MoneyLion Results Presentation Deck

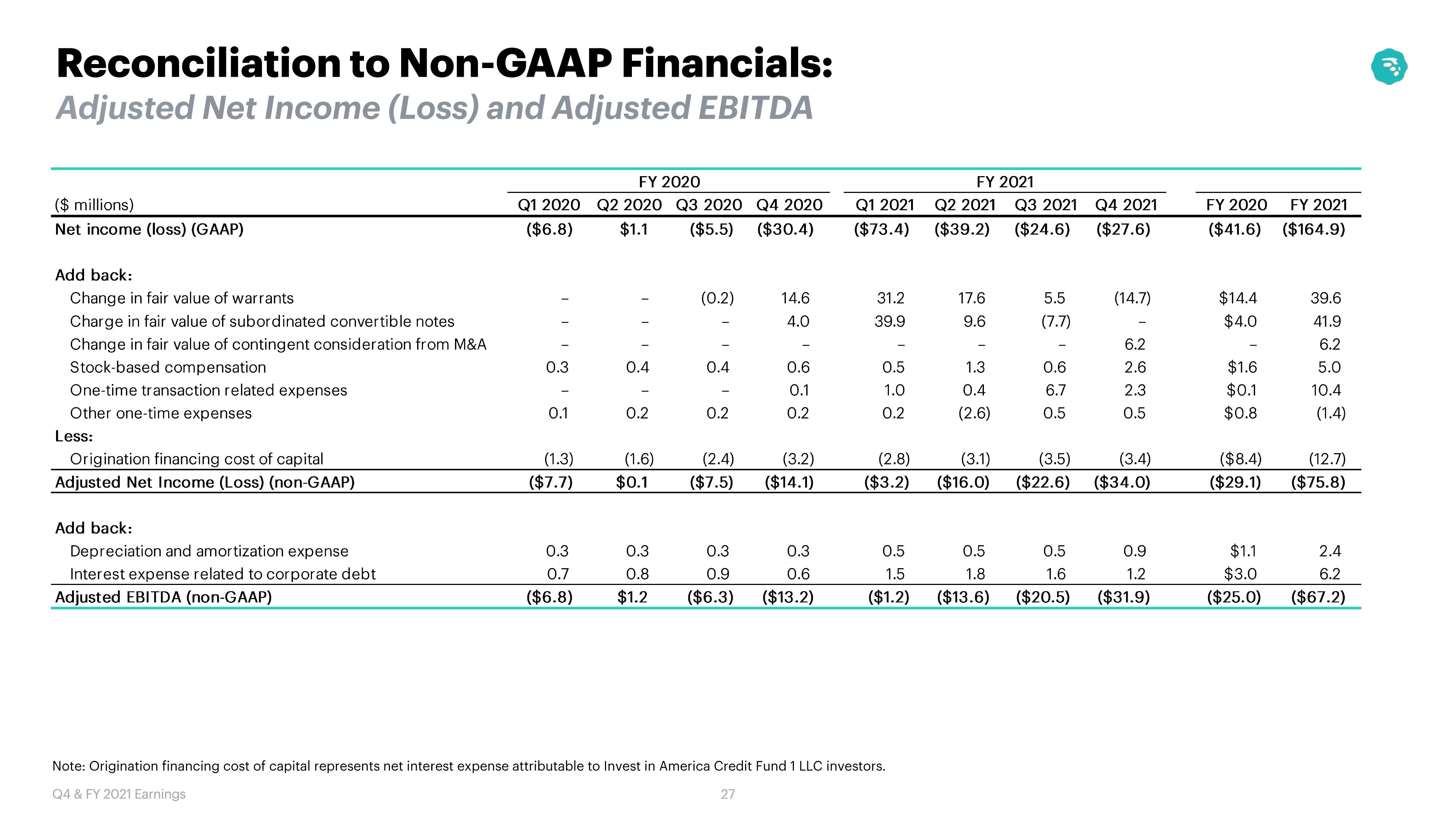

Reconciliation to Non-GAAP Financials:

Adjusted Net Income (Loss) and Adjusted EBITDA

($ millions)

Net income (loss) (GAAP)

Add back:

Change in fair value of warrants

Charge in fair value of subordinated convertible notes

Change in fair value of contingent consideration from M&A

Stock-based compensation

One-time transaction related expenses

Other one-time expenses

Less:

Origination financing cost of capital

Adjusted Net Income (Loss) (non-GAAP)

Add back:

Depreciation and amortization expense

Interest expense related to corporate debt

Adjusted EBITDA (non-GAAP)

FY 2020

Q1 2020 Q2 2020 Q3 2020 Q4 2020

($6.8) $1.1 ($5.5) ($30.4)

0.3

0.1

(1.3)

($7.7)

0.4

0.2

(0.2)

0.4

0.2

(1.6)

(2.4)

$0.1 ($7.5)

14.6

4.0

0.6

0.1

0.2

(3.2)

($14.1)

0.3

0.3

0.3

0.9

0.7

0.8

($6.8) $1.2 ($6.3) ($13.2)

0.3

0.6

Q1 2021

($73.4)

31.2

39.9

0.5

1.0

0.2

FY 2021

Q2 2021 Q3 2021

($39.2) ($24.6)

17.6

9.6

Note: Origination financing cost of capital represents net interest expense attributable to Invest in America Credit Fund 1 LLC investors.

Q4 & FY 2021 Earnings

27

1.3

0.4

(2.6)

(2.8)

(3.1)

($3.2) ($16.0)

0.5

0.5

1.5

1.8

($1.2) ($13.6)

5.5

(7.7)

0.6

6.7

0.5

(3.5)

($22.6)

0.5

1.6

($20.5)

Q4 2021

($27.6)

(14.7)

6.2

2.6

2.3

0.5

(3.4)

($34.0)

0.9

1.2

($31.9)

FY 2020

($41.6)

$14.4

$4.0

$1.6

$0.1

$0.8

($8.4)

($29.1)

$1.1

$3.0

($25.0)

FY 2021

($164.9)

39.6

41.9

6.2

5.0

10.4

(1.4)

(12.7)

($75.8)

2.4

6.2

($67.2)View entire presentation