Dutch Bros Results Presentation Deck

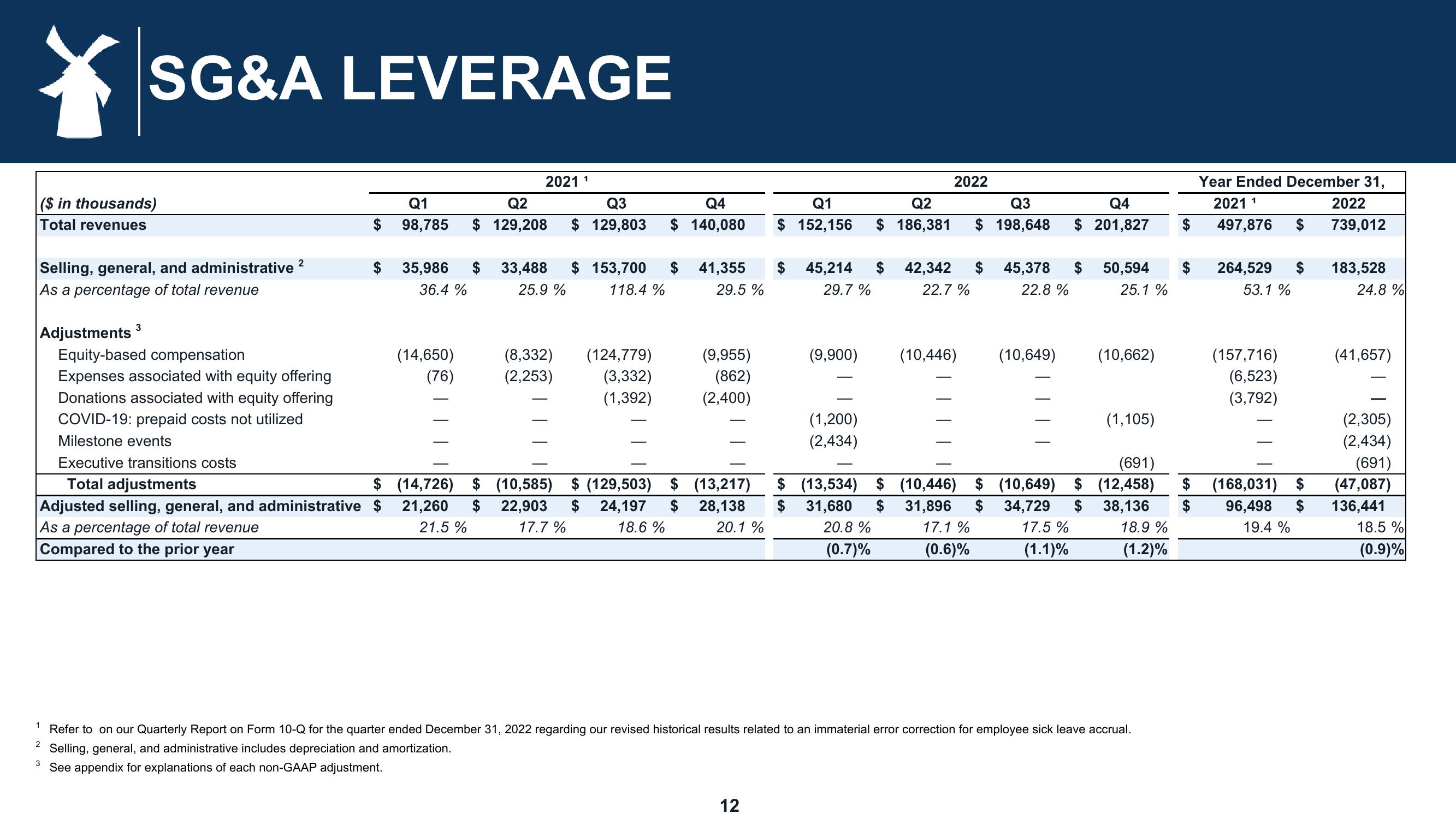

($ in thousands)

Total revenues

Selling, general, and administrative

As a percentage of total revenue

Adjustments

SG&A LEVERAGE

1

3

2

2

Adjusted selling, general, and administrative

As a percentage of total revenue

Compared to the prior year

Equity-based compensation

Expenses associated with equity offering

Donations associated with equity offering

COVID-19: prepaid costs not utilized

Milestone events

Executive transitions costs

Total adjustments

$

$

Q1

98,785

35,986 $

36.4 %

(14,650)

(76)

2021

Q2

Q3

Q4

$ 129,208 $ 129,803 $ 140,080

33,488 $ 153,700 $

25.9 %

118.4 %

(8,332)

(2,253)

(124,779)

(3,332)

(1,392)

41,355 $

29.5 %

(9,955)

(862)

(2,400)

Q1

$ 152,156

$

$ (14,726) $ (10,585) $ (129,503) $ (13,217)

21,260 $ 22,903 $ 24,197 $

21.5 %

17.7%

18.6 %

12

(9,900)

Q2

$ 186,381

45,214 $ 42,342

29.7 %

22.7%

(1,200)

(2,434)

2022

(10,446)

Q4

Q3

$ 198,648 $ 201,827

$

45,378 $

22.8 %

(10,649)

50,594 $

25.1 %

(10,662)

(691)

$ (13,534) $ (10,446) $ (10,649) $ (12,458)

28,138 $ 31,680 $ 31,896 $ 34,729 $ 38,136

20.1 %

17.1%

17.5 %

20.8 %

18.9 %

(0.7)%

(0.6)%

(1.1)%

(1.2)%

(1,105)

Refer to on our Quarterly Report on Form 10-Q for the quarter ended December 31, 2022 regarding our revised historical results related to an immaterial error correction for employee sick leave accrual.

Selling, general, and administrative includes depreciation and amortization.

3 See appendix for explanations of each non-GAAP adjustment.

$

$

Year Ended December 31,

2021 1

497,876 $

264,529 $

53.1 %

(157,716)

(6,523)

(3,792)

(168,031) $

96,498 $

19.4%

2022

739,012

183,528

24.8%

(41,657)

(2,305)

(2,434)

(691)

(47,087)

136,441

18.5 %

(0.9)%View entire presentation