FY 2018 Fourth Quarter Earnings Call

Q4 FY18 Adjusted-EBITDA: Seating

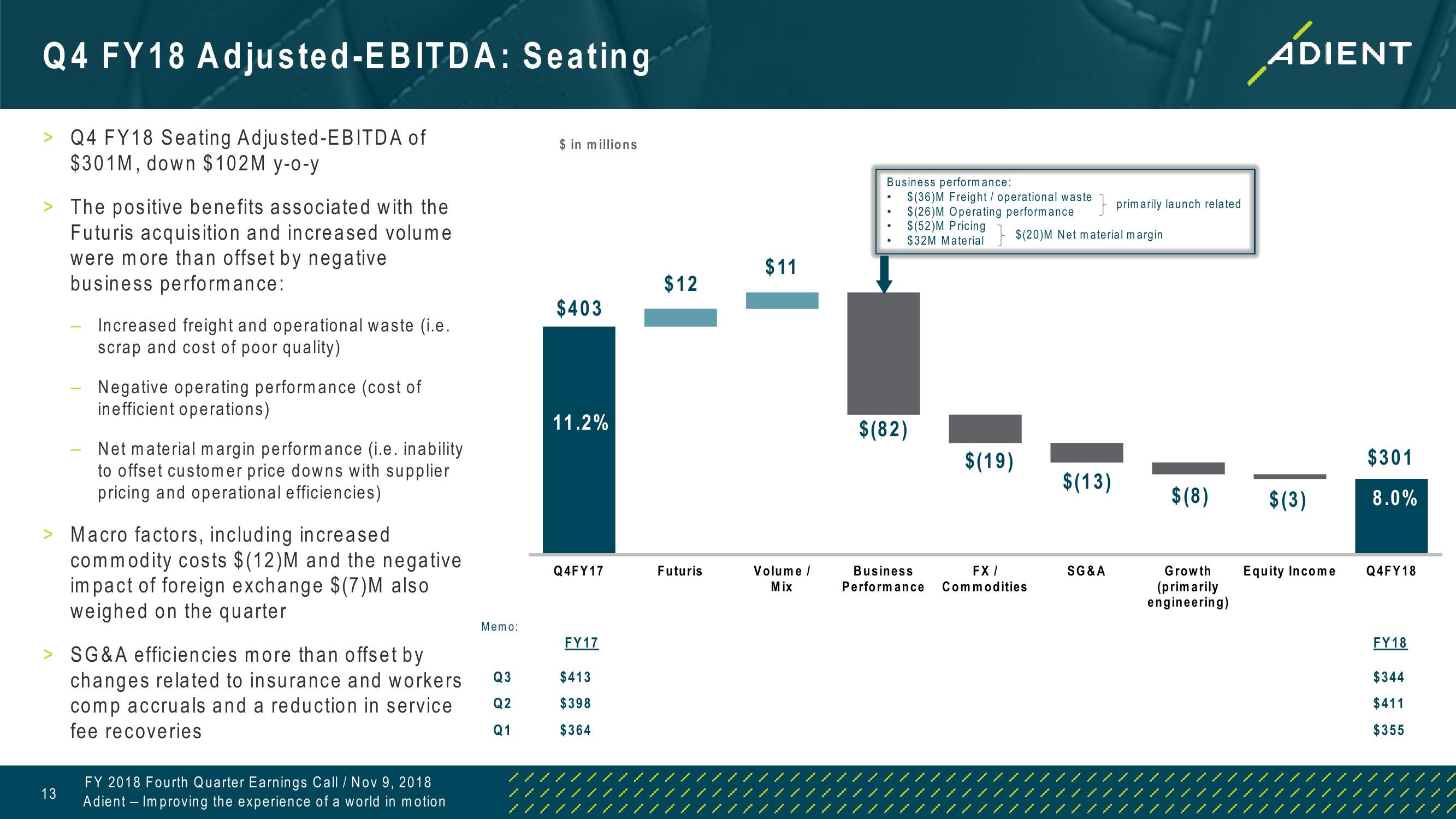

> Q4 FY18 Seating Adjusted-EBITDA of

$301M, down $102M y-o-y

> The positive benefits associated with the

Futuris acquisition and increased volume.

were more than offset by negative

business performance:

Increased freight and operational waste (i.e.

scrap and cost of poor quality)

$ in millions

$11

$12

$403

Negative operating performance (cost of

inefficient operations)

Net material margin performance (i.e. inability

to offset customer price downs with supplier

pricing and operational efficiencies)

> Macro factors, including increased

commodity costs $(12) M and the negative

impact of foreign exchange $(7) M also

weighed on the quarter

Business performance:

$(36)M Freight/ operational waste

$(26)M Operating performance

$(52)M Pricing

primarily launch related

$32M Material $(20)M Net material margin

ADIENT

11.2%

$(82)

$(19)

$301

$(13)

$(8)

$(3)

8.0%

Q4 FY17

Futuris

Volume /

Mix

Business

FX/

Performance Commodities

SG&A

Growth

(primarily

Equity Income

Q4FY18

engineering)

Memo:

FY17

>

SG&A efficiencies more than offset by

changes related to insurance and workers

comp accruals and a reduction in service

fee recoveries

Q3

$413

Q2

$398

Q1

$364

13

FY 2018 Fourth Quarter Earnings Call / Nov 9, 2018

Adient Improving the experience of a world in motion

FY18

$344

$411

$355View entire presentation