Bank of America Results Presentation Deck

Global Markets¹

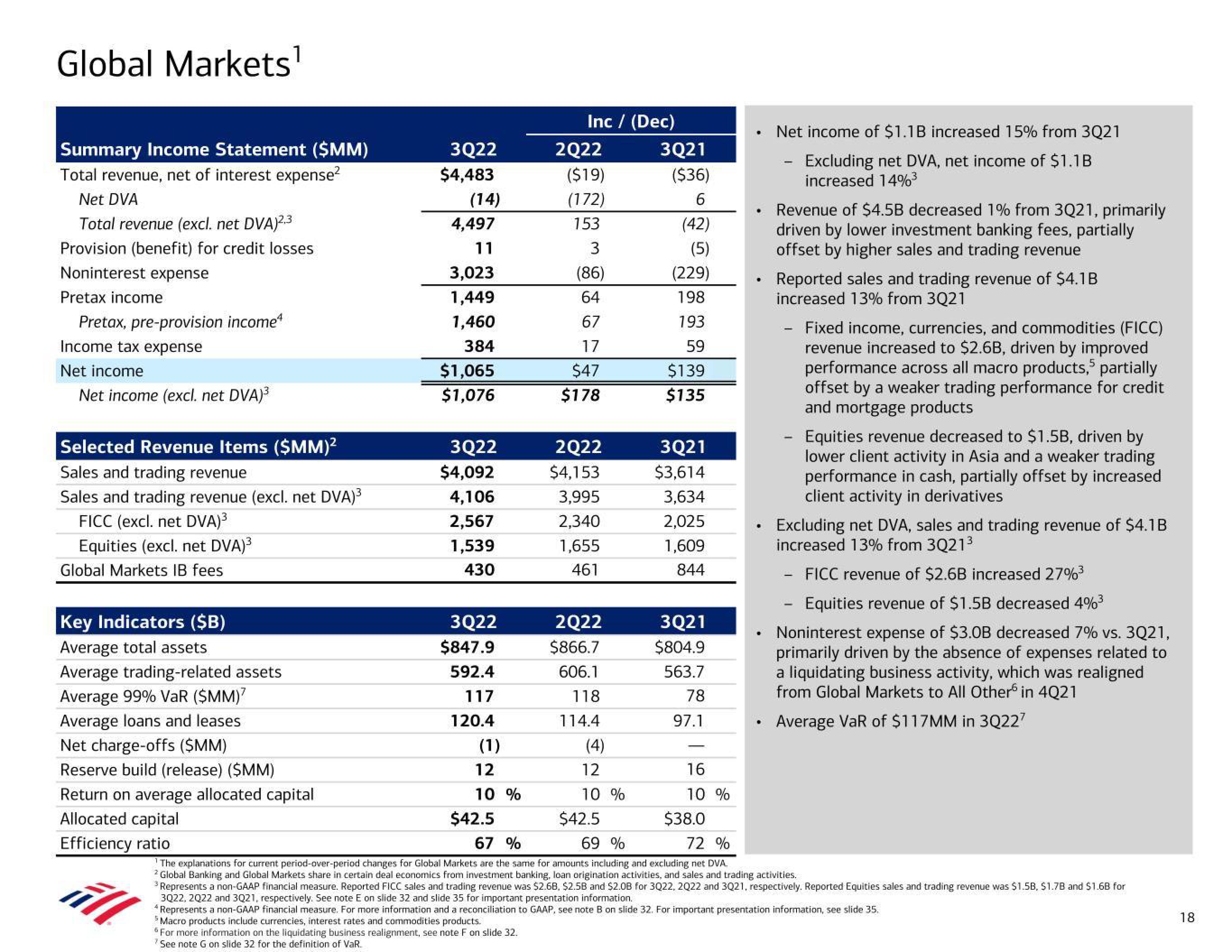

Summary Income Statement ($MM)

Total revenue, net of interest expense²

Net DVA

Total revenue (excl. net DVA)2.3

Provision (benefit) for credit losses

Noninterest expense

Pretax income

Pretax, pre-provision income4

Income tax expense

Net income

Net income (excl. net DVA)³

Selected Revenue Items ($MM)²

Sales and trading revenue

Sales and trading revenue (excl. net DVA)³

FICC (excl. net DVA)³

Equities (excl. net DVA)³

Global Markets IB fees

Key Indicators ($B)

Average total assets

Average trading-related assets

Average 99% VaR ($MM)?

Average loans and leases

Net charge-offs ($MM)

Reserve build (release) ($MM)

Return on average allocated capital

Allocated capital

Efficiency ratio

3Q22

$4,483

(14)

4,497

11

3,023

1,449

1,460

384

$1,065

$1,076

3Q22

$4,092

4,106

2,567

1,539

430

3Q22

$847.9

592.4

117

120.4

(1)

12

10 %

$42.5

Inc / (Dec)

For more information on the liquidating business realignment, see note F on slide 32.

See note G on slide 32 for the definition of VaR.

2Q22

($19)

(172)

153

3

(86)

64

67

17

$47

$178

2Q22

$4,153

3,995

2,340

1,655

461

2Q22

$866.7

606.1

118

114.4

(4)

12

10 %

$42.5

3Q21

($36)

6

(42)

(5)

(229)

198

193

59

$139

$135

3Q21

$3,614

3,634

2,025

1,609

844

3Q21

$804.9

563.7

78

97.1

16

10 %

$38.0

.

.

Net income of $1.1B increased 15% from 3Q21

Excluding net DVA, net income of $1.1B

increased 14%³

Revenue of $4.5B decreased 1% from 3Q21, primarily

driven by lower investment banking fees, partially

offset by higher sales and trading revenue

Reported sales and trading revenue of $4.1B

increased 13% from 3Q21

Fixed income, currencies, and commodities (FICC)

revenue increased to $2.6B, driven by improved

performance across all macro products,5 partially

offset by a weaker trading performance for credit

and mortgage products

Equities revenue decreased to $1.5B, driven by

lower client activity in Asia and a weaker trading

performance in cash, partially offset by increased

client activity in derivatives

Excluding net DVA, sales and trading revenue of $4.1B

increased 13% from 3Q21³

FICC revenue of $2.6B increased 27%³

Equities revenue of $1.5B decreased 4%³

Noninterest expense of $3.0B decreased 7% vs. 3Q21,

primarily driven by the absence of expenses related to

a liquidating business activity, which was realigned

from Global Markets to All Other in 4Q21

Average VaR of $117MM in 3Q227

67 %

69 %

72 %

The explanations for current period-over-period changes for Global Markets are the same for amounts including and excluding net DVA.

2 Global Banking and Global Markets share in certain deal economics from investment banking, loan origination activities, and sales and trading activities.

³ Represents a non-GAAP financial measure. Reported FICC sales and trading revenue was $2.68, $2.5B and $2.0B for 3Q22, 2022 and 3Q21, respectively. Reported Equities sales and trading revenue was $1.5B, $1.7B and $1.6B for

3Q22, 2022 and 3Q21, respectively. See note E on slide 32 and slide 35 for important presentation information.

*Represents a non-GAAP financial measure. For more information and a reconciliation to GAAP, see note B on slide 32. For important presentation information, see slide 35.

5 Macro products include currencies, interest rates and commodities products.

18View entire presentation