First Busey Results Presentation Deck

2Q23 Earnings Investor Presentation

First Busey Corporation | Ticker: BUSE

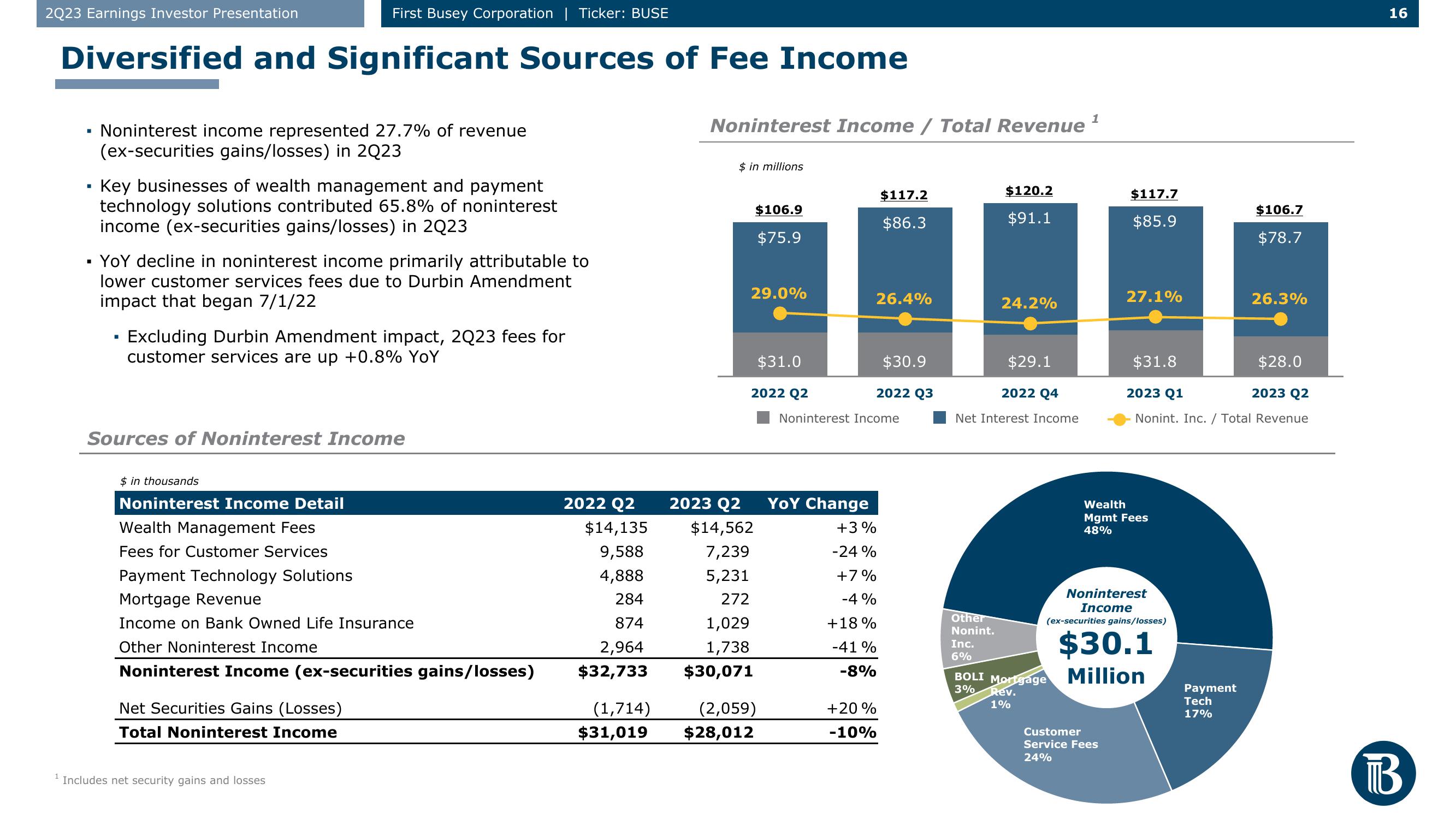

Diversified and Significant Sources of Fee Income

■

■

Noninterest income represented 27.7% of revenue

(ex-securities gains/losses) in 2Q23

Key businesses of wealth management and payment

technology solutions contributed 65.8% of noninterest

income (ex-securities gains/losses) in 2Q23

YOY decline in noninterest income primarily attributable to

lower customer services fees due to Durbin Amendment

impact that began 7/1/22

I

Excluding Durbin Amendment impact, 2Q23 fees for

customer services are up +0.8% YoY

Sources of Noninterest Income

$ in thousands

Noninterest Income Detail

Wealth Management Fees

Fees for Customer Services

Payment Technology Solutions

Mortgage Revenue

Income on Bank Owned Life Insurance

Other Noninterest Income

Noninterest Income (ex-securities gains/losses)

Net Securities Gains (Losses)

Total Noninterest Income

Includes net security gains and losses

2022 Q2

$14,135

9,588

4,888

284

874

2,964

$32,733

(1,714)

$31,019

1

Noninterest Income / Total Revenue ¹

$ in millions

2023 Q2

29.0%

$106.9

$75.9

$14,562

7,239

5,231

272

2022 Q2

1,029

1,738

$30,071

$31.0

(2,059)

$28,012

YOY Change

+3%

-24%

+7%

-4%

+18 %

-41%

-8%

$117.2

$86.3

+20%

-10%

26.4%

$30.9

Noninterest Income

2022 Q3

Other

Nonint.

$120.2

$91.1

24.2%

2022 Q4

Net Interest Income

Inc.

6%

$29.1

$117.7

$85.9

27.1%

$31.8

Wealth

Mgmt Fees

48%

Customer

Service Fees

24%

$28.0

2023 Q2

2023 Q1

Nonint. Inc. / Total Revenue

Noninterest

Income

(ex-securities gains/losses)

$30.1

BOLI Mortgage Million

3% Rev.

1%

$106.7

$78.7

Payment

Tech

17%

26.3%

16

BView entire presentation