Goldman Sachs Results Presentation Deck

Capital and Balance Sheet

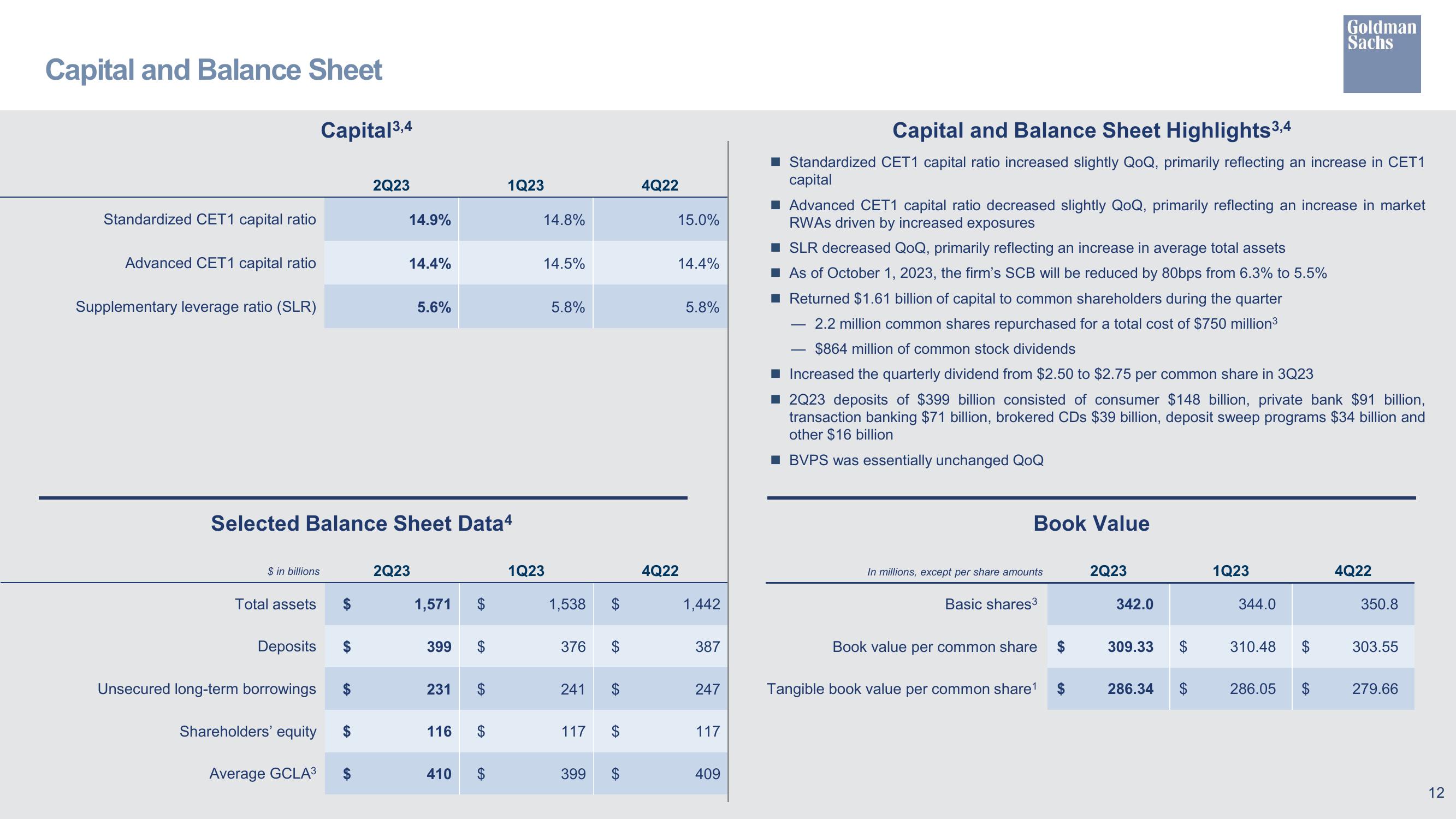

Capital ³,4

Standardized CET1 capital ratio

Advanced CET1 capital ratio

Supplementary leverage ratio (SLR)

$ in billions

Total assets

Deposits

Unsecured long-term borrowings

Selected Balance Sheet Data4

Shareholders' equity

Average GCLA³

2Q23

SA

14.9%

14.4%

5.6%

2Q23

1,571

399

231

116

410

GA

SA

1Q23

SA

14.8%

14.5%

1Q23

5.8%

1,538 $

376

241

117

399

SA

SA

4Q22

15.0%

14.4%

4Q22

5.8%

1,442

387

247

117

409

Capital and Balance Sheet Highlights 3,4

Standardized CET1 capital ratio increased slightly QoQ, primarily reflecting an increase in CET1

capital

■ Advanced CET1 capital ratio decreased slightly QoQ, primarily reflecting an increase in market

RWAS driven by increased exposures

■ SLR decreased QoQ, primarily reflecting an increase in average total assets

■ As of October 1, 2023, the firm's SCB will be reduced by 80bps from 6.3% to 5.5%

■ Returned $1.61 billion of capital to common shareholders during the quarter

2.2 million common shares repurchased for a total cost of $750 million³

$864 million of common stock dividends

Increased the quarterly dividend from $2.50 to $2.75 per common share in 3Q23

2Q23 deposits of $399 billion consisted of consumer $148 billion, private bank $91 billion,

transaction banking $71 billion, brokered CDs $39 billion, deposit sweep programs $34 billion and

other $16 billion

BVPS was essentially unchanged QoQ

Book Value

In millions, except per share amounts

Basic shares³

Book value per common share

Tangible book value per common share¹

2Q23

342.0

309.33

286.34

1Q23

344.0

310.48

Goldman

Sachs

286.05

$

4Q22

350.8

303.55

279.66

12View entire presentation