UBS Results Presentation Deck

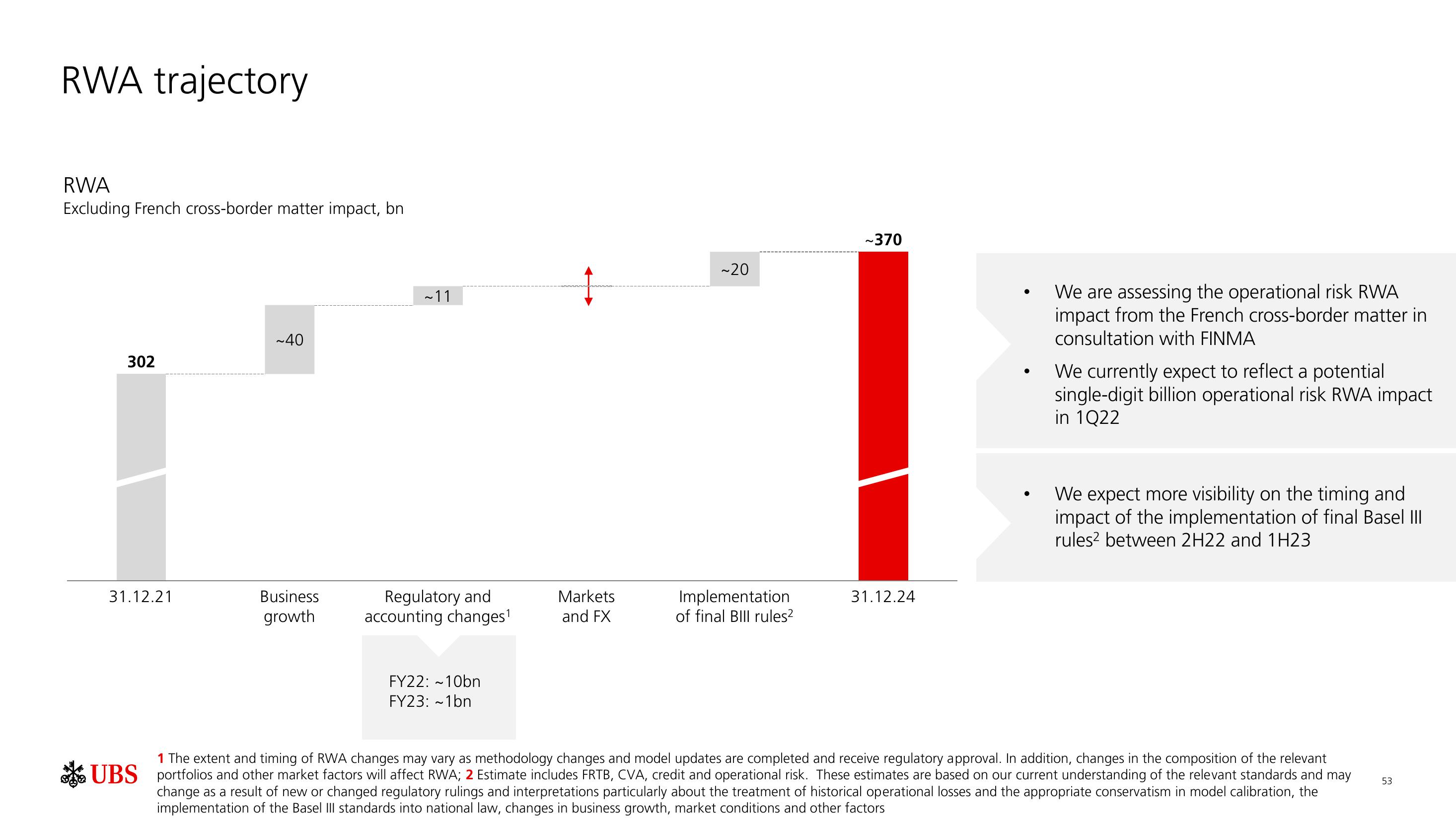

RWA trajectory

RWA

Excluding French cross-border matter impact, bn

302

31.12.21

~40

Business

growth

~11

Regulatory and

accounting changes¹

FY22: ~10bn

FY23: ~1bn

Markets

and FX

~20

Implementation

of final BIII rules²

~370

31.12.24

●

●

We are assessing the operational risk RWA

impact from the French cross-border matter in

consultation with FINMA

We currently expect to reflect a potential

single-digit billion operational risk RWA impact

in 1Q22

We expect more visibility on the timing and

impact of the implementation of final Basel III

rules² between 2H22 and 1H23

1 The extent and timing of RWA changes may vary as methodology changes and model updates are completed and receive regulatory approval. In addition, changes in the composition of the relevant

UBS portfolios and other market factors will affect RWA; 2 Estimate includes FRTB, CVA, credit and operational risk. These estimates are based on our current understanding of the relevant standards and may

change as a result of new or changed regulatory rulings and interpretations particularly about the treatment of historical operational losses and the appropriate conservatism in model calibration, the

implementation of the Basel III standards into national law, changes in business growth, market conditions and other factors

53View entire presentation