LSE Mergers and Acquisitions Presentation Deck

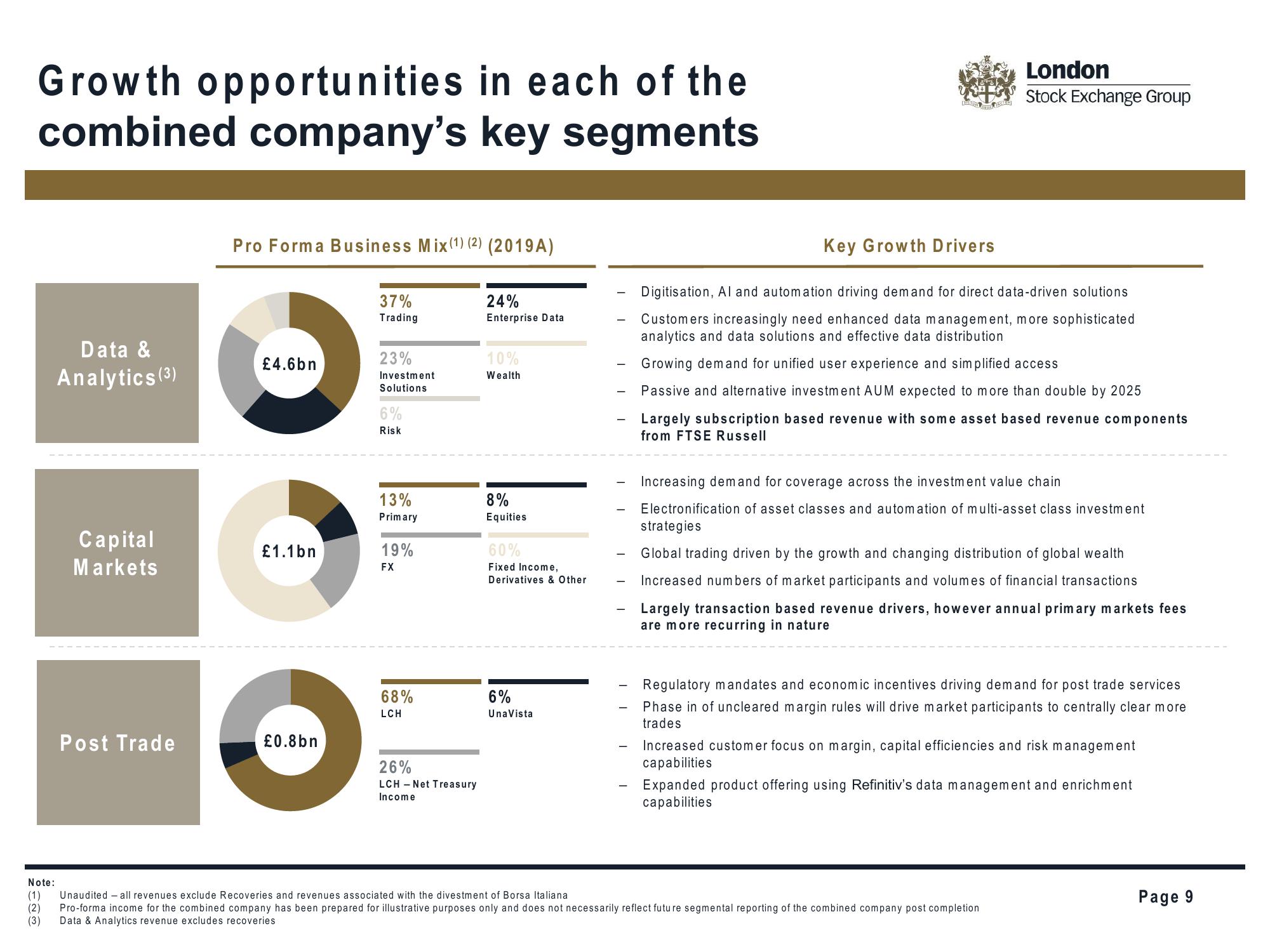

Growth opportunities in each of the

combined company's key segments

Data &

Analytics (3)

Capital

Markets

Post Trade

Pro Forma Business Mix (¹) (2) (2019A)

£4.6bn

£1.1bn

£0.8bn

37%

Trading

23%

Investment

Solutions

6%

Risk

13%

Primary

19%

FX

68%

LCH

26%

LCH-Net Treasury

Income

24%

Enterprise Data

10%

Wealth

8%

Equities

60%

Fixed Income,

Derivatives & Other

6%

UnaVista

Key Growth Drivers

London

Stock Exchange Group

Digitisation, Al and automation driving demand for direct data-driven solutions

Customers increasingly need enhanced data management, more sophisticated

analytics and data solutions and effective data distribution

Growing demand for unified user experience and simplified access

Passive and alternative investment AUM expected to more than double by 2025

Largely subscription based revenue with some asset based revenue components

from FTSE Russell

Increasing demand for coverage across the investment value chain

Electronification of asset classes and automation of multi-asset class investment

strategies

Global trading driven by the growth and changing distribution of global wealth

Increased numbers of market participants and volumes of financial transactions

Largely transaction based revenue drivers, however annual primary markets fees

are more recurring in nature

Regulatory mandates and economic incentives driving demand for post trade services

Phase in of uncleared margin rules will drive market participants to centrally clear more

trades

Increased customer focus on margin, capital efficiencies and risk management

capabilities

Expanded product offering using Refinitiv's data management and enrichment

capabilities

Note:

(1) Unaudited all revenues exclude Recoveries and revenues associated with the divestment of Borsa Italiana.

(2)

Pro-forma income for the combined company has been prepared for illustrative purposes only and does not necessarily reflect future segmental reporting of the combined company post completion

(3) Data & Analytics revenue excludes recoveries

PageView entire presentation