Next.e.GO Investor Update

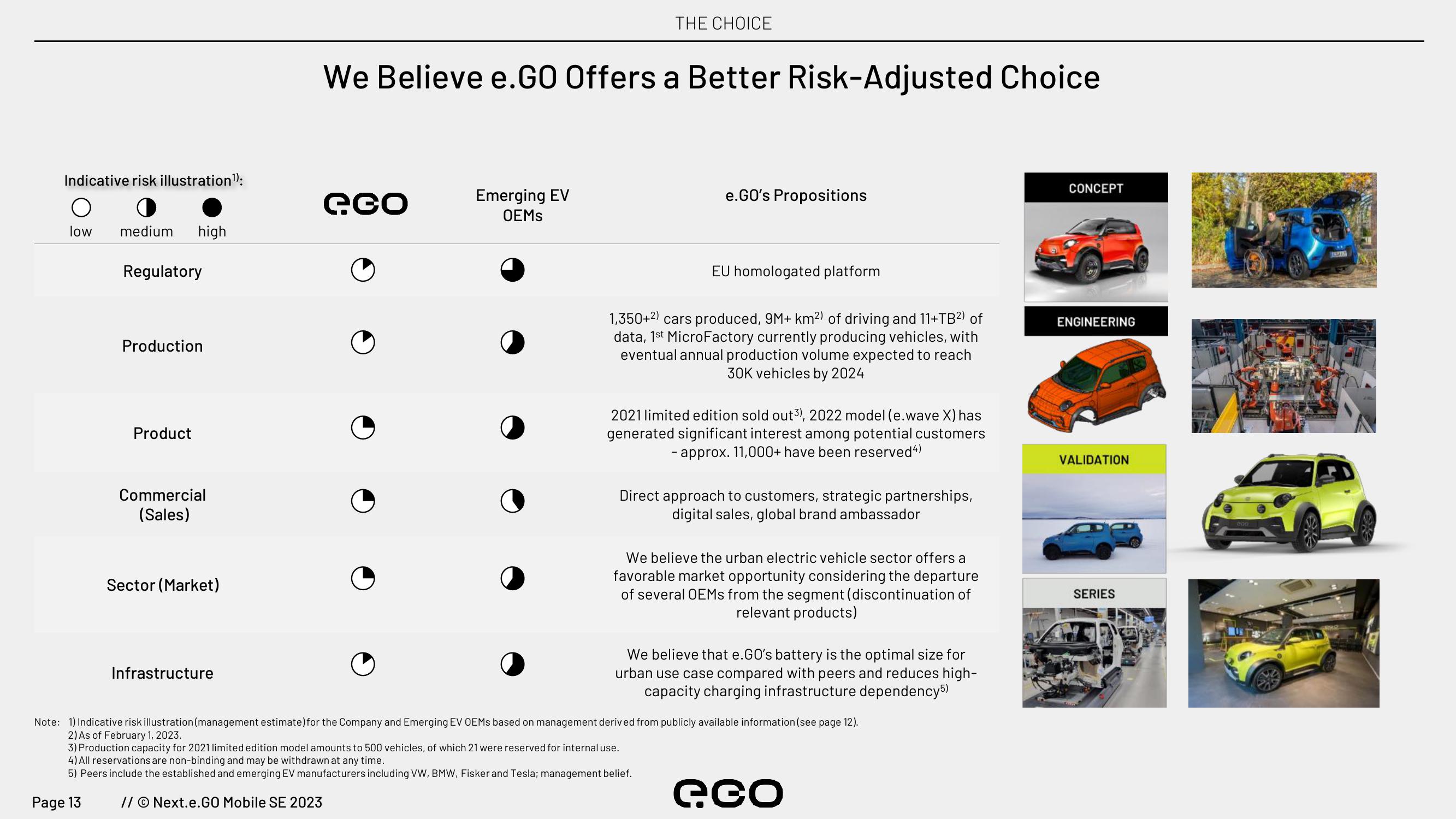

Indicative risk illustration¹):

low medium high

Regulatory

Production

Product

Commercial

(Sales)

Sector (Market)

Infrastructure

We Believe e.GO Offers a Better Risk-Adjusted Choice

e.co

Emerging EV

OEMs

THE CHOICE

●

e.GO's Propositions

EU homologated platform

1,350+2) cars produced, 9M+ km²) of driving and 11+TB²) of

data, 1st MicroFactory currently producing vehicles, with

eventual annual production volume expected to reach

30K vehicles by 2024

2021 limited edition sold out3), 2022 model (e.wave X) has

generated significant interest among potential customers

- approx. 11,000+ have been reserved 4)

Direct approach to customers, strategic partnerships,

digital sales, global brand ambassador

We believe the urban electric vehicle sector offers a

favorable market opportunity considering the departure

of several OEMs from the segment (discontinuation of

relevant products)

We believe that e.GO's battery is the optimal size for

urban use case compared with peers and reduces high-

capacity charging infrastructure dependency5)

Note: 1) Indicative risk illustration (management estimate) for the Company and Emerging EV OEMs based on management derived from publicly available information (see page 12).

2) As of February 1, 2023.

3) Production capacity for 2021 limited edition model amounts to 500 vehicles, of which 21 were reserved for internal use.

4) All reservations are non-binding and may be withdrawn at any time.

5) Peers include the established and emerging EV manufacturers including VW, BMW, Fisker and Tesla; management belief.

Page 13

// © Next.e.GO Mobile SE 2023

eco

CONCEPT

ENGINEERING

VALIDATION

SERIES

16210View entire presentation