Levi Strauss Investor Day Presentation Deck

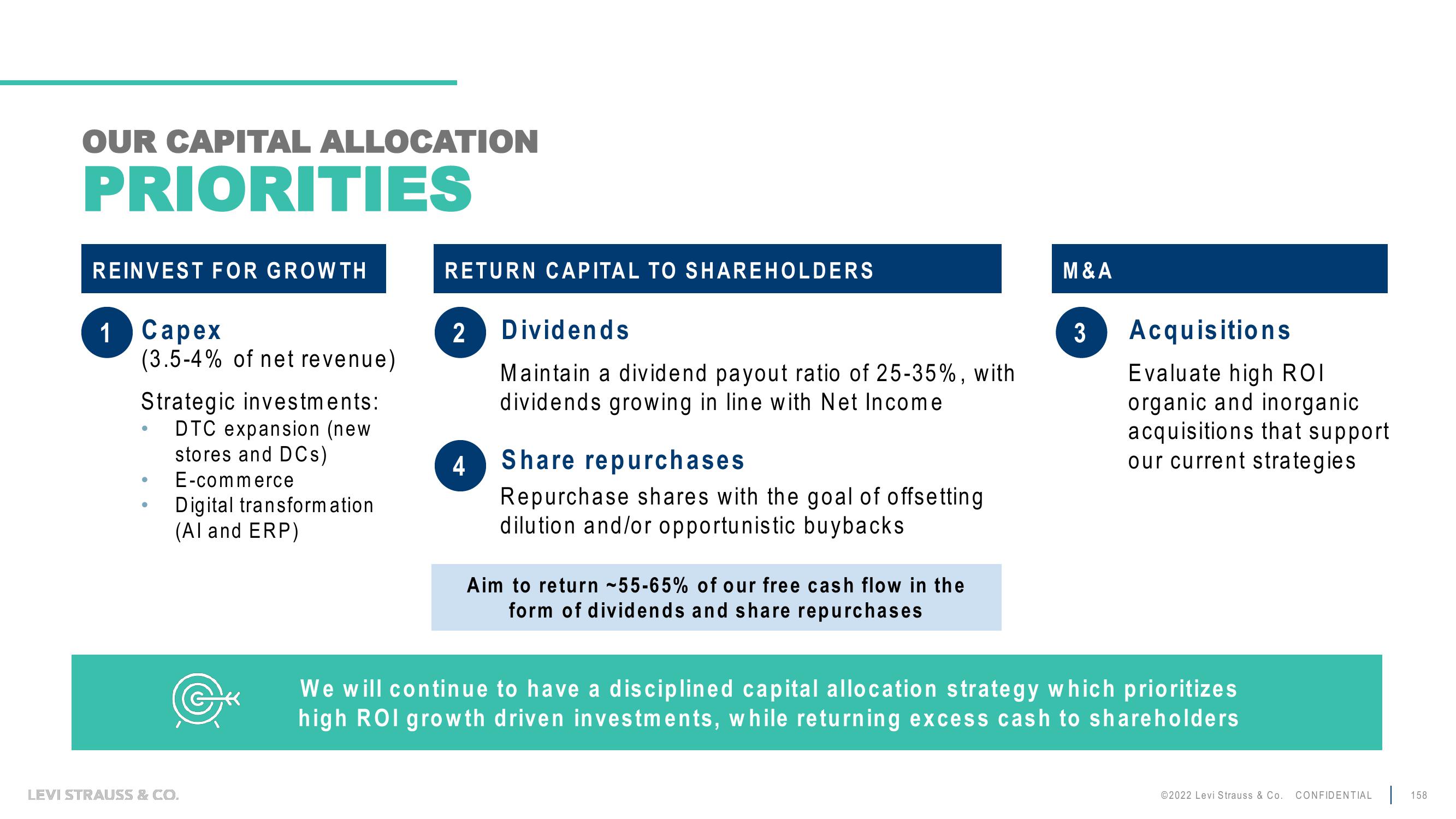

OUR CAPITAL ALLOCATION

PRIORITIES

REINVEST FOR GROWTH

1 Capex

(3.5-4% of net revenue)

Strategic investments:

DTC expansion (new

stores and DCs)

E-commerce

●

●

Digital transformation

(Al and ERP)

LEVI STRAUSS & CO.

RETURN CAPITAL TO SHAREHOLDERS

2

4

Dividends

Maintain a dividend payout ratio of 25-35%, with

dividends growing in line with Net Income

Share repurchases

Repurchase shares with the goal of offsetting

dilution and/or opportunistic buybacks

Aim to return ~55-65% of our free cash flow in the

form of dividends and share repurchases

M&A

3

Acquisitions

Evaluate high ROI

organic and inorganic

acquisitions that support

our current strategies

We will continue to have a disciplined capital allocation strategy which prioritizes

high ROI growth driven investments, while returning excess cash to shareholders

©2022 Levi Strauss & Co. CONFIDENTIAL 158View entire presentation