J.P.Morgan 2Q23 Investor Results

JPMORGAN CHASE & CO.

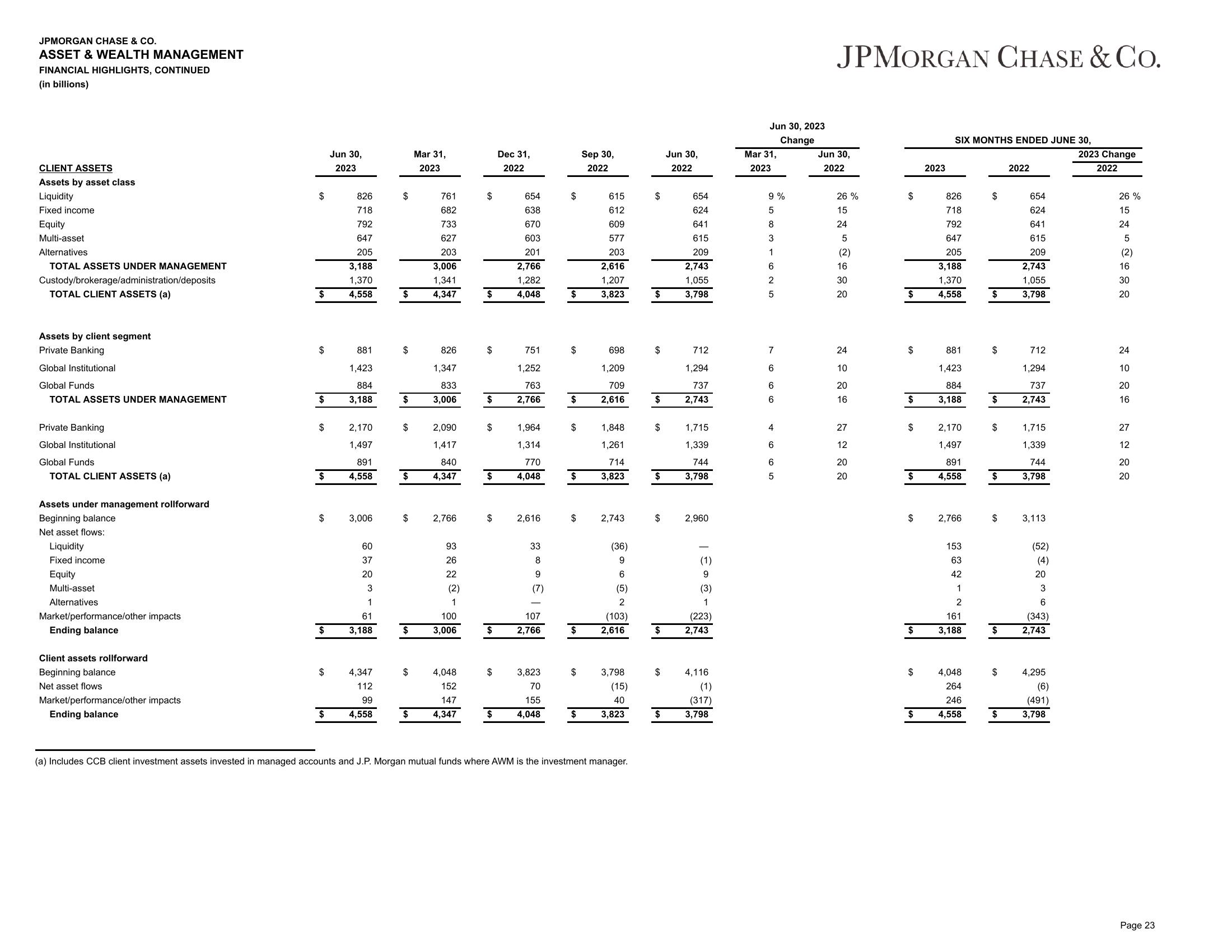

ASSET & WEALTH MANAGEMENT

FINANCIAL HIGHLIGHTS, CONTINUED

(in billions)

CLIENT ASSETS

Assets by asset class

Liquidity

Fixed income

Equity

Multi-asset

Alternatives

TOTAL ASSETS UNDER MANAGEMENT

Custody/brokerage/administration/deposits

TOTAL CLIENT ASSETS (a)

Assets by client segment

Private Banking

Global Institutional

Global Funds

TOTAL ASSETS UNDER MANAGEMENT

Private Banking

Global Institutional

Global Funds

TOTAL CLIENT ASSETS (a)

Assets under management rollforward

Beginning balance

Net asset flows:

Liquidity

Fixed income

Equity

Multi-asset

Alternatives

Market/performance/other impacts

Ending balance

Client assets rollforward

Beginning balance

Net asset flows

Market/performance/other impacts

Ending balance

$

$

$

$

$

$

$

$

Jun 30,

2023

$

826

718

792

647

205

3,188

1,370

4,558

881

1,423

884

3,188

2,170

1,497

891

4,558

60

37

20

3

1

61

$ 3,188

3,006

4,347

112

99

4,558

$

$

$

$

$

$

$

$

$

$

Mar 31,

2023

761

682

733

627

203

3,006

1,341

4,347

826

1,347

833

3,006

2,090

1,417

840

4,347

2,766

93

26

22

(2)

1

100

3,006

4,048

152

147

4,347

$

$

$

$

$

$

$

Dec 31,

2022

654

638

670

**235

603

201

2,766

1,282

4,048

751

1,252

763

2,766

1,964

1,314

770

4,048

2,616

33

8

9

(7)

107

2,766

3,823

70

155

$ 4,048

$

$

$

$

$

$

$

$

$

$

Sep 30,

2022

615

612

609

577

203

2,616

1,207

3,823

698

1,209

709

2,616

1,848

1,261

714

3,823

2,743

(36)

9

6

(5)

2

(103)

2,616

3,798

(15)

40

3,823

(a) Includes CCB client investment assets invested in managed accounts and J.P. Morgan mutual funds where AWM is the investment manager.

$

$

$

$

$

$

$

$

$

$

Jun 30,

2022

654

624

641

615

209

2,743

1,055

3,798

712

1,294

737

2,743

1,715

1,339

744

3,798

2,960

(1)

9

(3)

1

(223)

2,743

4,116

(1)

(317)

3,798

Jun 30, 2023

Change

Mar 31,

2023

9%

5

8

3

1

6

2

5

7

6

6

6

4

6

6

5

JPMORGAN CHASE & CO.

Jun 30,

2022

26 %

15

24

5

(2)

16

30

20

24

10

20

16

27

12

20

20

$

$

$

$

$

$

$

2023

$

SIX MONTHS ENDED JUNE 30,

826

718

792

647

205

3,188

1,370

4,558

881

1,423

884

3,188

2,170

1,497

891

4,558

2,766

153

63

42

1

2

161

3,188

4,048

264

246

$ 4,558

$

$

$

$

$

$

$

$

$

$

2022

654

624

641

615

209

2,743

1,055

3,798

712

1,294

737

2,743

1,715

1,339

744

3,798

3,113

(52)

(4)

20

3

6

(343)

2,743

4,295

(6)

(491)

3,798

2023 Change

2022

26 %

15

24

5

(2)

16

30

20

24

10

20

16

27

12

20

20

Page 23View entire presentation