J.P.Morgan Results Presentation Deck

Corporate & Investment Bank1

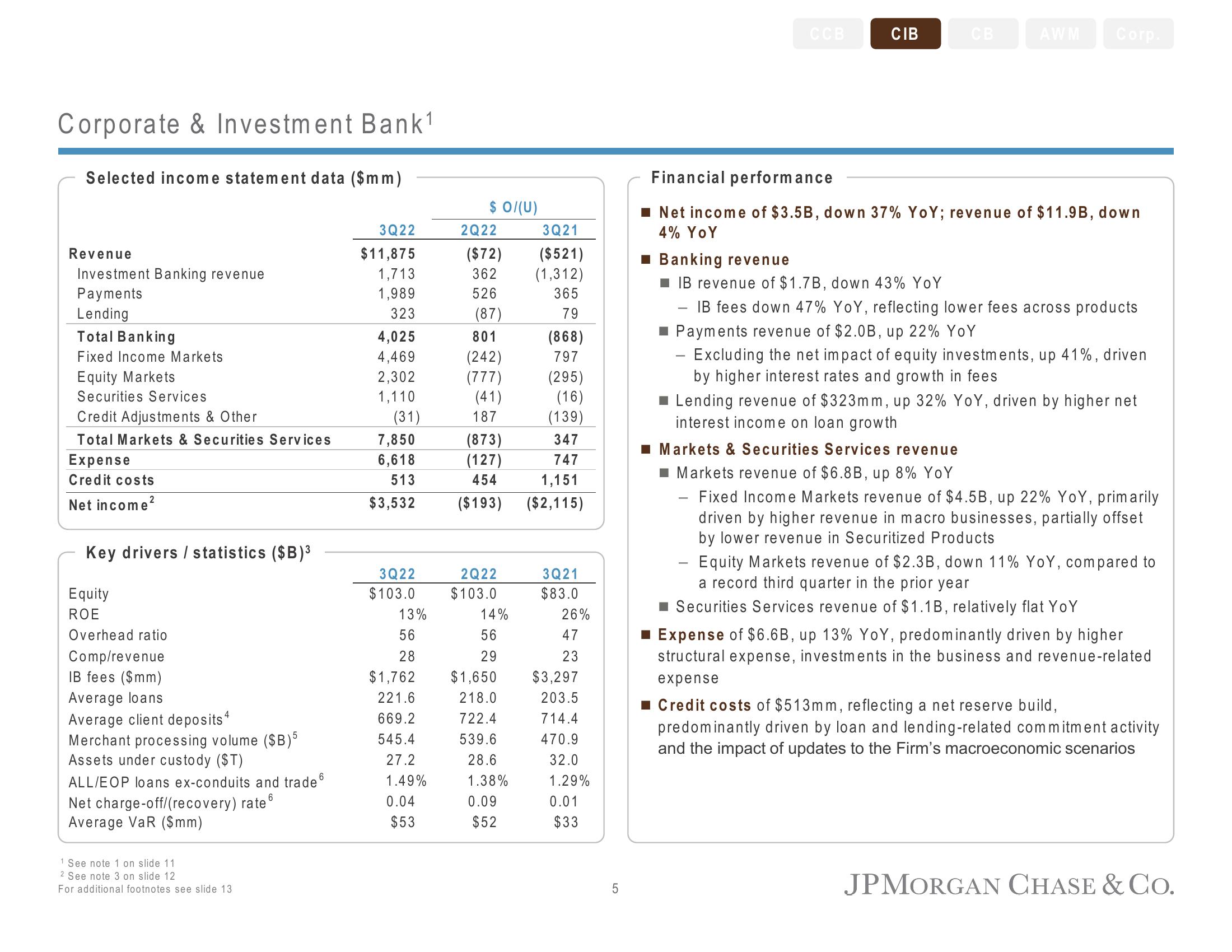

Selected income statement data ($mm)

Revenue

Investment Banking revenue

Payments

Lending

Total Banking

Fixed Income Markets

Equity Markets

Securities Services

Credit Adjustments & Other

Total Markets & Securities Services

Expense

Credit costs

Net income²

Key drivers / statistics ($B)³

Equity

ROE

Overhead ratio

Comp/revenue

IB fees ($mm)

Average loans

Average client deposits 4

Merchant processing volume ($B)5

Assets under custody ($T)

6

ALL/EOP loans ex-conduits and trade

6

Net charge-off/(recovery) rate

Average VaR ($mm)

1 See note 1 on slide 11

2 See note 3 on slide 12

For additional footnotes see slide 13

3Q22

$11,875

1,713

1,989

323

4,025

4,469

2,302

1,110

(31)

7,850

6,618

513

$3,532

3Q22

$103.0

13%

56

28

$1,762

221.6

669.2

545.4

27.2

1.49%

0.04

$53

$ 0/(U)

2Q22

($72)

362

526

(87)

801

(242)

(777)

(41)

187

2Q22

$103.0

(295)

(16)

(139)

(873)

347

(127)

747

454

1,151

($193) ($2,115)

14%

56

29

3Q21

($521)

(1,312)

365

79

$1,650

218.0

722.4

539.6

28.6

1.38%

0.09

$52

(868)

797

3Q21

$83.0

26%

47

23

$3,297

203.5

714.4

470.9

32.0

1.29%

0.01

$33

LO

5

CCB

CIB

CB

AWM Corp.

Financial performance

Net income of $3.5B, down 37% YoY; revenue of $11.9B, down

4% YoY

■ Banking revenue

■IB revenue of $1.7B, down 43% YoY

IB fees down 47% YoY, reflecting lower fees across products

■ Payments revenue of $2.0B, up 22% YoY

Excluding the net impact of equity investments, up 41%, driven

by higher interest rates and growth in fees

Lending revenue of $323mm, up 32% YoY, driven by higher net

interest income on loan growth

■ Markets & Securities Services revenue

■ Markets revenue of $6.8B, up 8% YoY

Fixed Income Markets revenue of $4.5B, up 22% YoY, primarily

driven by higher revenue in macro businesses, partially offset

by lower revenue in Securitized Products

Equity Markets revenue of $2.3B, down 11% YoY, compared to

a record third quarter in the prior year

■ Securities Services revenue of $1.1B, relatively flat YoY

■ Expense of $6.6B, up 13% YoY, predominantly driven by higher

structural expense, investments in the business and revenue-related

expense

■Credit costs of $513mm, reflecting a net reserve build,

predominantly driven by loan and lending-related commitment activity

and the impact of updates to the Firm's macroeconomic scenarios

JPMORGAN CHASE & Co.View entire presentation