Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

Illustrative Valuation

Base Case Assumptions

For Reference

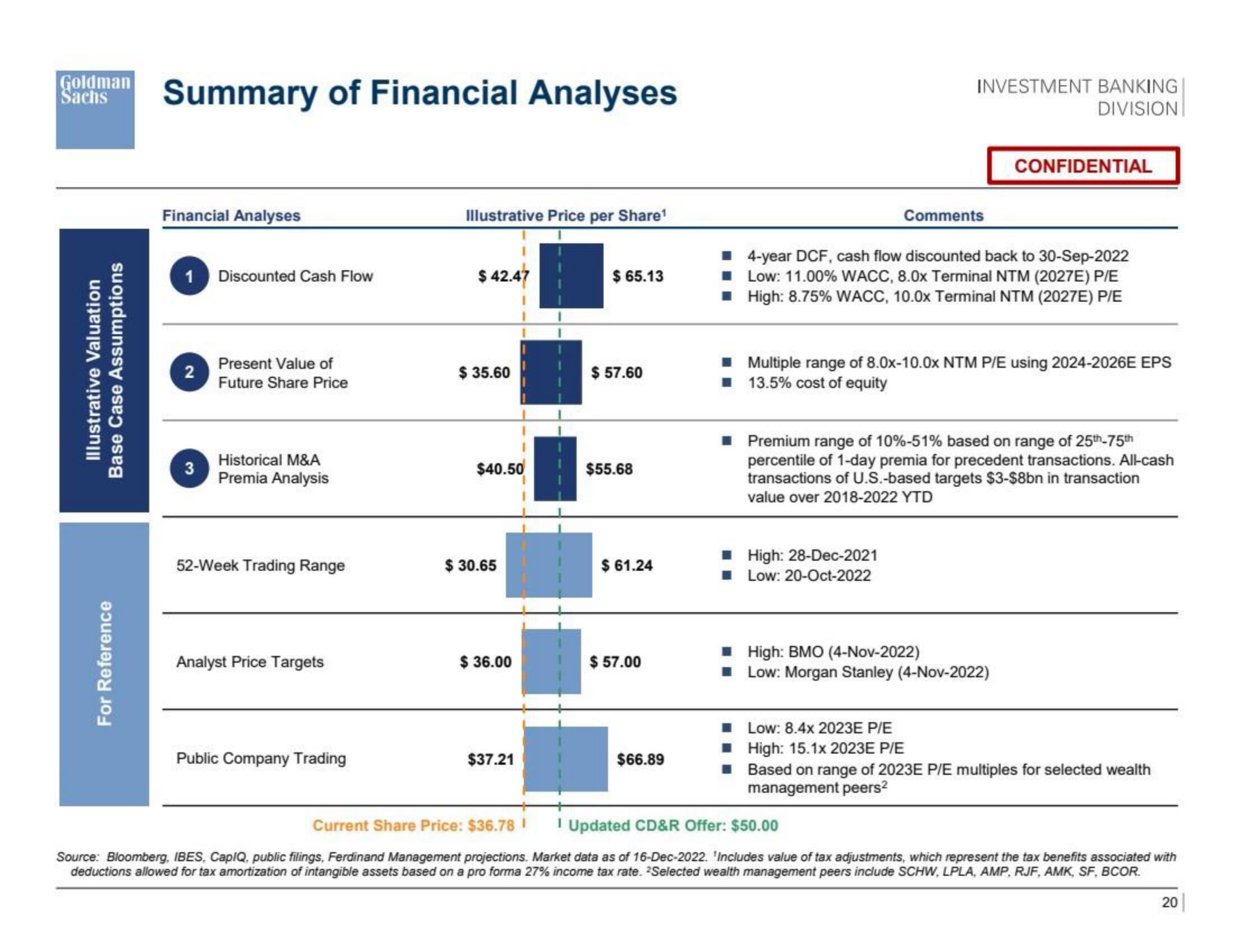

Summary of Financial Analyses

Financial Analyses

1 Discounted Cash Flow

2

3

Present Value of

Future Share Price

Historical M&A

Premia Analysis

52-Week Trading Range

Analyst Price Targets

Public Company Trading

Illustrative Price per Share¹

$ 42.47

$ 35.60

$40.50

$ 30.65

$36.00

$37.21

$ 65.13

$57.60

$55.68

$61.24

$57.00

$66.89

INVESTMENT BANKING

DIVISION

Comments

4-year DCF, cash flow discounted back to 30-Sep-2022

Low: 11.00% WACC, 8.0x Terminal NTM (2027E) P/E

■

■ High: 8.75% WACC, 10.0x Terminal NTM (2027E) P/E

■ High: 28-Dec-2021

■Low: 20-Oct-2022

CONFIDENTIAL

■ Multiple range of 8.0x-10.0x NTM P/E using 2024-2026E EPS

■ 13.5% cost of equity

■ Premium range of 10%-51% based on range of 25th-75th

percentile of 1-day premia for precedent transactions. All-cash

transactions of U.S.-based targets $3-$8bn in transaction

value over 2018-2022 YTD

High: BMO (4-Nov-2022)

■ Low: Morgan Stanley (4-Nov-2022)

■ Low: 8.4x 2023E P/E

■ High: 15.1x 2023E P/E

Based on range of 2023E P/E multiples for selected wealth

management peers²

Current Share Price: $36.78 1 1 Updated CD&R Offer: $50.00

Source: Bloomberg, IBES, CapIQ, public filings, Ferdinand Management projections. Market data as of 16-Dec-2022. 'Includes value of tax adjustments, which represent the tax benefits associated with

deductions allowed for tax amortization of intangible assets based on a pro forma 27% income tax rate. Selected wealth management peers include SCHW, LPLA, AMP, RJF, AMK, SF, BCOR.

20View entire presentation