CorpAcq SPAC Presentation Deck

1A

Mi

*

R 7

KY

Sh

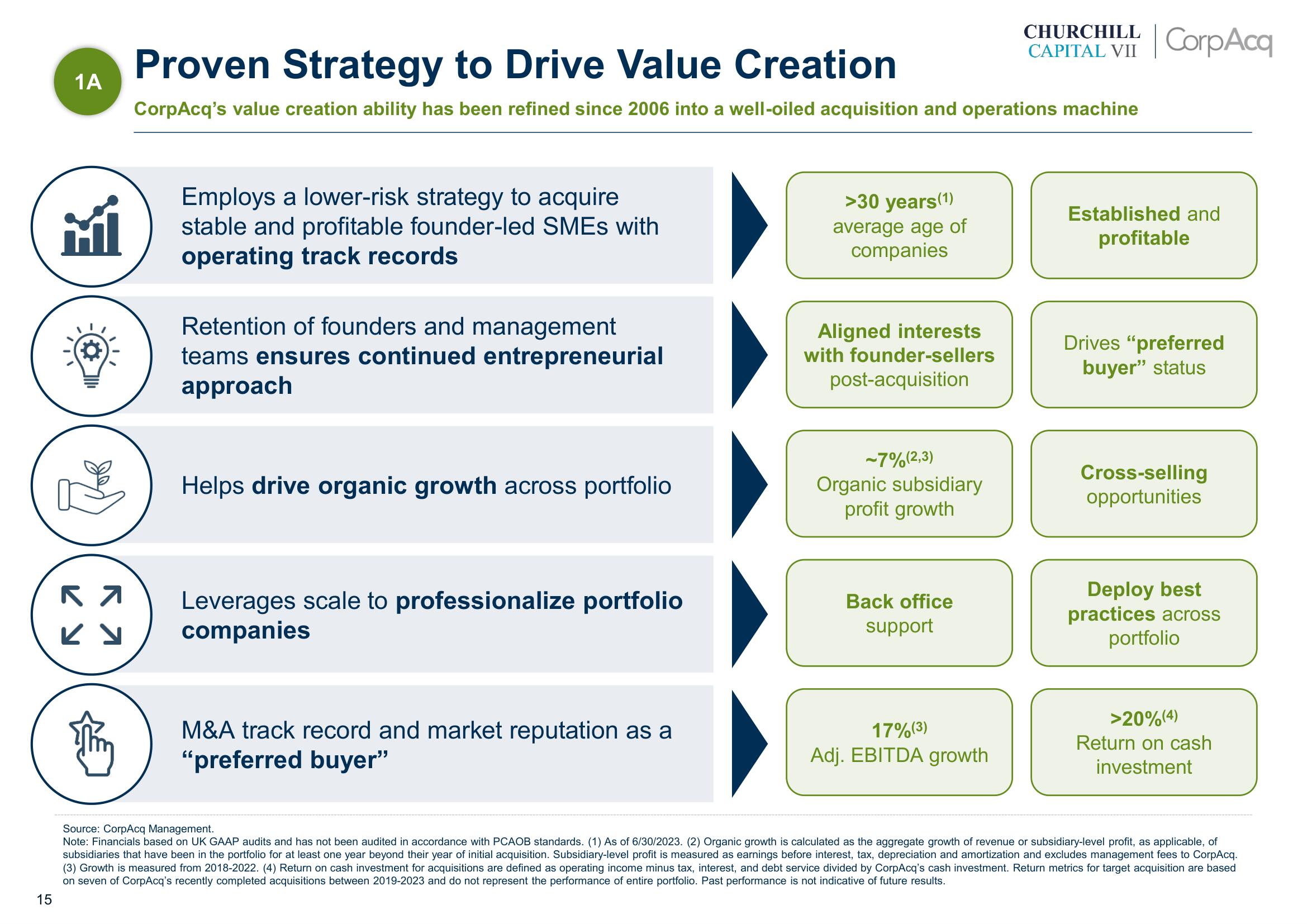

Proven Strategy to Drive Value Creation

CorpAcq's value creation ability has been refined since 2006 into a well-oiled acquisition and operations machine

Employs a lower-risk strategy to acquire

stable and profitable founder-led SMEs with

operating track records

Retention of founders and management

teams ensures continued entrepreneurial

approach

Helps drive organic growth across portfolio

Leverages scale to professionalize portfolio

companies

M&A track record and market reputation as a

"preferred buyer"

>30 years (1)

average age of

companies

Aligned interests

with founder-sellers

post-acquisition

-7% (2,3)

Organic subsidiary

profit growth

Back office

support

CAPITAL VII CorpAcq

17%(3)

Adj. EBITDA growth

Established and

profitable

Drives "preferred

buyer" status

Cross-selling

opportunities

Deploy best

practices across

portfolio

>20%(4)

Return on cash

investment

Source: CorpAcq Management.

Note: Financials based on UK GAAP audits and has not been audited in accordance with PCAOB standards. (1) As of 6/30/2023. (2) Organic growth is calculated as the aggregate growth of revenue or subsidiary-level profit, as applicable, of

subsidiaries that have been in the portfolio for at least one year beyond their year of initial acquisition. Subsidiary-level profit is measured as earnings before interest, tax, depreciation and amortization and excludes management fees to CorpAcq.

(3) Growth is measured from 2018-2022. (4) Return on cash investment for acquisitions are defined as operating income minus tax, interest, and debt service divided by CorpAcq's cash investment. Return metrics for target acquisition are based

on seven of CorpAcq's recently completed acquisitions between 2019-2023 and do not represent the performance of entire portfolio. Past performance is not indicative of future results.

15View entire presentation