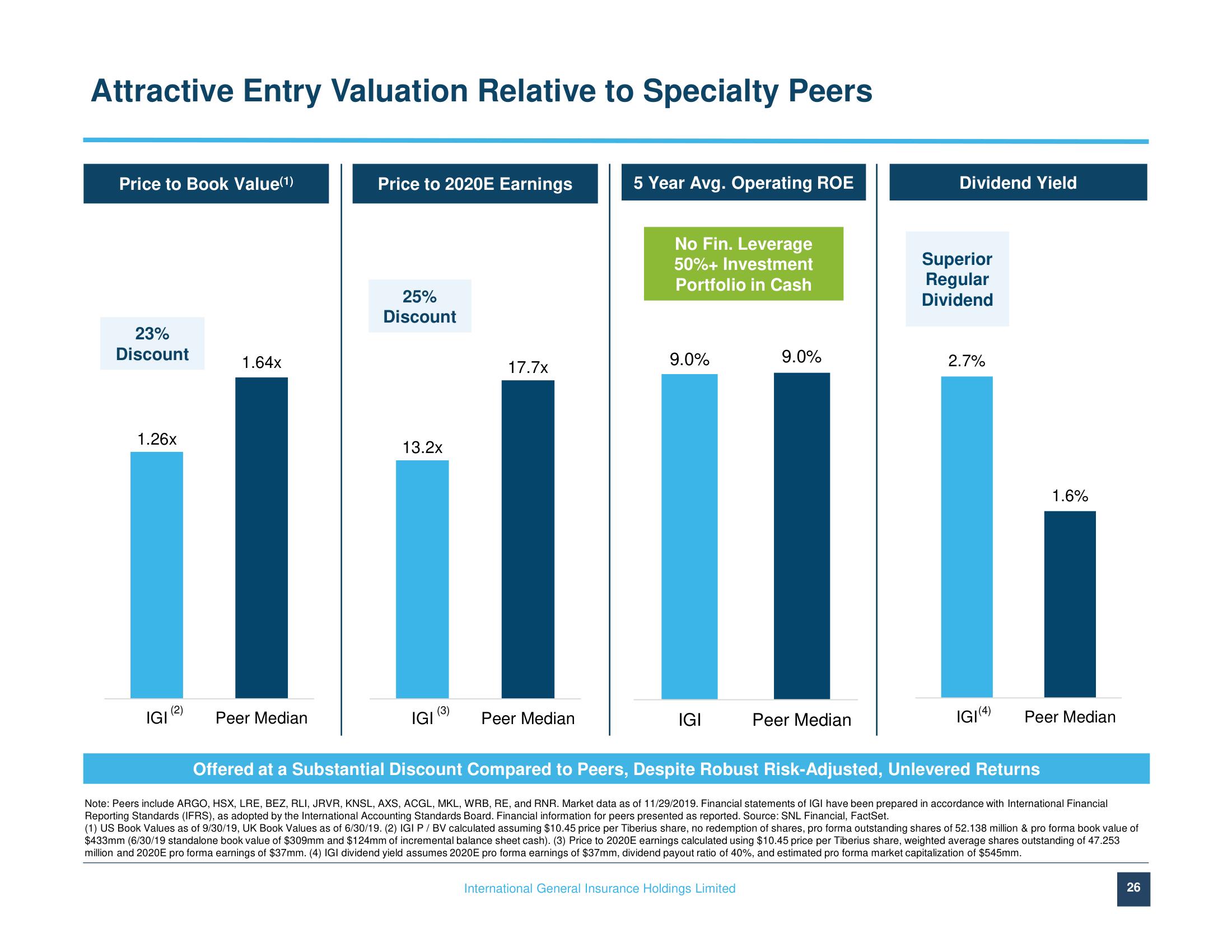

Attractive Entry Valuation Relative to Specialty Peers

Price to Book Value(1)

23%

Discount

1.26x

IGI

(2)

1.64x

Peer Median

Price to 2020E Earnings

25%

Discount

13.2x

IGI

(3)

17.7x

Peer Median

5 Year Avg. Operating ROE

No Fin. Leverage

50%+ Investment

Portfolio in Cash

9.0%

IGI

9.0%

Peer Median

International General Insurance Holdings Limited

Dividend Yield

Superior

Regular

Dividend

2.7%

IGI(4)

1.6%

Peer Median

Offered at a Substantial Discount Compared to Peers, Despite Robust Risk-Adjusted, Unlevered Returns

Note: Peers include ARGO, HSX, LRE, BEZ, RLI, JRVR, KNSL, AXS, ACGL, MKL, WRB, RE, and RNR. Market data as of 11/29/2019. Financial statements of IGI have been prepared in accordance with International Financial

Reporting Standards (IFRS), as adopted by the International Accounting Standards Board. Financial information for peers presented as reported. Source: SNL Financial, FactSet.

(1) US Book Values as of 9/30/19, UK Book Values as of 6/30/19. (2) IGI P/ BV calculated assuming $10.45 price per Tiberius share, no redemption of shares, pro forma outstanding shares of 52.138 million & pro forma book value of

$433mm (6/30/19 standalone book value of $309mm and $124mm of incremental balance sheet cash). (3) Price to 2020E earnings calculated using $10.45 price per Tiberius share, weighted average shares outstanding of 47.253

million and 2020E pro forma earnings of $37mm. (4) IGI dividend yield assumes 2020E pro forma earnings of $37mm, dividend payout ratio of 40%, and estimated pro forma market capitalization of $545mm.

26View entire presentation