Apollo Global Management Mergers and Acquisitions Presentation Deck

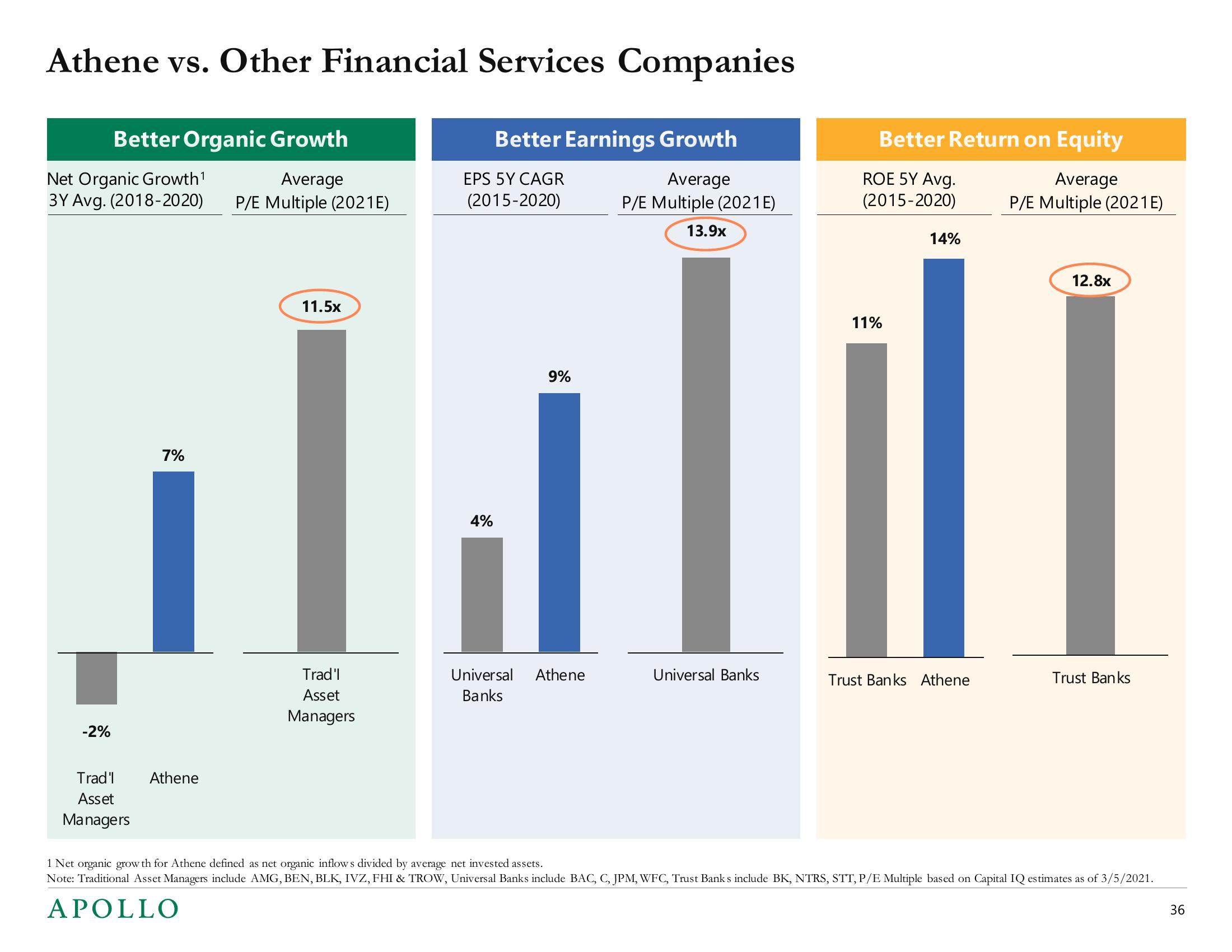

Athene vs. Other Financial Services Companies

Better Organic Growth

Net Organic Growth¹

Average

3Y Avg. (2018-2020) P/E Multiple (2021E)

-2%

Trad'l

Asset

Managers

7%

Athene

11.5x

Trad'l

Asset

Managers

Better Earnings Growth

Average

P/E Multiple (2021E)

13.9x

EPS 5Y CAGR

(2015-2020)

4%

9%

Universal Athene

Banks

Universal Banks

Better Return on Equity

ROE 5Y Avg.

Average

(2015-2020)

P/E Multiple (2021E)

11%

14%

Trust Banks Athene

12.8x

Trust Banks

1 Net organic grow th for Athene defined as net organic inflows divided by average net invested assets.

Note: Traditional Asset Managers include AMG, BEN, BLK, IVZ, FHI & TROW, Universal Banks include BAC, C, JPM, WFC, Trust Banks include BK, NTRS, STT, P/E Multiple based on Capital IQ estimates as of 3/5/2021.

APOLLO

36View entire presentation