Nareit’s REITworld 2023 Annual Conference

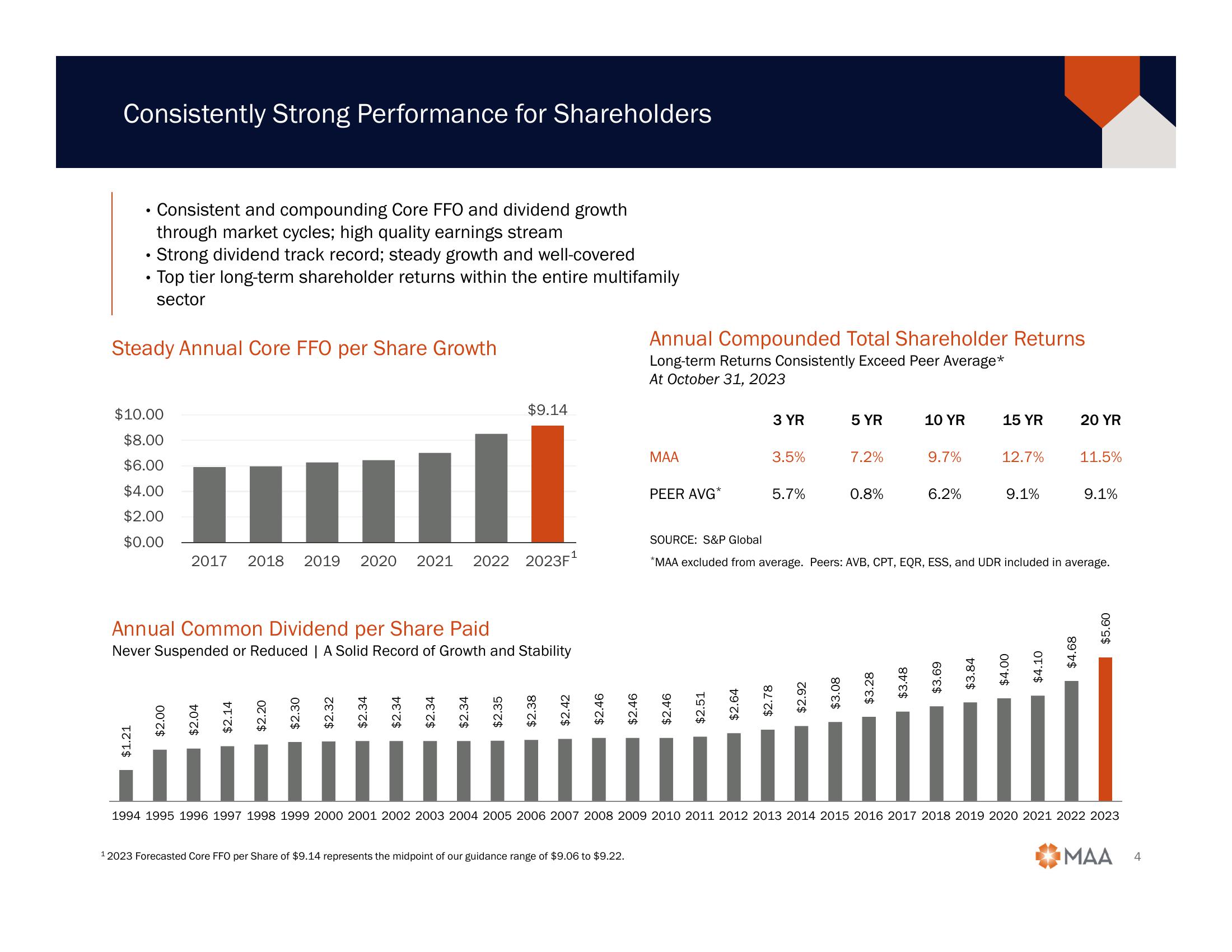

Consistently Strong Performance for Shareholders

• Consistent and compounding Core FFO and dividend growth

through market cycles; high quality earnings stream

• Strong dividend track record; steady growth and well-covered

• Top tier long-term shareholder returns within the entire multifamily

sector

Steady Annual Core FFO per Share Growth

$10.00

$8.00

$6.00

$4.00

$2.00

$0.00

$1.21

Annual Common Dividend per Share Paid

Never Suspended or Reduced | A Solid Record of Growth and Stability

$2.00

11

2017 2018 2019 2020 2021 2022 2023F¹

$2.04

$2.14

$2.20

$2.30

$2.32

$2.34

$2.34

$9.14

$2.34

$2.34

$2.38

$2.42

$2.46

Annual Compounded Total Shareholder Returns

Long-term Returns Consistently Exceed Peer Average*

At October 31, 2023

12023 Forecasted Core FFO per Share of $9.14 represents the midpoint of our guidance range of $9.06 to $9.22.

MAA

PEER AVG*

$2.64

3 YR

3.5%

5.7%

$2.78

$2.92

5 YR

$3.08

7.2%

0.8%

$3.28

10 YR

$3.48

9.7%

6.2%

SOURCE: S&P Global

*MAA excluded from average. Peers: AVB, CPT, EQR, ESS, and UDR included in average.

$3.69

15 YR

$3.84

12.7%

9.1%

$4.00

$4.10

20 YR

$4.68

11.5%

9.1%

$5.60

.…………………………………………

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

MAA 4View entire presentation