Cyxtera SPAC Presentation Deck

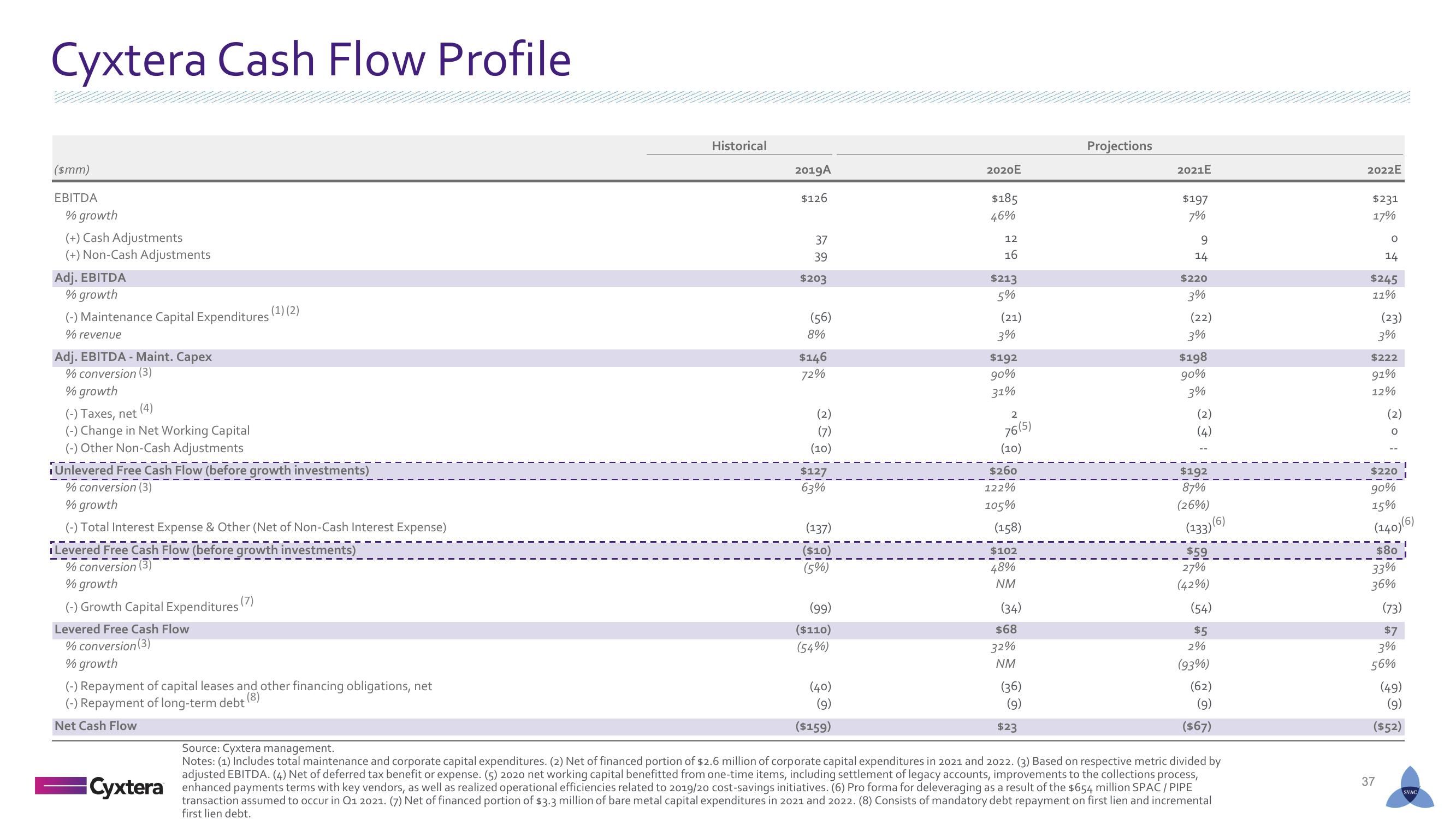

Cyxtera Cash Flow Profile

($mm)

EBITDA

% growth

(+) Cash Adjustments

(+) Non-Cash Adjustments

Adj. EBITDA

% growth

(-) Maintenance Capital Expenditures

% revenue

Adj. EBITDA - Maint. Capex

% conversion (3)

% growth

(4)

(-) Taxes, net

(-) Change in Net Working Capital

(-) Other Non-Cash Adjustments

¡Unlevered Free Cash Flow (before growth investments)

% conversion (3)

% growth

(-) Total Interest Expense & Other (Net of Non-Cash Interest Expense)

Levered Free Cash Flow (before growth investments)

% conversion (3)

% growth

(-) Growth Capital Expenditures (7)

(1) (2)

Levered Free Cash Flow

% conversion (3)

% growth

(-) Repayment of capital leases and other financing obligations, net

(-) Repayment of long-term debt

Net Cash Flow

Historical

2019A

$126

37

39

$203

(56)

8%

$146

72%

(2)

(10)

$127

63%

(137)

($10)

(5%)

(99)

($110)

(54%)

(40)

(9)

($159)

2020E

$185

46%

12

16

$213

5%

(21)

3%

$192

90%

31%

2

76(5)

(10)

$260

122%

105%

(158)

$102

48%

NM

(34)

$68

32%

NM

(36)

(9)

$23

Projections

2021E

$197

7%

9

14

$220

3%

(22)

3%

$198

90%

3%

F

$192

87%

(26%)

(6)

(133)

$59

27%

(42%)

(54)

$5

2%

(93%)

(62)

(9)

($67)

Source: Cyxtera management.

Notes: (1) Includes total maintenance and corporate capital expenditures. (2) Net of financed portion of $2.6 million of corporate capital expenditures in 2021 and 2022. (3) Based on respective metric divided by

adjusted EBITDA. (4) Net of deferred tax benefit or expense. (5) 2020 net working capital benefitted from one-time items, including settlement of legacy accounts, improvements to the collections process,

Cyxtera enhanced payments terms with key vendors, as well as realized operational efficiencies related to 2019/20 cost-savings initiatives. (6) Pro forma for deleveraging as a result of the $654 million SPAC/PIPE

transaction assumed to occur in Q1 2021. (7) Net of financed portion of $3.3 million of bare metal capital expenditures in 2021 and 2022. (8) Consists of mandatory debt repayment on first lien and incremental

first lien debt.

2022E

$231

17%

O

14

$245

11%

(23)

3%

$222

91%

12%

(2)

$220

90%

15%

(140)(6)

1

37

$80

33%

36%

(73)

$7

3%

56%

(49)

(9)

($52)

SVACView entire presentation