Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

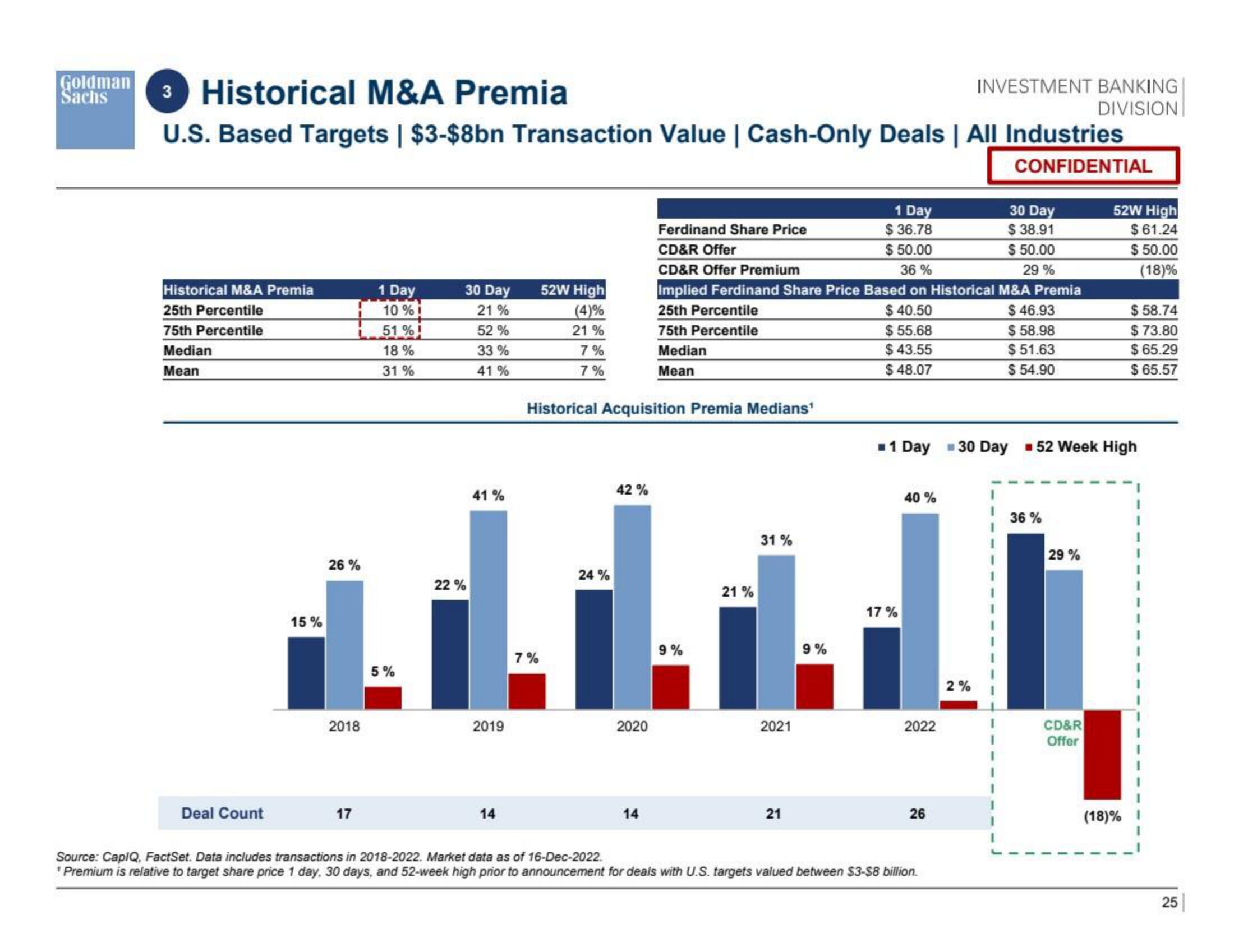

3 Historical M&A Premia

U.S. Based Targets | $3-$8bn Transaction Value | Cash-Only Deals | All Industries

CONFIDENTIAL

Historical M&A Premia

25th Percentile

75th Percentile

Median

Mean

Deal Count

15%

26%

2018

1 Day

10% i

17

51%!

18 %

31%

30 Day 52W High

21%

(4)%

52%

21%

33%

41%

5%

42%

31%

24%

21%

ALLADI

9%

9%

2020

2021

22%

41%

2019

14

7%

7%

Historical Acquisition Premia Medians¹

7%

Ferdinand Share Price

CD&R Offer

1 Day

$36.78

$ 50.00

CD&R Offer Premium

36%

Implied Ferdinand Share Price Based on Historical M&A Premia

25th Percentile

75th Percentile

$40.50

$ 55.68

$43.55

$ 46.93

$ 58.98

$51.63

Median

Mean

$48.07

$ 54.90

14

21

17%

40 %

■1 Day 30 Day 52 Week High

2022

INVESTMENT BANKING

DIVISION

26

Source: CapIQ, FactSet. Data includes transactions in 2018-2022. Market data as of 16-Dec-2022.

*Premium is relative to target share price 1 day, 30 days, and 52-week high prior to announcement for deals with U.S. targets valued between $3-$8 billion.

30 Day

$38.91

$ 50.00

29 %

2%

36%

29%

CD&R

52W High

$61.24

$50.00

(18)%

Offer

$58.74

$73.80

$65.29

$65.57

(18)%

25View entire presentation