Sonder Investor Presentation Deck

Non-GAAP Reconciliations

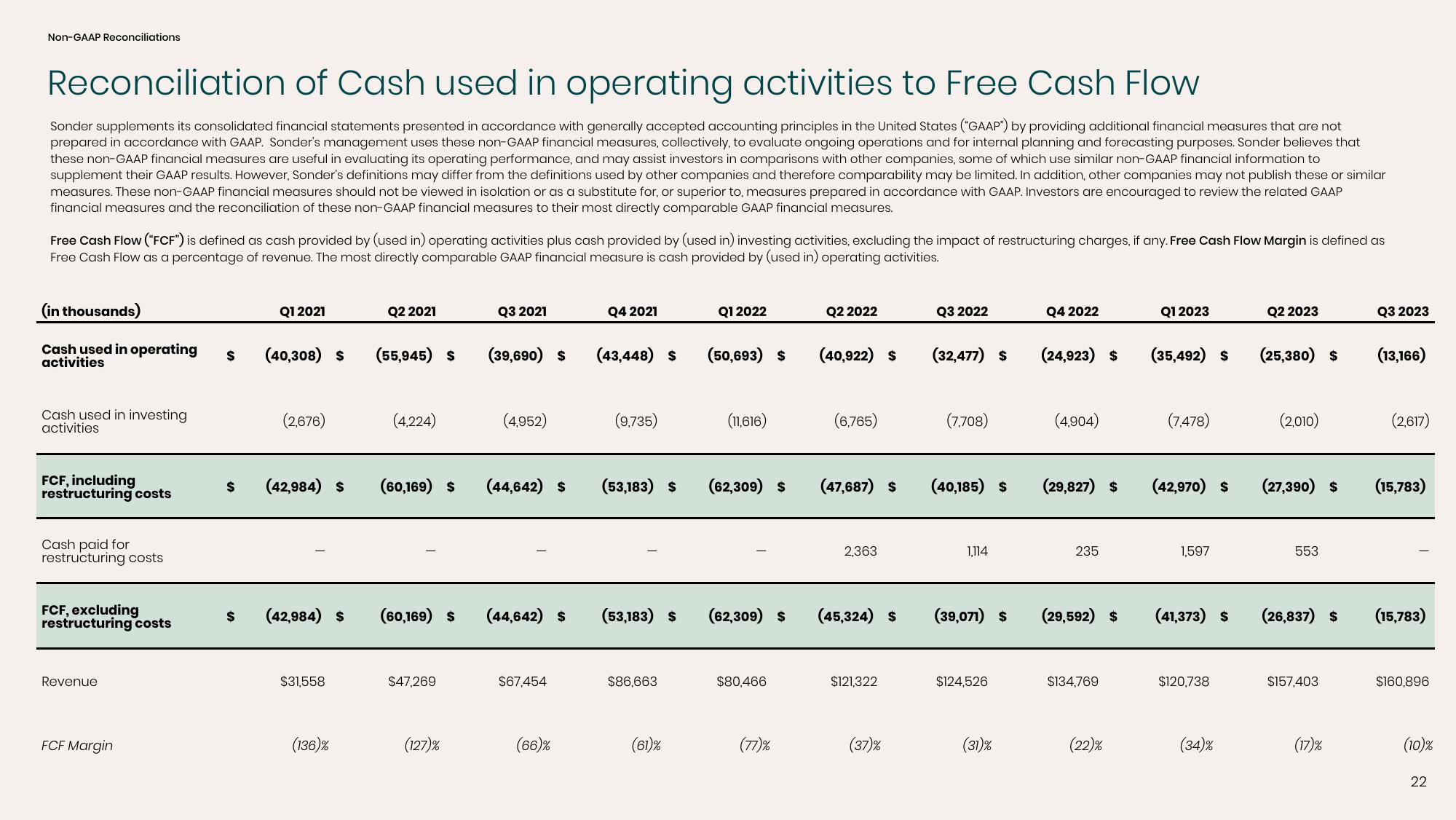

Reconciliation of Cash used in operating activities to Free Cash Flow

Sonder supplements its consolidated financial statements presented in accordance with generally accepted accounting principles in the United States ("GAAP") by providing additional financial measures that are not

prepared in accordance with GAAP. Sonder's management uses these non-GAAP financial measures, collectively, to evaluate ongoing operations and for internal planning and forecasting purposes. Sonder believes that

these non-GAAP financial measures are useful in evaluating its operating performance, and may assist investors in comparisons with other companies, some of which use similar non-GAAP financial information to

supplement their GAAP results. However, Sonder's definitions may differ from the definitions used by other companies and therefore comparability may be limited. In addition, other companies may not publish these or similar

measures. These non-GAAP financial measures should not be viewed in isolation or as a substitute for, or superior to, measures prepared in accordance with GAAP. Investors are encouraged to review the related GAAP

financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures.

Free Cash Flow ("FCF") is defined as cash provided by (used in) operating activities plus cash provided by (used in) investing activities, excluding the impact of restructuring charges, if any. Free Cash Flow Margin is defined as

Free Cash Flow as a percentage of revenue. The most directly comparable GAAP financial measure is cash provided by (used in) operating activities.

(in thousands)

Cash used in operating $

activities

Cash used in investing

activities

FCF, including

restructuring costs

Cash paid for

restructuring costs

FCF, excluding

restructuring costs

Revenue

FCF Margin

Q1 2021

(40,308) $

(2,676)

$ (42,984) S

$ (42,984) S

$31,558

(136)%

Q2 2021

(55,945) $

(4,224)

Q3 2021

$47,269

(39,690) $

(60,169) $ (44,642) S

(127)%

(4,952)

(60,169) $ (44,642) $

$67,454

(66)%

Q4 2021

(43,448) S

(9,735)

(53,183) S

(53,183) $

$86,663

(61)%

Q1 2022

(50,693) $

(11,616)

(62,309) S

(62,309) $

$80,466

(77)%

Q2 2022

(40,922) $

(6,765)

(47,687) $

2,363

(45,324) $

$121,322

(37)%

Q3 2022

(32,477) $

(7,708)

(40,185) $

1,114

$124,526

Q4 2022

(31)%

(24,923) $

(4,904)

(29,827) $

(39,071) $ (29,592) $

235

$134,769

(22)%

Q1 2023

(35,492) $

(7,478)

(42,970) $

1,597

(41,373) $

$120,738

(34)%

Q2 2023

(25,380) $

(2,010)

(27,390) $

553

(26,837) $

$157,403

(17)%

Q3 2023

(13,166)

(2,617)

(15,783)

(15,783)

$160,896

(10)%

22View entire presentation