Maersk Investor Presentation Deck

Terminals & Towage - highlights Q1 2020

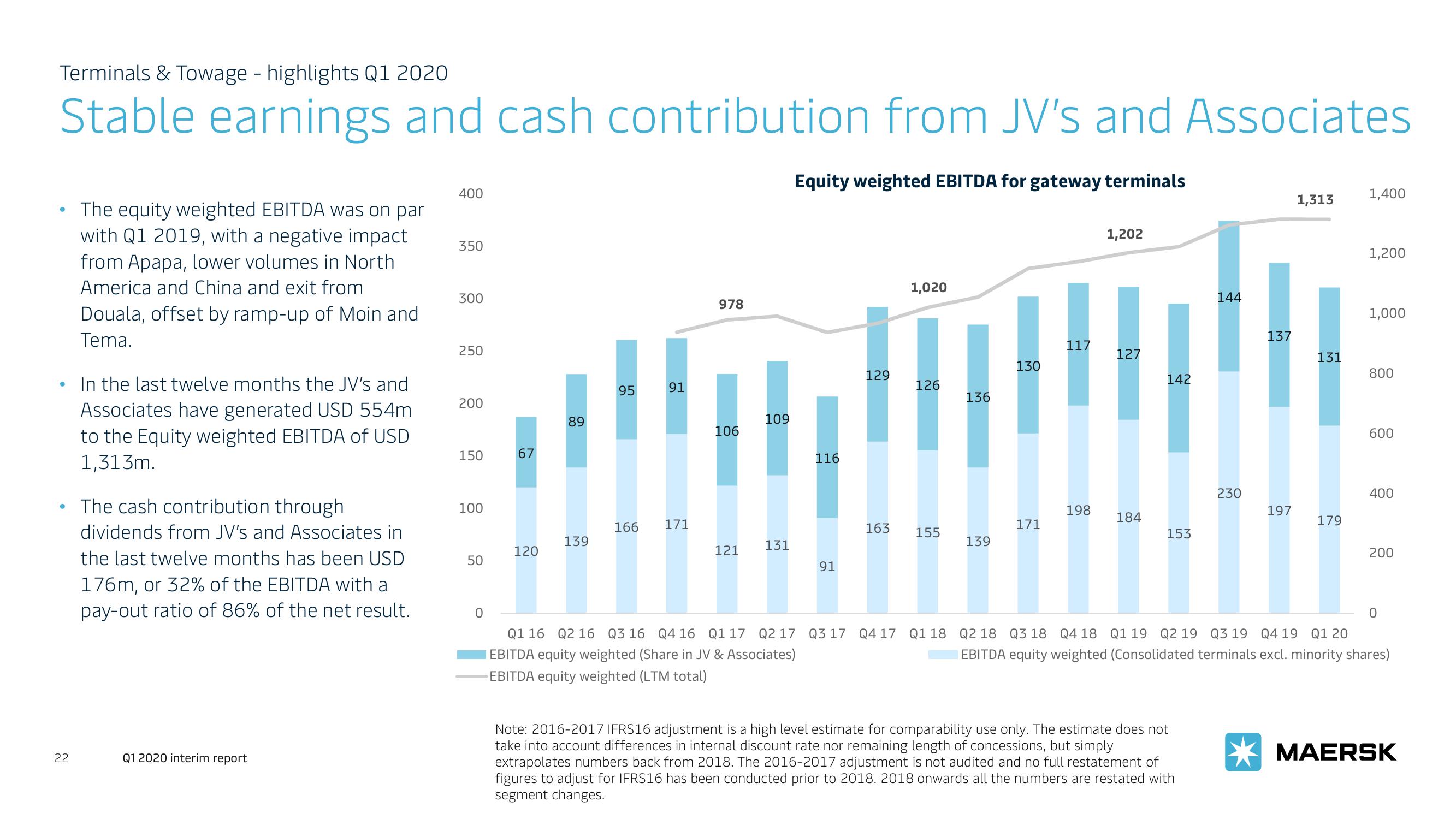

Stable earnings and cash contribution from JV's and Associates

Equity weighted EBITDA for gateway terminals

●

22

The equity weighted EBITDA was on par

with Q1 2019, with a negative impact

from Apapa, lower volumes in North

America and China and exit from

Douala, offset by ramp-up of Moin and

Tema.

In the last twelve months the JV's and

Associates have generated USD 554m

to the Equity weighted EBITDA of USD

1,313m.

The cash contribution through

dividends from JV's and Associates in

the last twelve months has been USD

176m, or 32% of the EBITDA with a

pay-out ratio of 86% of the net result.

Q1 2020 interim report

400

350

300

250

200

150

100

50

0

67

120

89

139

95

91

166 171

978

106

121

109

131

116

91

129

163

1,020

130

TH

136

126

155

139

171

117

198

1,202

127

184

142

153

144

Note: 2016-2017 IFRS16 adjustment is a high level estimate for comparability use only. The estimate does not

take into account differences in internal discount rate nor remaining length of concessions, but simply

extrapolates numbers back from 2018. The 2016-2017 adjustment is not audited and no full restatement of

figures to adjust for IFRS16 has been conducted prior to 2018. 2018 onwards all the numbers are restated with

segment changes.

230

137

197

1,313

131

179

1,400

1,200

1,000

800

600

400

200

0

Q1 16 Q2 16 Q3 16 Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 Q2 18 Q3 18 Q4 18 Q1 19 Q2 19 Q3 19 Q4 19 Q1 20

EBITDA equity weighted (Share in JV & Associates)

EBITDA equity weighted (Consolidated terminals excl. minority shares)

EBITDA equity weighted (LTM total)

MAERSKView entire presentation