Baird Investment Banking Pitch Book

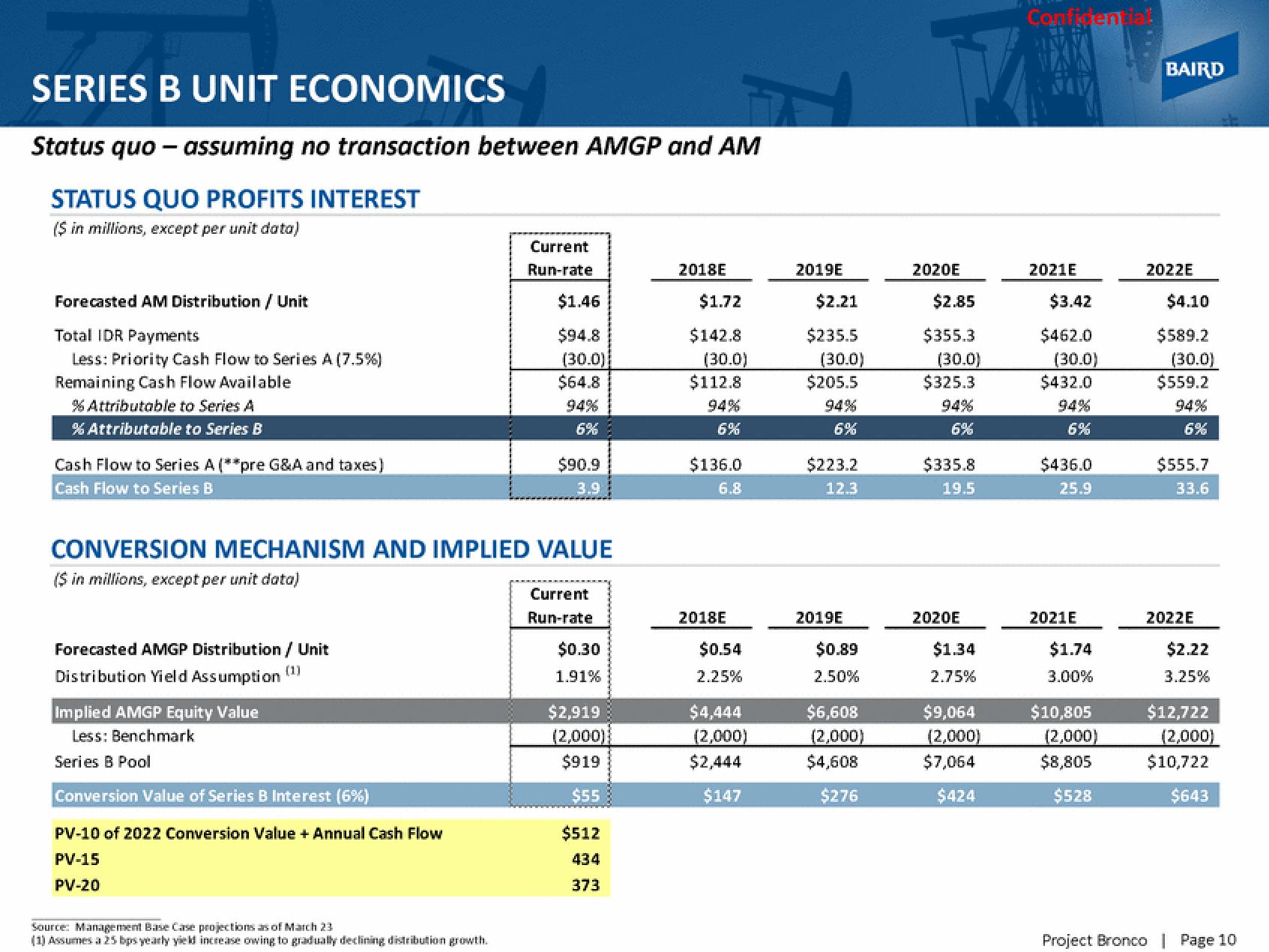

SERIES B UNIT ECONOMICS

Status quo - assuming no transaction between AMGP and AM

STATUS QUO PROFITS INTEREST

($ in millions, except per unit data)

Forecasted AM Distribution / Unit

Total IDR Payments

Less: Priority Cash Flow to Series A (7.5%)

Remaining Cash Flow Available

% Attributable to Series A

% Attributable to Series B

Cash Flow to Series A (**pre G&A and taxes)

Cash Flow to Series B

Forecasted AMGP Distribution / Unit

(1)

Distribution Yield Assumption

Implied AMGP Equity Value

Less: Benchmark

CONVERSION MECHANISM AND IMPLIED VALUE

($ in millions, except per unit data)

Series B Pool

Conversion Value of Series B Interest (6%)

PV-10 of 2022 Conversion Value + Annual Cash Flow

PV-15

PV-20

Current

Run-rate

Source: Management Base Case projections as of March 23

(1) Assumes a 25 bps yearly yield increase owing to gradually declining distribution growth.

$1.46

$94.8

(30.0)

$64.8

94%

6%

$90.9

3.9

Current

Run-rate

$0.30

1.91%

$2,919

(2,000)

$919

$55

$512

434

373

2018E

$1.72

$142.8

(30.0)

$112.8

94%

6%

$136.0

6.8

2018E

$0.54

2.25%

$4,444

(2,000)

$2,444

$147

2019E

$2.21

$235.5

(30.0)

$205.5

6%

$223.2

12.3

2019E

$0.89

2.50%

$6,608

(2,000)

$4,608

$276

2020E

$2.85

$355.3

(30.0)

$325.3

94%

6%

$335.8

19.5

2020E

$1.34

2.75%

$9,064

(2,000)

$7,064

$424

Confidential

2021E

$3.42

$462.0

(30.0)

$432.0

94%

6%

$436.0

25.9

2021E

$1.74

3.00%

$10,805

(2,000)

$8,805

$528

BAIRD

2022E

$4.10

$589.2

(30.0)

$559.2

94%

6%

$555.7

33.6

2022E

$2.22

3.25%

$12,722

(2,000)

$10,722

$643

Project Bronco | Page 10View entire presentation