SmileDirectClub Investor Presentation Deck

●

●

●

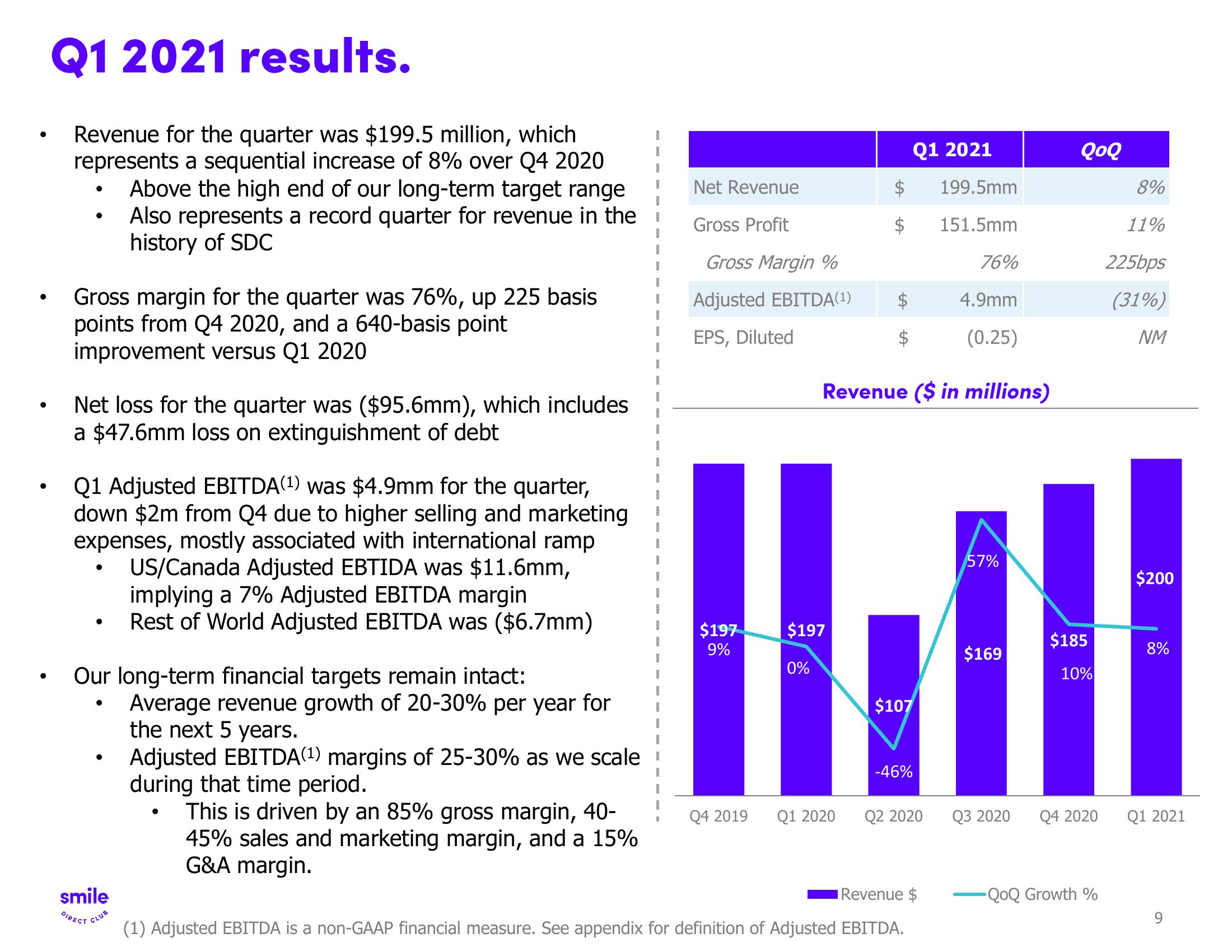

Q1 2021 results.

Revenue for the quarter was $199.5 million, which

represents a sequential increase of 8% over Q4 2020

Above the high end of our long-term target range

Also represents a record quarter for revenue in the

history of SDC

Gross margin for the quarter was 76%, up 225 basis

points from Q4 2020, and a 640-basis point

improvement versus Q1 2020

Net loss for the quarter was ($95.6mm), which includes

a $47.6mm loss on extinguishment of debt

Q1 Adjusted EBITDA(¹) was $4.9mm for the quarter,

down $2m from Q4 due to higher selling and marketing

expenses, mostly associated with international ramp

US/Canada Adjusted EBTIDA was $11.6mm,

implying a 7% Adjusted EBITDA margin

Rest of World Adjusted EBITDA was ($6.7mm)

●

Our long-term financial targets remain intact:

smile

DIRECT CLUB

Average revenue growth of 20-30% per year for

the next 5 years.

Adjusted EBITDA(1) margins of 25-30% as we scale

during that time period.

This is driven by an 85% gross margin, 40-

45% sales and marketing margin, and a 15%

G&A margin.

Net Revenue

Gross Profit

Gross Margin %

Adjusted EBITDA(1)

EPS, Diluted

$197

9%

$197

0%

Q4 2019 Q1 2020

Q1 2021

Revenue ($ in millions)

$107

-46%

Q2 2020

199.5mm

151.5mm

Revenue $

(1) Adjusted EBITDA is a non-GAAP financial measure. See appendix for definition of Adjusted EBITDA.

76%

4.9mm

(0.25)

57%

$169

Q3 2020

QOQ

$185

10%

Q4 2020

-QoQ Growth %

8%

11%

225bps

(31%)

NM

$200

8%

Q1 2021

9View entire presentation