P3 Health Partners SPAC Presentation Deck

Right Space

Right Team

Right Model

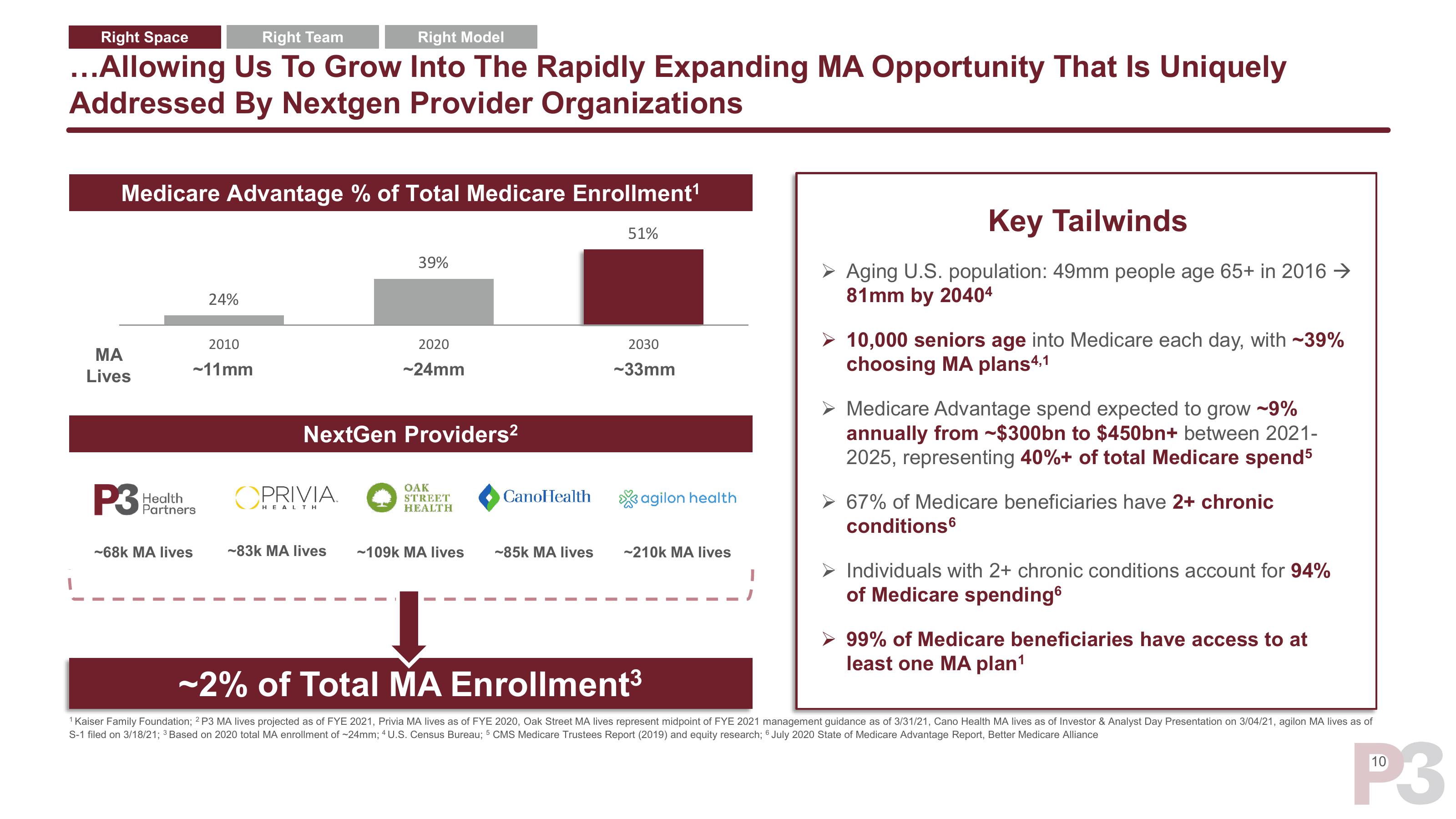

...Allowing Us To Grow Into The Rapidly Expanding MA Opportunity That Is Uniquely

Addressed By Nextgen Provider Organizations

Medicare Advantage % of Total Medicare Enrollment¹

ΜΑ

Lives

P3

2010

~11mm

Health

Partners

24%

~68k MA lives

39%

OPRIVIA

HEALTH

2020

~24mm

NextGen Providers²

OAK

STREET

HEALTH

-83k MA lives ~109k MA lives

CanoHealth

-85k MA lives

51%

2030

-33mm

agilon health

-210k MA lives

Key Tailwinds

Aging U.S. population: 49mm people age 65+ in 2016 →

81mm by 20404

► 10,000 seniors age into Medicare each day, with -39%

choosing MA plans4,1

Medicare Advantage spend expected to grow ~9%

annually from ~$300bn to $450bn+ between 2021-

2025, representing 40% of total Medicare spend5

➤ 67% of Medicare beneficiaries have 2+ chronic

conditions6

Individuals with 2+ chronic conditions account for 94%

of Medicare spending6

➤ 99% of Medicare beneficiaries have access to at

least one MA plan¹

~2% of Total MA Enrollment³

1 Kaiser Family Foundation; 2 P3 MA lives projected as of FYE 2021, Privia MA lives as of FYE 2020, Oak Street MA lives represent midpoint of FYE 2021 management guidance as of 3/31/21, Cano Health MA lives as of Investor & Analyst Day Presentation on 3/04/21, agilon MA lives as of

S-1 filed on 3/18/21; 3 Based on 2020 total MA enrollment of ~24mm; 4 U.S. Census Bureau; 5 CMS Medicare Trustees Report (2019) and equity research; 6 July 2020 State of Medicare Advantage Report, Better Medicare Alliance

10

P3View entire presentation