Baird Investment Banking Pitch Book

AR KEY PERFORMANCE DRIVERS (CONT.)

1

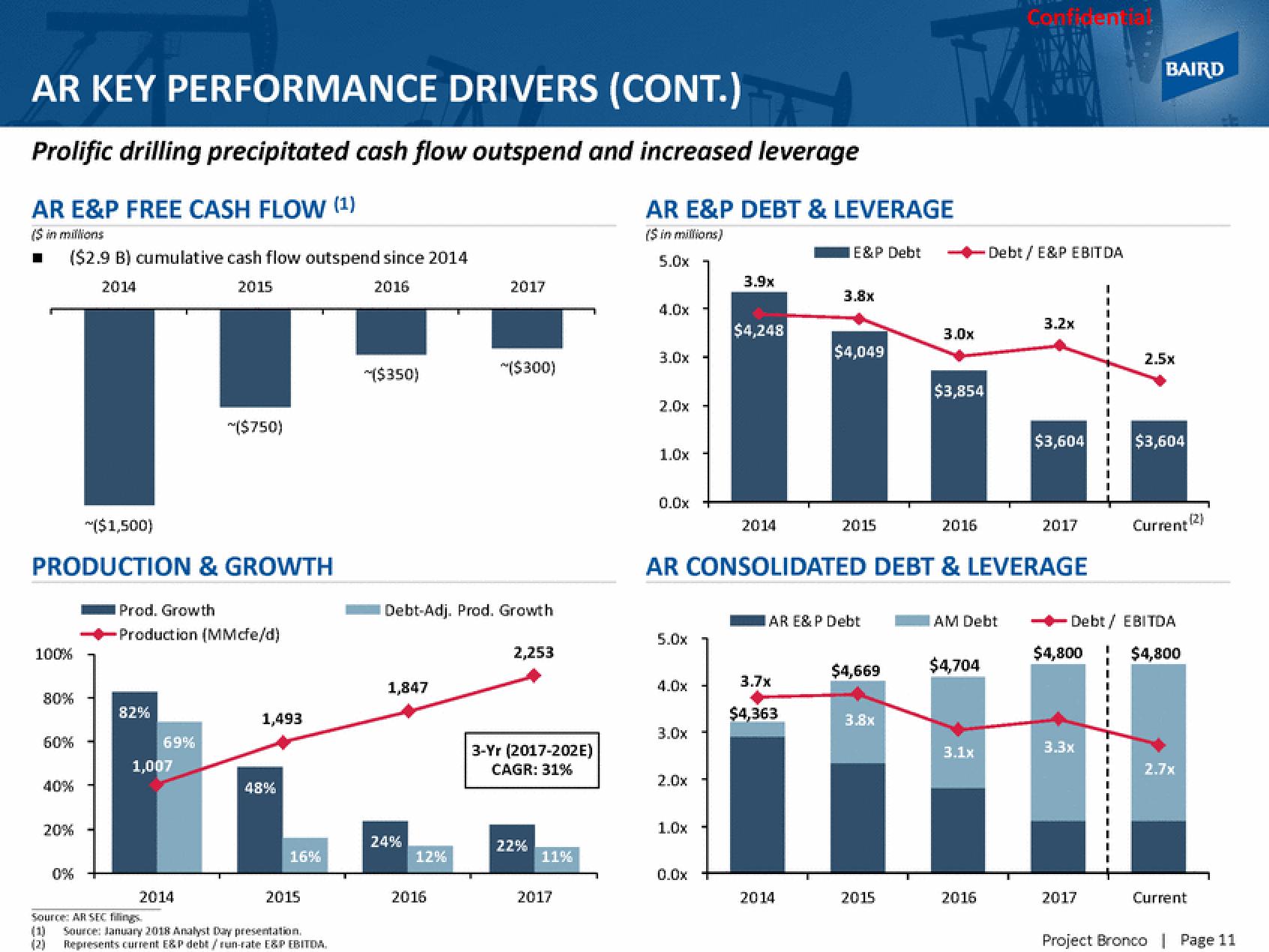

Prolific drilling precipitated cash flow outspend and increased leverage

AR E&P FREE CASH FLOW (1)

($ in millions

($2.9 B) cumulative cash flow outspend since 2014

2014

2015

2016

($1,500)

PRODUCTION & GROWTH

100%

80%

60%

40%

20%

(2)

Prod. Growth

Production (MMcfe/d)

82%

69%

1,007

Source: AR SEC filings

~($750)

2014

1,493

48%

16%

2015

Source: January 2018 Analyst Day presentation.

Represents current E&P debt/run-rate E&P EBITDA.

~($350)

1,847

Debt-Adj. Prod. Growth

24%

12%

2017

2016

*($300)

2,253

3-Yr (2017-202E)

CAGR: 31%

22%

11%

2017

AR E&P DEBT & LEVERAGE

($ in millions)

5.0x

4.0x

3.0x

2.0x

1.0x

0.0x

5.0x

4.0x

3.0x

2.0x

1.0x

3.9x

0.0x

$4,248

2014

E&P Debt

3.7x

$4,363

3.8x

2014

$4,049

2015

IAR E&P Debt

AR CONSOLIDATED DEBT & LEVERAGE

$4,669

3.8x

3.0x

2015

$3,854

2016

AM Debt

$4,704

3.1x

Confidential

Debt / E&P EBITDA

2016

3.2x

$3,604

2017

$4,800

3.3x

2017

BAIRD

Debt / EBITDA

$4,800

I

2.5x

$3,604

Current (2)

2.7x

Current

Project Bronco | Page 11View entire presentation