HBT Financial Results Presentation Deck

4) Prudent risk management

Comprehensive Enterprise Risk Management

Strategy and Risk Management

Majority of directors are independent, with varied experiences

and backgrounds

Board of directors has an established Audit Committee,

Compensation Committee, Nominating and Corporate

Governance Committee, and an Enterprise Risk Management

(ERM) Committee

ERM program embodies the "three lines of defense" model and

promotes business line risk ownership

Independent and robust internal audit structure, reporting directly

to our Audit Committee

■ Strong compliance culture and compliance management system

■ Code of Ethics and other governance documents are available

at ir.hbtfinancial.com

Data Security & Privacy

Robust data security program, and under our privacy policy, we

do not sell or share customer information with non-affiliated

entities

■ Formal company-wide business continuity plan covering all

departments, as well as a cybersecurity program that includes

internal and outsourced, independent testing of our systems and

employees

HBT

Financial

25

Disciplined Credit Risk Management

■ Risk management culture instilled by management

Well-diversified loan portfolio across commercial, regulatory

CRE, and residential

■ Primarily originated across in-footprint borrowers

■ Centralized credit underwriting group that evaluates all

exposures over $750,000 to ensure uniform application of

policies and procedures

Conservative credit culture, strong underwriting criteria, and

regular loan portfolio monitoring

Robust internal loan review process annually reviews more than

40% of loan commitments.

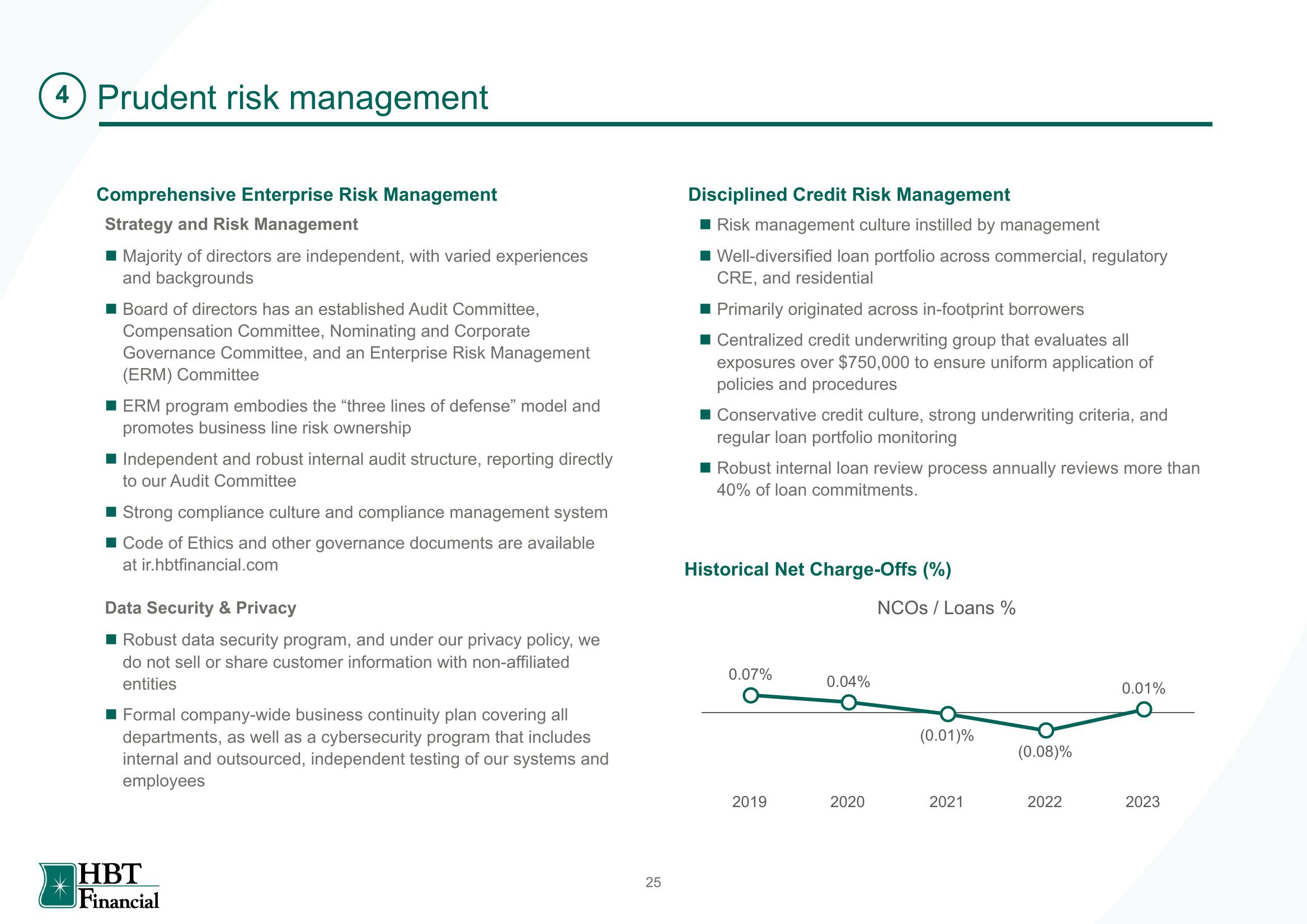

Historical Net Charge-Offs (%)

0.07%

2019

0.04%

2020

NCOS / Loans %

(0.01)%

2021

(0.08)%

2022

0.01%

2023View entire presentation