Tudor, Pickering, Holt & Co Investment Banking

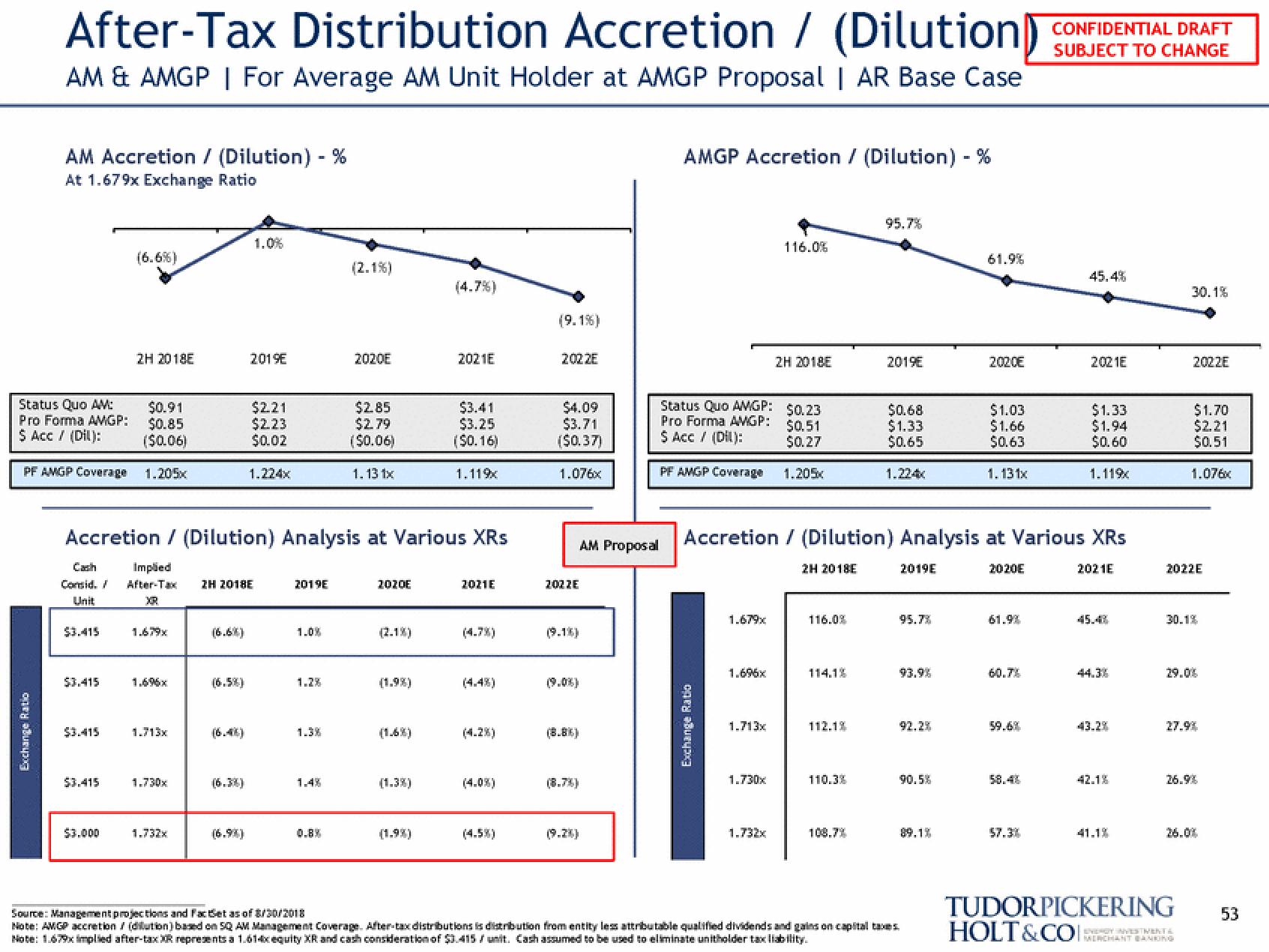

After-Tax Distribution Accretion / (Dilution

AM & AMGP | For Average AM Unit Holder at AMGP Proposal | AR Base Case

AM Accretion / (Dilution) - %

At 1.679x Exchange Ratio

Status Quo AM:

Pro Forma AMGP:

$ Acc / (Dil):

Exchange Ratio

$0.91

$0.85

($0.06)

PF AMGP Coverage 1.205x

$3.415

$3.415

$3.415

(6.6%)

$3.415

2H 2018E

$3.000

1.713x

1.730x

1.732x

1.0%

(6.6%)

2019E

$221

$2.23

$0.02

1.224x

Accretion / (Dilution) Analysis at Various XRs

Cash Impled

Consid. / After-Tax 2H 2018E

Unit

2019E

1.0%

1.38

1.4%

(2.1%)

0.8%

2020E

$2.85

$2.79

($0.06)

1.13 1x

2020E

(2.1%)

(1.9%)

(1.6%)

(4.7%)

(1.3%)

2021E

$3.41

$3.25

($0.16)

1.119

2021E

(4.2%)

(4.0%)

(4.5%)

(9.1%)

20ZZE

$4.09

$3.71

($0.37)

1.076x

2022E

(9.1%)

(9.0%)

AM Proposal

(8.8%)

(9.2%)

AMGP Accretion / (Dilution) - %

Status Quo AMGP: $0.23

Pro Forma AMGP:

$0.51

$ Acc / (Dil):

$0.27

PF AMGP Coverage

1.205x

Exchange Ratio

1.679x

1.696x

1.713x

116.0%

1.730x

2H 2018E

1.732x

2H 2018E

116.0%

114.1%

112.1%

Accretion / (Dilution) Analysis at Various XRs

110.3%

95.7%

108.7%

2019E

$0.68

$1.33

$0.65

1.224x

2019E

95.7%

93.9%

92.2%

90.5%

89.1%

61.9%

Source: Management projections and FactSet as of 8/30/2018

Note: AMGP accretion / (dilution) based on SQ AM Management Coverage. After-tax distributions is distribution from entity less attributable qualified dividends and gains on capital taxes.

Note: 1.679x implied after-tax XR represents a 1.61-4x equity XR and cash consideration of $3.415 / unit. Cash assumed to be used to eliminate unitholder tax liability.

2020E

$1.03

$1.66

$0.63

1.131x

2020E

61.9%

60.7%

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

58.4%

45.4%

2021E

$1.33

$1.94

$0.60

1.119x

2021E

44.3%

43.2%

42.1%

41.1%

30.1%

2022E

$1.70

$2.21

$0.51

1.076x

2022E

30.1%

29.0%

TUDORPICKERING

HOLT&COCHANT BANKING

27.9%

26.9%

53View entire presentation