PJT Partners Investment Banking Pitch Book

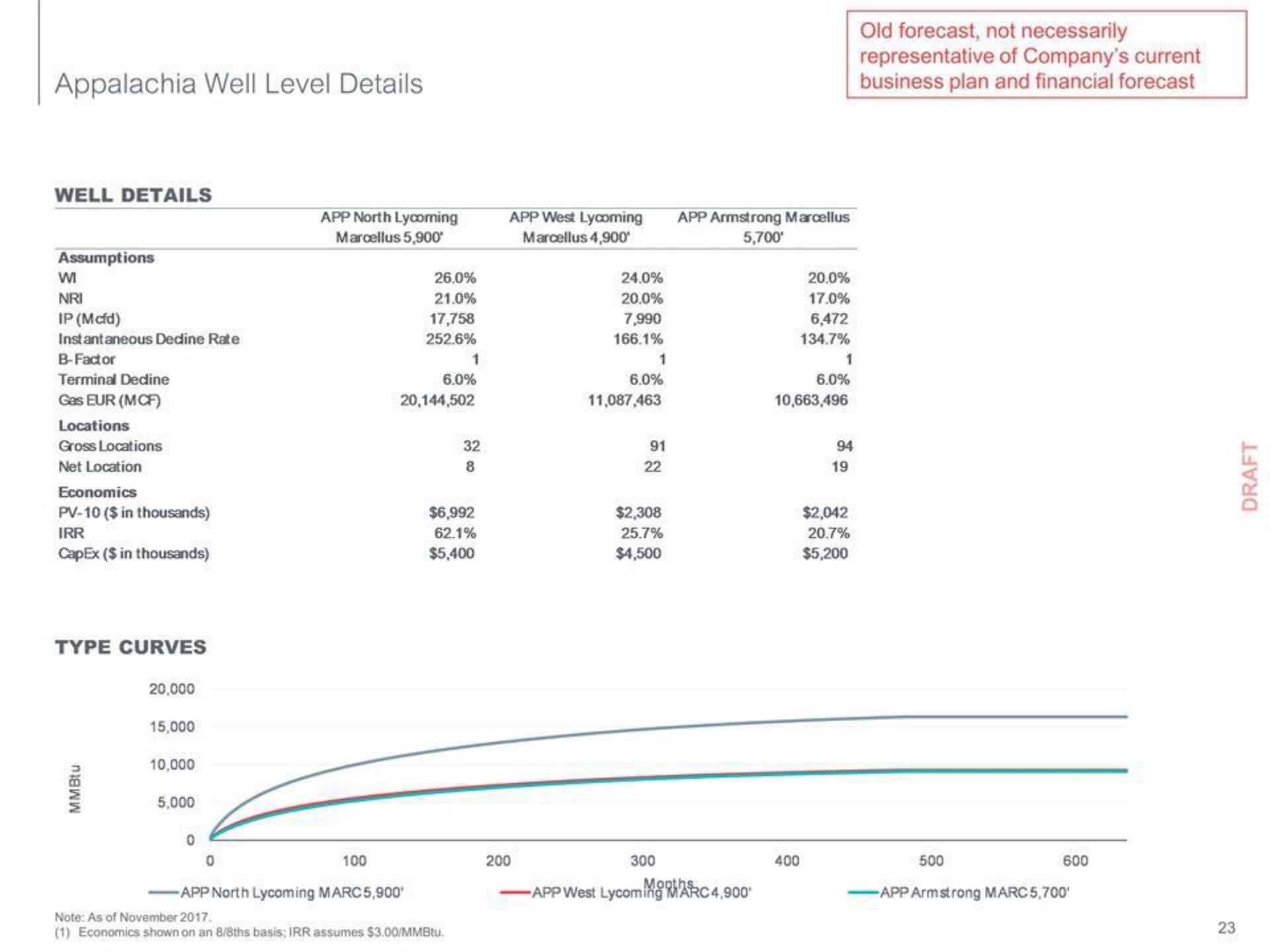

Appalachia Well Level Details

WELL DETAILS

Assumptions

WI

NRI

IP (Mcfd)

Instantaneous Dedine Rate

B-Factor

Terminal Dedine

Gas EUR (MCF)

Locations

Gross Locations

Net Location

Economics

PV-10 ($ in thousands)

IRR

CapEx ($ in thousands)

TYPE CURVES

MMBtu

20,000

15,000

10,000

5,000

0

0

APP North Lycoming

Marcellus 5,900'

100

26.0%

21.0%

17,758

252.6%

-APP North Lycoming MARC 5,900

6.0%

20,144,502

1

Note: As of November 2017.

(1) Economics shown on an 8/8ths basis; IRR assumes $3.00/MMBtu.

32

8

$6,992

62.1%

$5,400

APP West Lycoming

Marcellus 4,900'

200

24.0%

20.0%

7,990

166.1%

1

6.0%

11,087,463

91

22

$2,308

25.7%

$4,500

300

APP Armstrong Marcellus

5,700*

Mooths

-APP West Lycoming MARC 4,900

20.0%

17.0%

6,472

134.7%

1

6.0%

10,663,496

400

94

19

$2,042

20.7%

$5,200

Old forecast, not necessarily

representative of Company's current

business plan and financial forecast

500

600

-APP Armstrong MARC 5,700'

23

DRAFTView entire presentation