Nikola Results Presentation Deck

123

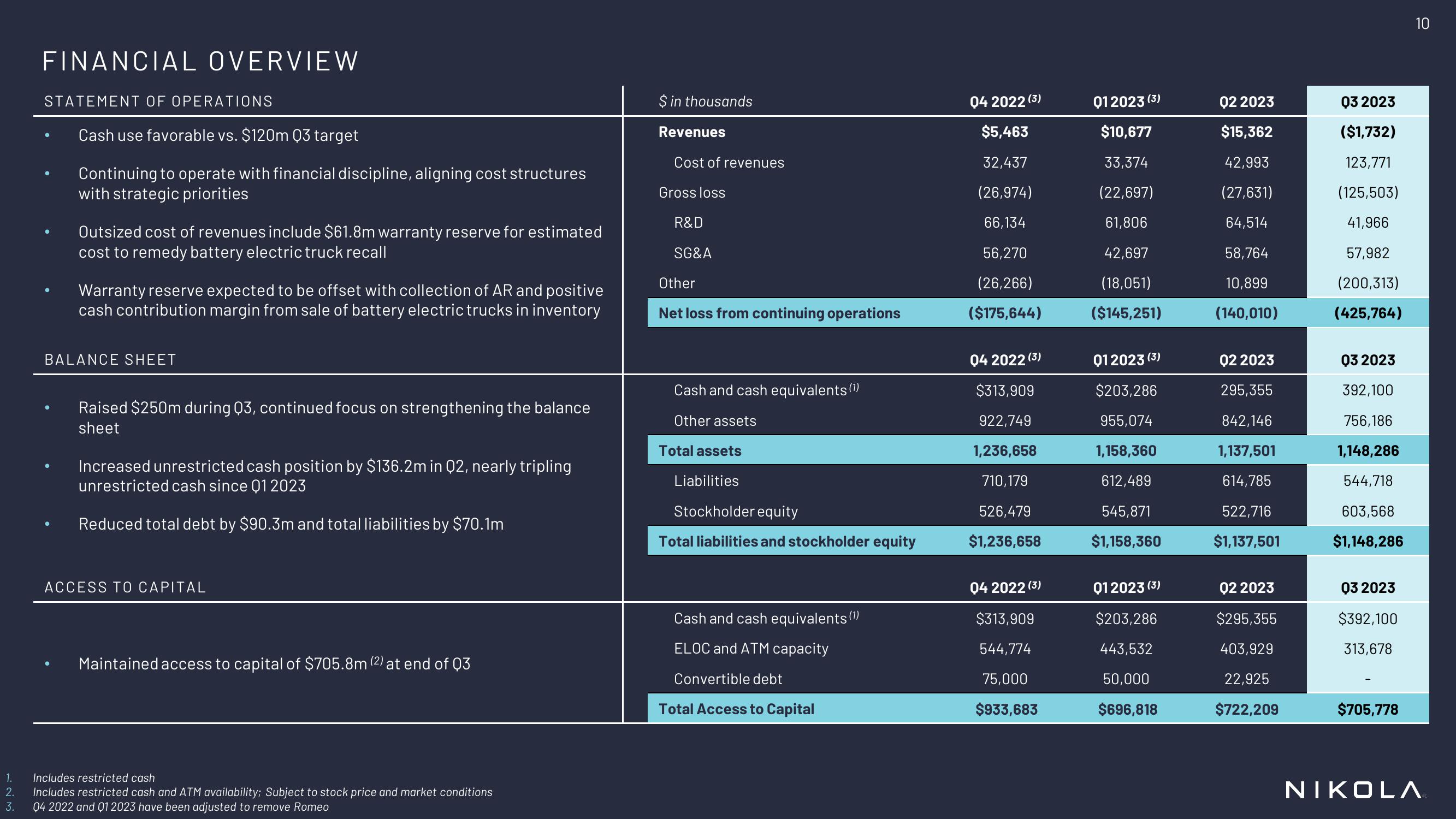

FINANCIAL OVERVIEW

STATEMENT OF OPERATIONS

Cash use favorable vs. $120m 03 target

Continuing to operate with financial discipline, aligning cost structures

with strategic priorities

Outsized cost of revenues include $61.8m warranty reserve for estimated

CO to remedy battery electric truck recall

Warranty reserve expected to be offset with collection of AR and positive

cash contribution margin from sale of battery electric trucks in inventory

BALANCE SHEET

Raised $250m during 03, continued focus on strengthening the balance

sheet

Increased unrestricted cash position by $136.2m in Q2, nearly tripling

unrestricted cash since 01 2023

Reduced total debt by $90.3m and total liabilities by $70.1m

ACCESS TO CAPITAL

Maintained access to capital of $705.8m (2) at end of Q3

Includes restricted cash

Includes restricted cash and ATM availability; Subject to stock price and market conditions

3. 04 2022 and 01 2023 have been adjusted to remove Romeo

$ in thousands

Revenues

Cost of revenues

Gross loss

R&D

SG&A

Other

Net loss from continuing operations

Cash and cash equivalents (¹)

Other assets

Total assets

Liabilities

Stockholder equity

Total liabilities and stockholder equity

Cash and cash equivalents (¹)

ELOC and ATM capacity

Convertible debt

Total Access to Capital

04 2022 (3)

$5,463

32,437

(26,974)

66,134

56,270

(26,266)

($175,644)

04 2022 (3)

$313,909

922,749

1,236,658

710,179

526,479

$1,236,658

04 2022 (3)

$313,909

544,774

75,000

$933,683

012023 (3)

$10,677

33,374

(22,697)

61,806

42,697

(18,051)

($145,251)

012023 (3)

$203,286

955,074

1,158,360

612,489

545,871

$1,158,360

012023 (3)

$203,286

443,532

50,000

$696,818

02 2023

$15,362

42,993

(27,631)

64,514

58,764

10,899

(140,010)

02 2023

295,355

842,146

1,137,501

614,785

522,716

$1,137,501

02 2023

$295,355

403,929

22,925

$722,209

Q3 2023

($1,732)

123,771

(125,503)

41,966

57,982

(200,313)

(425,764)

03 2023

392,100

756,186

1,148,286

544,718

603,568

$1,148,286

Q3 2023

$392,100

313,678

$705,778

10

NIKOLAView entire presentation