Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

Consumer

recovery

Record CIB

profits¹

Cost control

Net impairment

release

Strong capital

position

PERFORMANCE

Increased capital

return

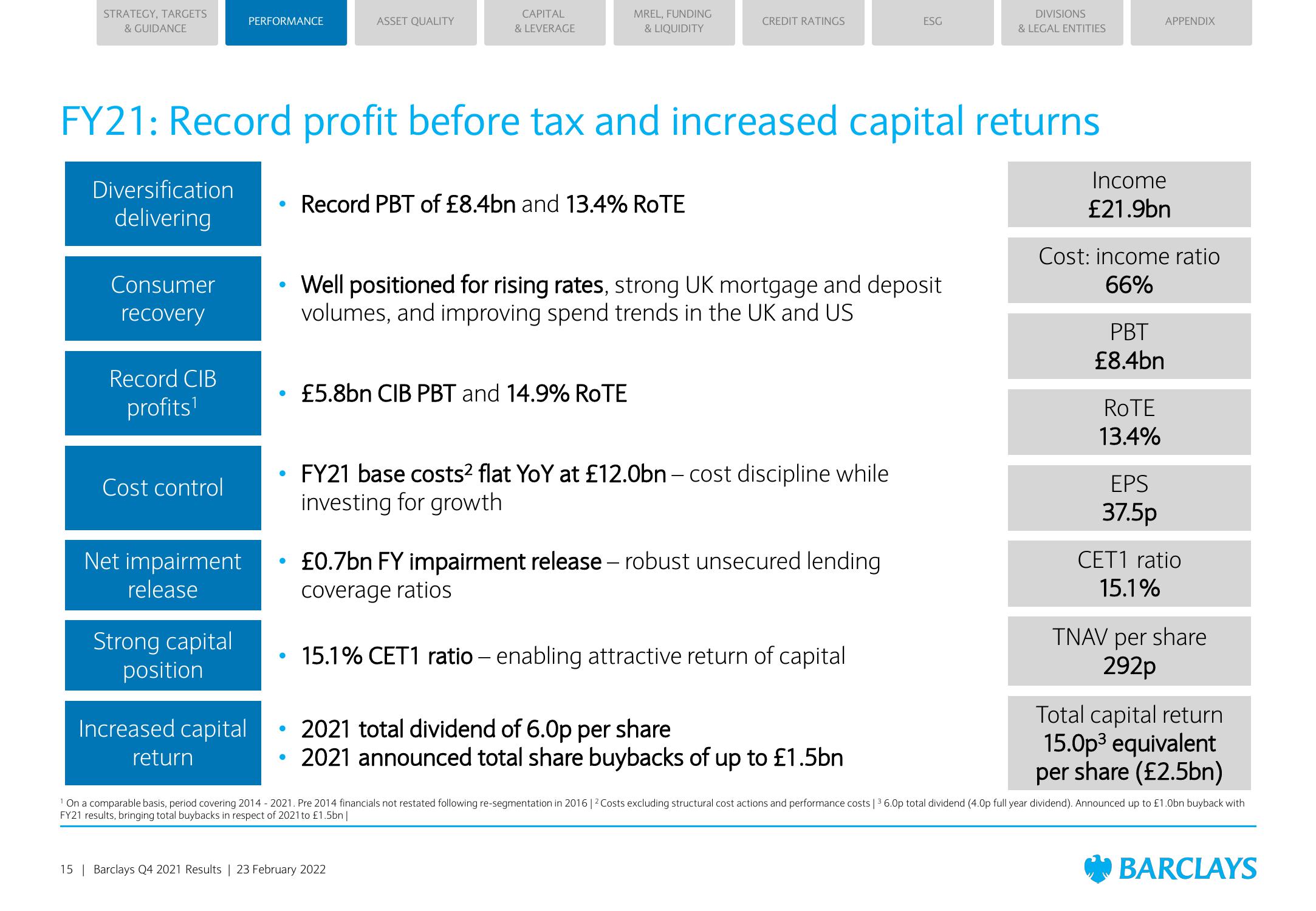

FY21: Record profit before tax and increased capital returns

Diversification

delivering

●

●

ASSET QUALITY

CAPITAL

& LEVERAGE

●

MREL, FUNDING

& LIQUIDITY

Record PBT of £8.4bn and 13.4% ROTE

• Well positioned for rising rates, strong UK mortgage and deposit

volumes, and improving spend trends in the UK and US

●

£5.8bn CIB PBT and 14.9% ROTE

CREDIT RATINGS

• FY21 base costs² flat YoY at £12.0bn - cost discipline while

investing for growth

• £0.7bn FY impairment release - robust unsecured lending

coverage ratios

15 | Barclays Q4 2021 Results | 23 February 2022

15.1% CET1 ratio – enabling attractive return of capital

2021 total dividend of 6.0p per share

• 2021 announced total share buybacks of up to £1.5bn

ESG

DIVISIONS

& LEGAL ENTITIES

Income

£21.9bn

Cost: income ratio

66%

PBT

£8.4bn

APPENDIX

ROTE

13.4%

EPS

37.5p

CET1 ratio

15.1%

TNAV per share

292p

Total capital return

15.0p³ equivalent

per share (£2.5bn)

1 On a comparable basis, period covering 2014-2021. Pre 2014 financials not restated following re-segmentation in 2016 | ² Costs excluding structural cost actions and performance costs | 36.0p total dividend (4.0p full year dividend). Announced up to £1.0bn buyback with

FY21 results, bringing total buybacks in respect of 2021 to £1.5bn |

BARCLAYSView entire presentation