Bank of America Investment Banking Pitch Book

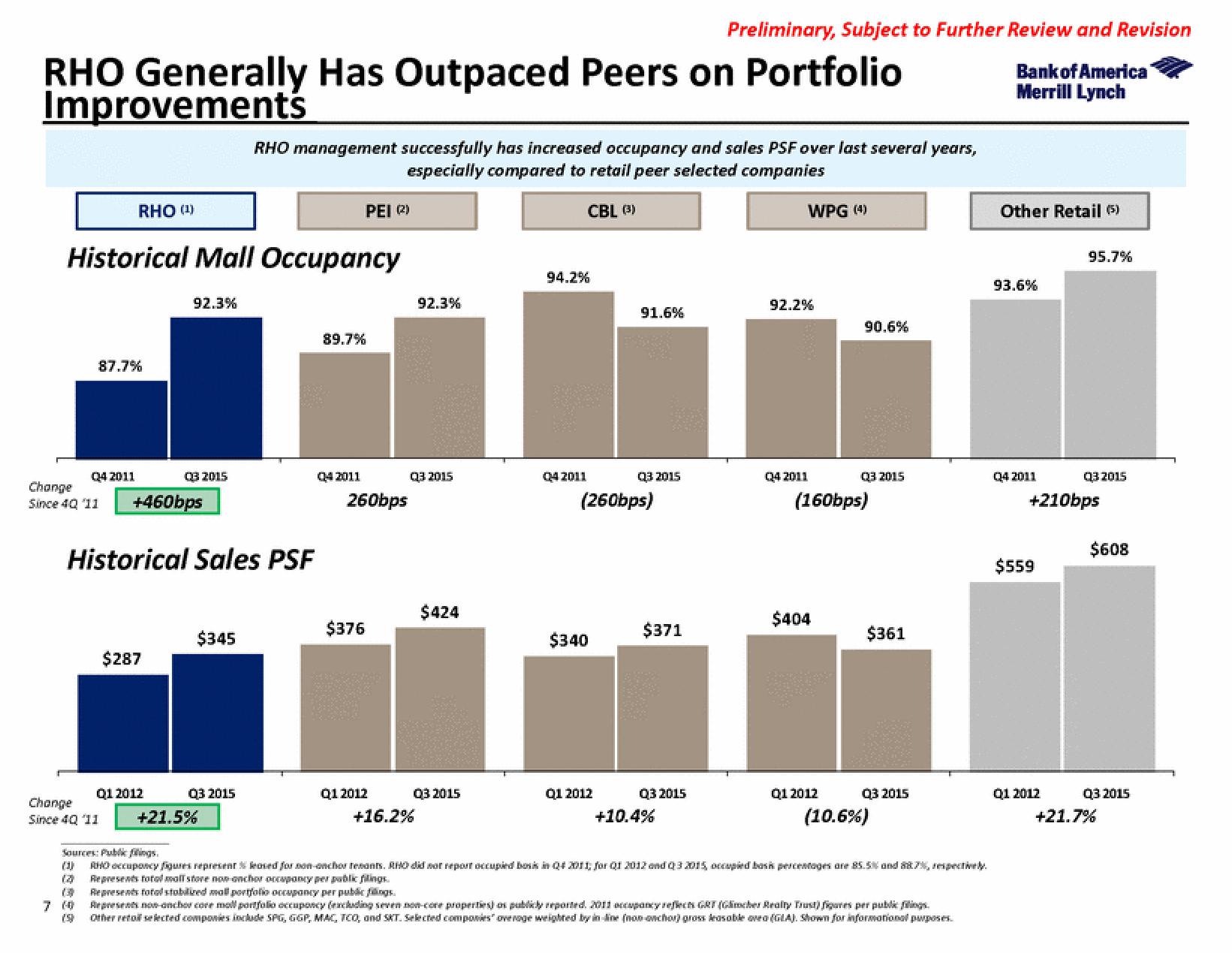

RHO Generally Has Outpaced Peers on Portfolio

Improvements

RHO (¹)

Historical Mall Occupancy

87.7%

Q4 2011

Change

Since 4Q 11 +460bps

Change

Since 40 '11

13

(3

7 (0

19

92.3%

Historical Sales PSF

$287

Q1 2012

03 2015

$345

Q3 2015

+21.5%

RHO management successfully has increased occupancy and sales PSF over last several years,

especially compared to retail peer selected companies

CBL (3)

89.7%

04 2011

PEI (2²)

260bps

$376

Q1 2012

92.3%

Q3 2015

+16.2%

$424

03 2015

94.2%

Q4 2011

$340

91.6%

(260bps)

Q1 2012

Q3 2015

Preliminary, Subject to Further Review and Revision

Bank of America

Merrill Lynch

$371

Q3 2015

+10.4%

WPG (4)

92.2%

Q4 2011

$404

90.6%

(160bps)

Q1 2012

03 2015

$361

Q3 2015

(10.6%)

Sources: Public filings.

RHO occupancy figures represent & leased for non-onchor resants. RHO did not report occupied bok in Q4 2011, for Q1 2012 and 03 2015, occupied bash percentages are 85.5% and 887%, respectively.

Represents tot mall store non anchor occupancy per public filings

Represents total stabilired mall portfolio occupancy per public figs.

Represents non-onchor core moll portfolio occupancy (excluding seven non-core properties) os publicly reported. 2011 occupancy reflects GRT (Glimcher Realty Trust) figures per public filings.

Other retol selected companies include SPG, GGP, MAC, TCO, and SAT. Selected companies" overage weighted by in line (non anchor) gross leasable oveo (GLA). Shown for informational purposes.

Other Retail (5)

93.6%

Q4 2011

$559

95.7%

+210bps

Q1 2012

Q3 2015

$608

Q3 2015

+21.7%View entire presentation