Tempo SPAC Presentation Deck

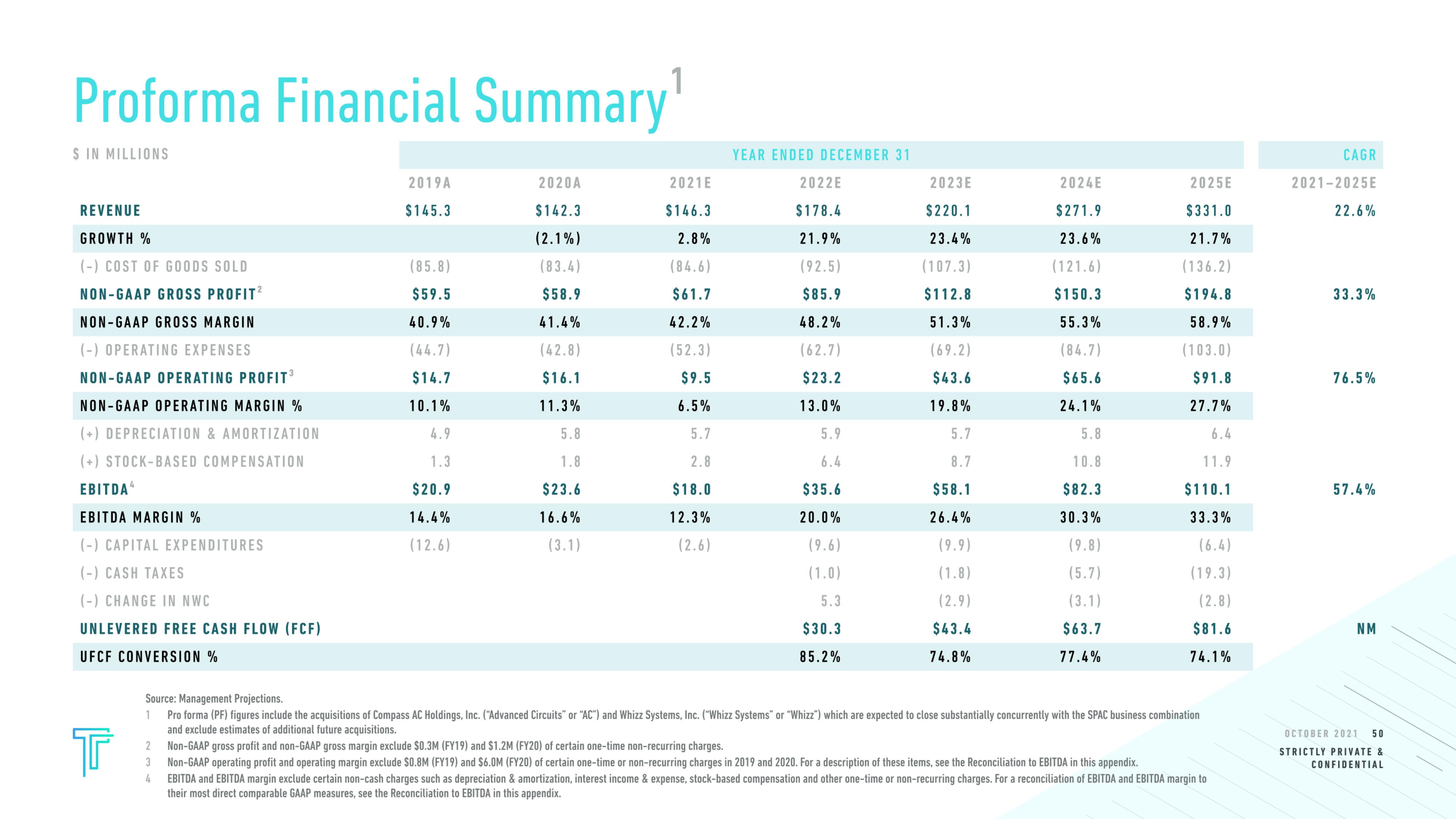

Proforma Financial Summary

$ IN MILLIONS

REVENUE

GROWTH %

(-) COST OF GOODS SOLD

NON-GAAP GROSS PROFIT²

NON-GAAP GROSS MARGIN

(-) OPERATING EXPENSES

NON-GAAP OPERATING PROFIT³

NON-GAAP OPERATING MARGIN %

(+) DEPRECIATION & AMORTIZATION

(+) STOCK-BASED COMPENSATION

EBITDA

EBITDA MARGIN %

(-) CAPITAL EXPENDITURES

(-) CASH TAXES

(-) CHANGE IN NWC

UNLEVERED FREE CASH FLOW (FCF)

UFCF CONVERSION%

T

2

3

2019A

$145.3

4

(85.8)

$59.5

40.9%

(44.7)

$14.7

10.1%

4.9

1.3

$20.9

14.4%

(12.6)

2020A

$142.3

(2.1%)

(83.4)

$58.9

41.4%

(42.8)

$16.1

11.3%

5.8

1.8

$23.6

16.6%

(3.1)

2021E

$146.3

2.8%

(84.6)

$61.7

42.2%

(52.3)

$9.5

6.5%

5.7

2.8

$18.0

12.3%

(2.6)

YEAR ENDED DECEMBER 31

2022E

$178.4

21.9%

(92.5)

$85.9

48.2%

(62.7)

$23.2

13.0%

5.9

6.4

$35.6

20.0%

(9.6)

(1.0)

5.3

$30.3

85.2%

2023E

$220.1

23.4%

(107.3)

$112.8

51.3%

(69.2)

$43.6

19.8%

5.7

8.7

$58.1

26.4%

(9.9)

(1.8)

(2.9)

$43.4

74.8%

2024E

$271.9

23.6%

(121.6)

$150.3

55.3%

(84.7)

$65.6

24.1%

5.8

10.8

$82.3

30.3%

(9.8)

(5.7)

(3.1)

$63.7

77.4%

2025E

$331.0

21.7%

(136.2)

$194.8

58.9%

(103.0)

$91.8

27.7%

Source: Management Projections.

1 Pro forma (PF) figures include the acquisitions of Compass AC Holdings, Inc. ("Advanced Circuits" or "AC") and Whizz Systems, Inc. ("Whizz Systems" or "Whizz") which are expected to close substantially concurrently with the SPAC business combination

and exclude estimates of additional future acquisitions.

Non-GAAP gross profit and non-GAAP gross margin exclude $0.3M (FY19) and $1.2M (FY20) of certain one-time non-recurring charges.

Non-GAAP operating profit and operating margin exclude $0.8M (FY19) and $6.0M (FY20) of certain one-time or non-recurring charges in 2019 and 2020. For a description of these items, see the Reconciliation to EBITDA in this appendix.

EBITDA and EBITDA margin exclude certain non-cash charges such as depreciation & amortization, interest income & expense, stock-based compensation and other one-time or non-recurring charges. For a reconciliation of EBITDA and EBITDA margin to

their most direct comparable GAAP measures, see the Reconciliation to EBITDA in this appendix.

6.4

11.9

$110.1

33.3%

(6.4)

(19.3)

(2.8)

$81.6

74.1%

CAGR

2021-2025E

22.6%

33.3%

76.5%

57.4%

NM

OCTOBER 2021 50

STRICTLY PRIVATE &

CONFIDENTIALView entire presentation