Evercore Investment Banking Pitch Book

SIRE Situation Analysis

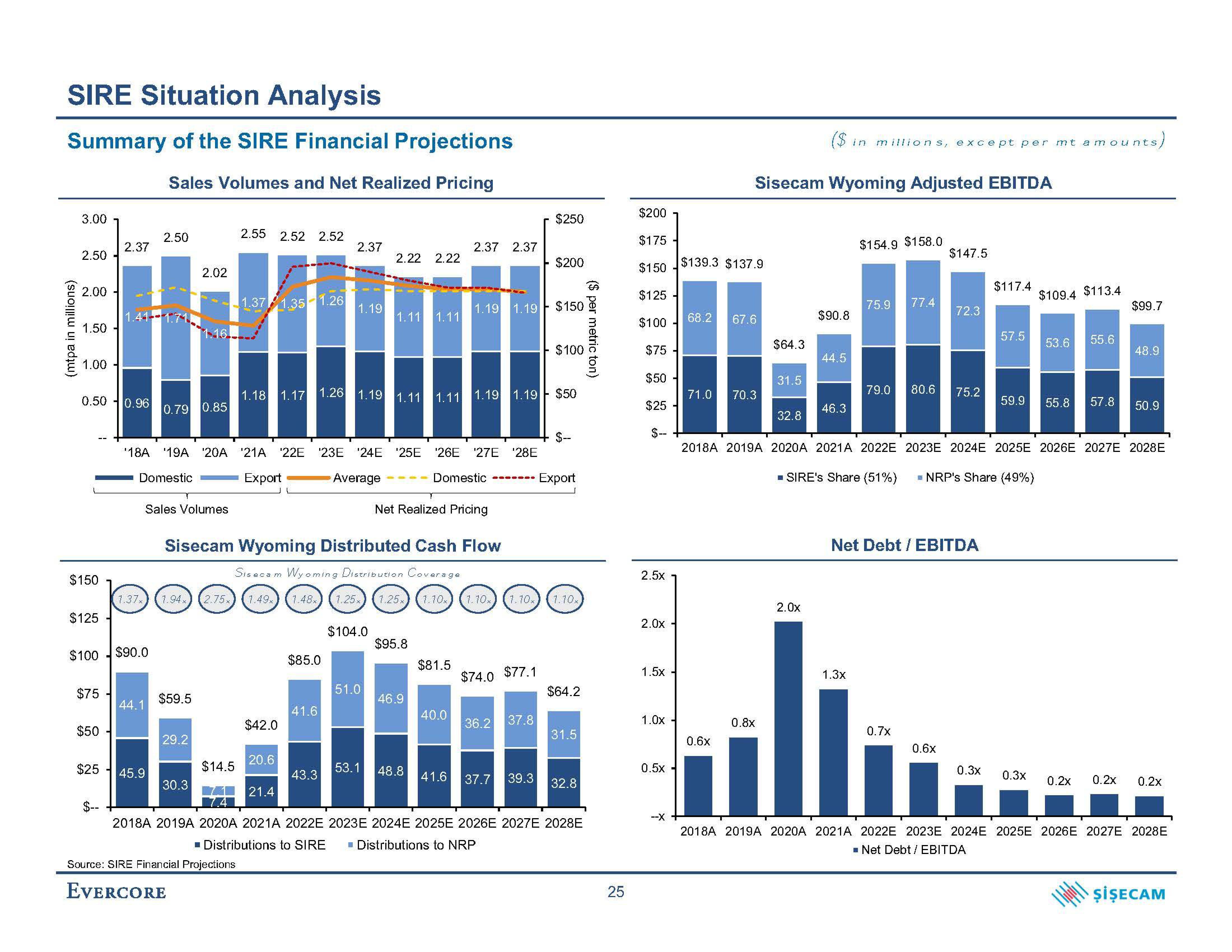

Summary of the SIRE Financial Projections

Sales Volumes and Net Realized Pricing

(mtpa in millions)

3.00

2.50

2.00

1.50

1.00

$150

0.50 0.96

$125

$75 -

2.37

$50-

1.41

$--

$100 $90.0

2.50

44.1

$25 45.9

0.79 0.85

Sales Volumes

2.02

$59.5

1.16.

29.2

2.55 2.52 2.52

30.3

1.37 1.35-1.26

1.18

$14.5

1.37x) 1.94x 2.75x) 1.49x (1.48x) 1.25, (1.25x

$42.0

Net Realized Pricing

Sisecam Wyoming Distributed Cash Flow

Sisecam Wyoming Distribution Coverage

20.6

18A '19A '20A ¹21A 22E '23E '24E '25E ¹26E '27E ¹28E

Domestic

Export

Domestic▪▪▪▪▪ Export

7.1 21.4

2.37

1.19

$85.0

41.6

1.17 1.26 1.19 1.11 1.11 1.19 1.19

43.3

Average

2.22 2.22

1.11 1.11

$104.0

51.0

$95.8

46.9

53.1 48.8

2.37 2.37

1.10x

1.19 1.19

$81.5

40.0

$74.0

$77.1

$250

36.2 37.8

$200

41.6 37.7 39.3

$150

$100

1.10x) (1.10x 1.10x)

$50

$--

$64.2

31.5

32.8

2018A 2019A 2020A 2021A 2022E 2023E 2024E 2025E 2026E 2027E 2028E

■ Distributions to SIRE ■ Distributions to NRP

Source: SIRE Financial Projections

EVERCORE

($ per metric ton)

25

$200

$175

$150

$125-

$100 68.2

$75 -

$50

$25

$--

2.5x

2.0x

1.5x

1.0x-

0.5x

--X

($ in

Sisecam Wyoming Adjusted EBITDA

$139.3 $137.9

67.6

71.0 70.3

0.6x

$64.3

0.8x

31.5

32.8

$90.8

44.5

2.0x

46.3

millions, except per mt amounts

$154.9 $158.0

75.9

1.3x

79.0

■ SIRE's Share (51%)

77.4

80.6

0.7x

$147.5

72.3

75.2

Net Debt / EBITDA

0.6x

$117.4

57.5

2018A 2019A 2020A 2021A 2022E 2023E 2024E 2025E 2026E 2027E 2028E

■ NRP's Share (49%)

0.3x

59.9

$109.4 $113.4

0.3x

53.6 55.6

55.8 57.8

ts)

0.2x

$99.7

48.9

50.9

0.2x 0.2x

2018A 2019A 2020A 2021A 2022E 2023E 2024E 2025E 2026E 2027E 2028E

■ Net Debt / EBITDA

ŞİŞECAMView entire presentation