Eos Energy Investor Presentation Deck

Path to Profitability

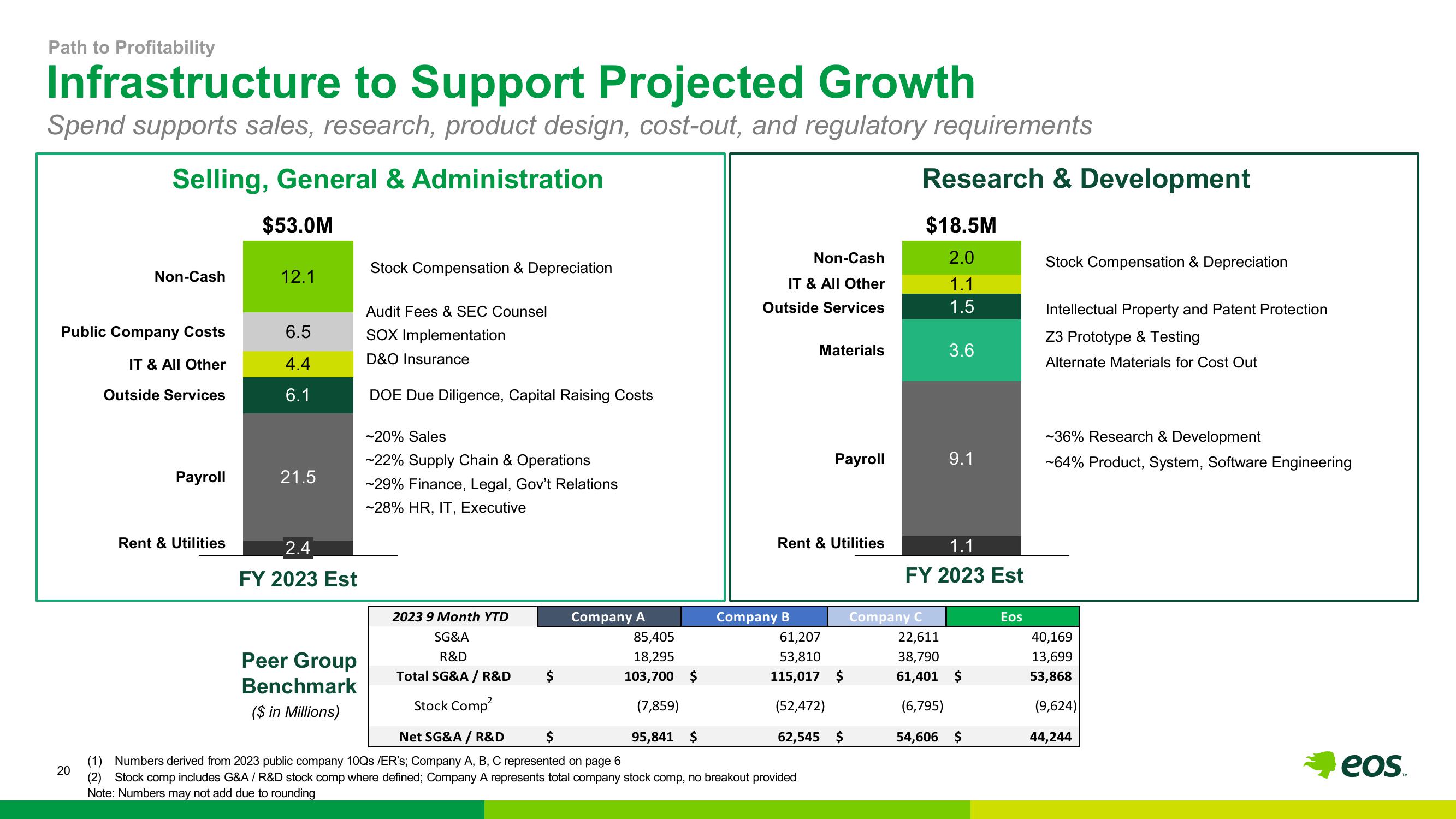

Infrastructure to Support Projected Growth

Spend supports sales, research, product design, cost-out, and regulatory requirements

Selling, General & Administration

$53.0M

Non-Cash

Public Company Costs

IT & All Other

Outside Services

20

Payroll

Rent & Utilities

12.1

6.5

4.4

6.1

21.5

2.4

FY 2023 Est

Peer Group

Benchmark

($ in Millions)

Stock Compensation & Depreciation

Audit Fees & SEC Counsel

SOX Implementation

D&O Insurance

DOE Due Diligence, Capital Raising Costs

~20% Sales

~22% Supply Chain & Operations

-29% Finance, Legal, Gov't Relations

~28% HR, IT, Executive

2023 9 Month YTD

SG&A

R&D

Total SG&A / R&D

Stock Comp²

Company A

85,405

18,295

103,700 $

(7,859)

95,841 $

Non-Cash

IT & All Other

Outside Services

Company B

Materials

Rent & Utilities

Payroll

Net SG&A / R&D

$

(1) Numbers derived from 2023 public company 10Qs /ER's; Company A, B, C represented on page 6

(2) Stock comp includes G&A / R&D stock comp where defined; Company A represents total company stock comp, no breakout provided

Note: Numbers may not add due to rounding

61,207

53,810

115,017 $

(52,472)

62,545 $

Research & Development

$18.5M

2.0

1.1

1.5

Company C

3.6

9.1

1.1

FY 2023 Est

22,611

38,790

61,401 $

(6,795)

54,606 $

Eos

Stock Compensation & Depreciation

Intellectual Property and Patent Protection

Z3 Prototype & Testing

Alternate Materials for Cost Out

-36% Research & Development

-64% Product, System, Software Engineering

40,169

13,699

53,868

(9,624)

44,244

eos.View entire presentation