Rocket Lab SPAC Presentation Deck

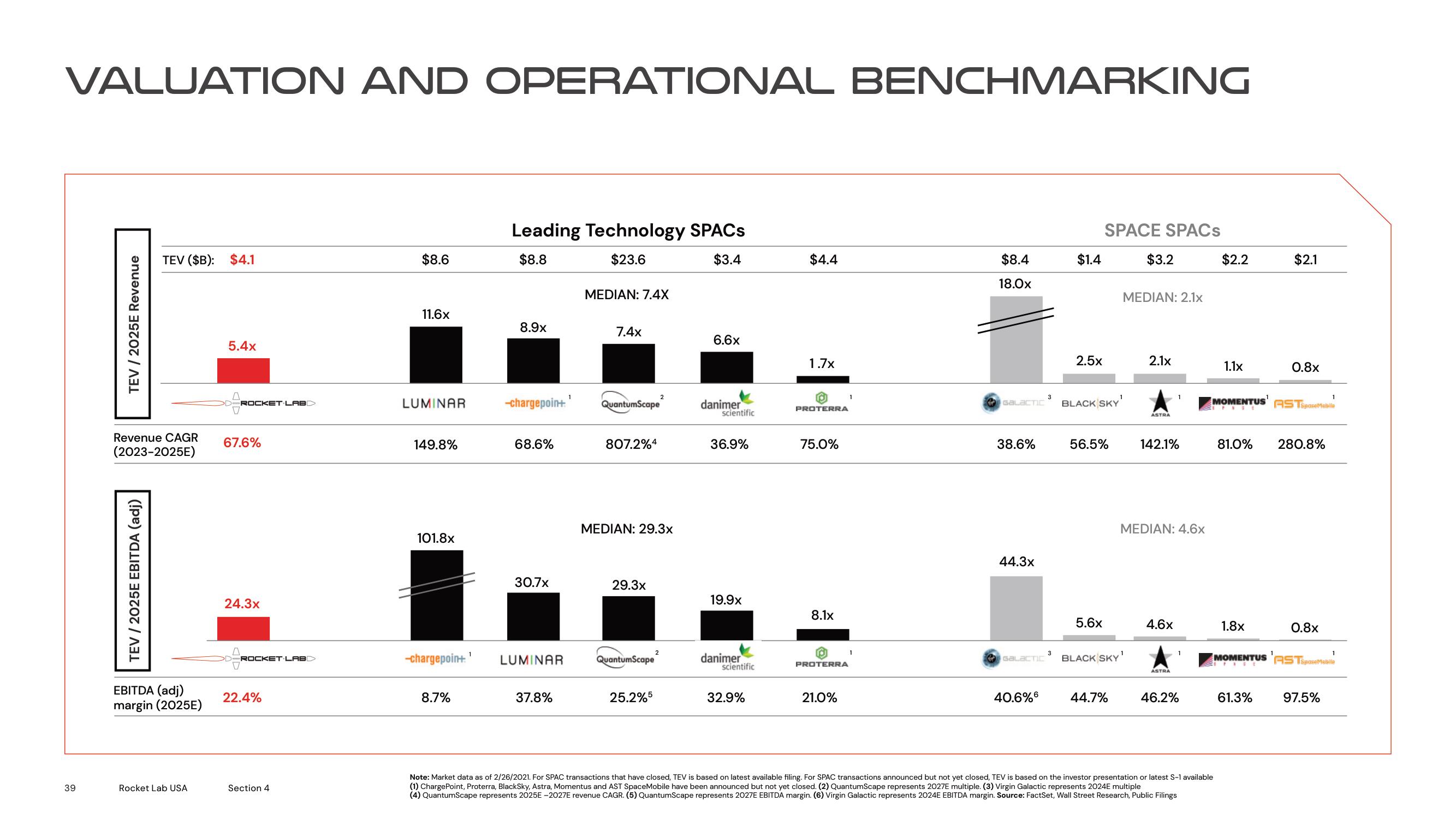

VALUATION AND OPERATIONAL BENCHMARKING

39

TEV / 2025E Revenue

TEV ($B): $4.1

Revenue CAGR

(2023-2025E)

TEV / 2025E EBITDA (adj)

EBITDA (adj)

margin (2025E)

Rocket Lab USA

5.4x

ROCKET LABD

67.6%

24.3x

ROCKET LABD

22.4%

Section 4

$8.6

11.6x

LUMINAR

149.8%

101.8x

-chargepoin+¹

8.7%

Leading Technology SPACs

$8.8

$23.6

$3.4

8.9x

-chargepoin+¹

68.6%

30.7x

LUMINAR

37.8%

MEDIAN: 7.4X

7.4x

QuantumScape

807.2%4

MEDIAN: 29.3x

29.3x

2

QuantumScape

25.2%5

2

6.6x

danimer

scientific

36.9%

19.9x

danimer

scientific

32.9%

$4.4

1.7x

PROTERRA

75.0%

8.1x

PROTERRA

21.0%

1

1

$8.4

18.0x

GALACTIC

38.6%

44.3x

GALACTIC

40.6%

3

3

$1.4

2.5x

SPACE SPACs

BLACK SKY

56.5%

5.6x

44.7%

$3.2

MEDIAN: 2.1x

BLACK SKY¹

2.1x

ASTRA

142.1%

MEDIAN: 4.6x

4.6x

ASTRA

1

46.2%

$2.2

Note: Market data as of 2/26/2021. For SPAC transactions that have closed, TEV is based on latest available filing. For SPAC transactions announced but not yet closed, TEV is based on the investor presentation or latest S-1 available

(1) ChargePoint, Proterra, BlackSky, Astra, Momentus and AST SpaceMobile have been announced but not yet closed. (2) QuantumScape represents 2027E multiple. (3) Virgin Galactic represents 2024E multiple

(4) QuantumScape represents 2025E-2027E revenue CAGR. (5) QuantumScape represents 2027E EBITDA margin. (6) Virgin Galactic represents 2024E EBITDA margin. Source: FactSet, Wall Street Research, Public Filings

1.1x

MOMENTUS AST

SPESE

1.8x

$2.1

81.0% 280.8%

MOMENTUS

0.8x

61.3%

0.8x

1

ASTSpaseMobile

97.5%View entire presentation