Ocado Investor Day Presentation Deck

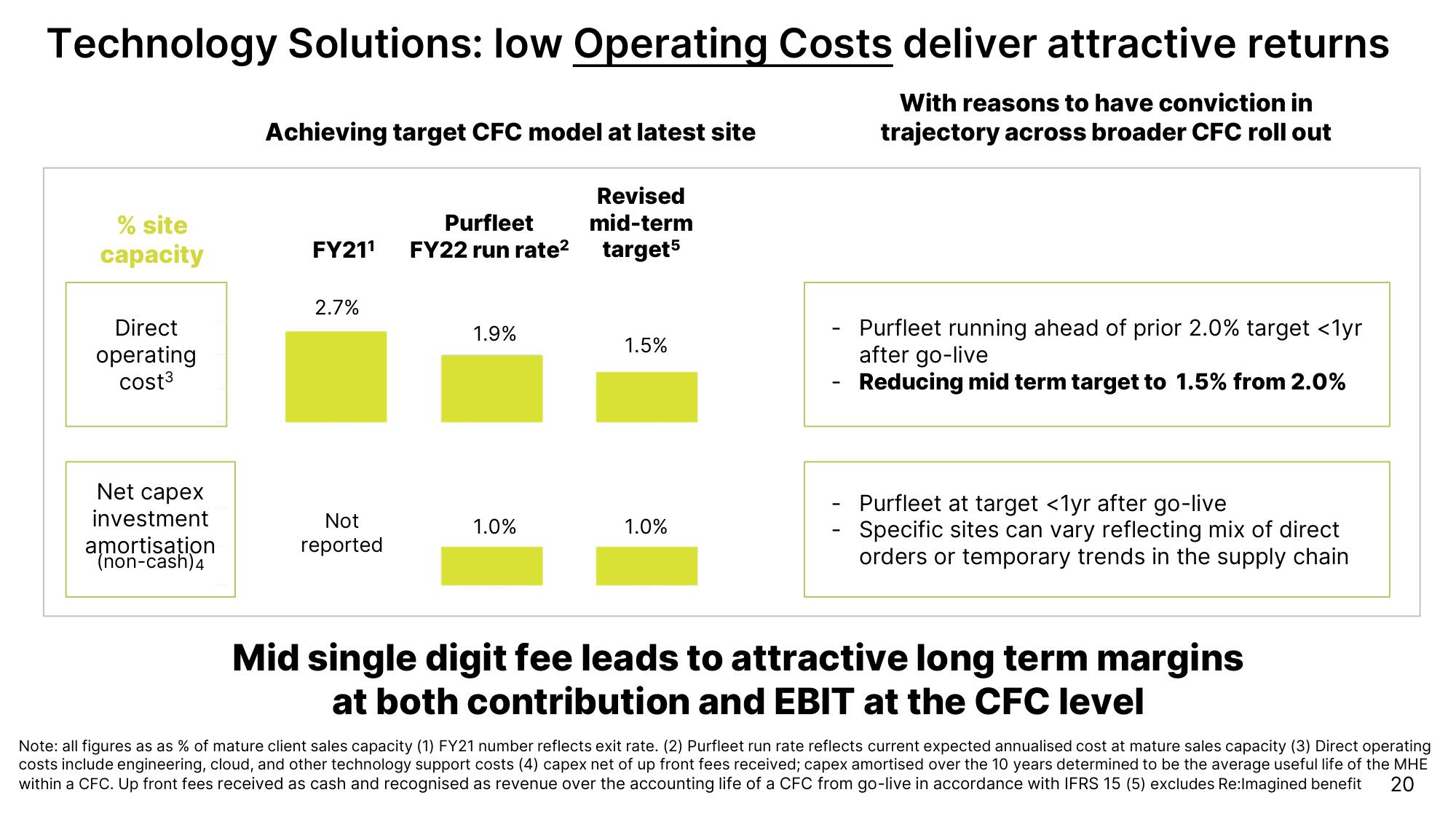

Technology Solutions: low Operating Costs deliver attractive returns

With reasons to have conviction in

trajectory across broader CFC roll out

% site

capacity

Direct

operating

cost³

Net capex

investment

amortisation

(non-cash)4

Achieving target CFC model at latest site

Revised

mid-term

Purfleet

FY21¹ FY22 run rate² target5

2.7%

Not

reported

1.9%

1.0%

1.5%

1.0%

Purfleet running ahead of prior 2.0% target <1yr

after go-live

Reducing mid term target to 1.5% from 2.0%

Purfleet at target <1yr after go-live

Specific sites can vary reflecting mix of direct

orders or temporary trends in the supply chain

Mid single digit fee leads to attractive long term margins

at both contribution and EBIT at the CFC level

Note: all figures as as % of mature client sales capacity (1) FY21 number reflects exit rate. (2) Purfleet run rate reflects current expected annualised cost at mature sales capacity (3) Direct operating

costs include engineering, cloud, and other technology support costs (4) capex net of up front fees received; capex amortised over the 10 years determined to be the average useful life of the MHE

within a CFC. Up front fees received as cash and recognised as revenue over the accounting life of a CFC from go-live in accordance with IFRS 15 (5) excludes Re:Imagined benefit 20View entire presentation