Main Street Capital Investor Day Presentation Deck

Follow-on Investment Case Studies

Hawk Ridge

Company Description

Initial Transaction

■

Value-added reseller of engineering, design and

manufacturing software and

additive

manufacturing solutions (3D printing)

Provides online training, engineering services

and other value-added services as additional

revenue streams sold alongside software

programs and additive manufacturing solutions

■

Minority recapitalization that allowed the CEO to

obtain a majority equity position and provided full

liquidity to inactive equity owners

CEO sought a financial partner with a long-term

holding period and shared vision for future growth

Acquisition Strategy / Rationale

Multi-pronged acquisition strategy:

Expand geographic footprint

■

■

Drive revenue synergies by upselling into

acquired customer bases

Identify additional ways to monetize

customer base through new service and

product offerings

Representative Acquisitions

Completed ten acquisitions since MAIN's initial

investment, including six significant acquisitions and

four smaller "tuck in" acquisitions

Significantly expanded the company's geographic

coverage

Materially changed and expanded the Company's

service offerings and revenue sources

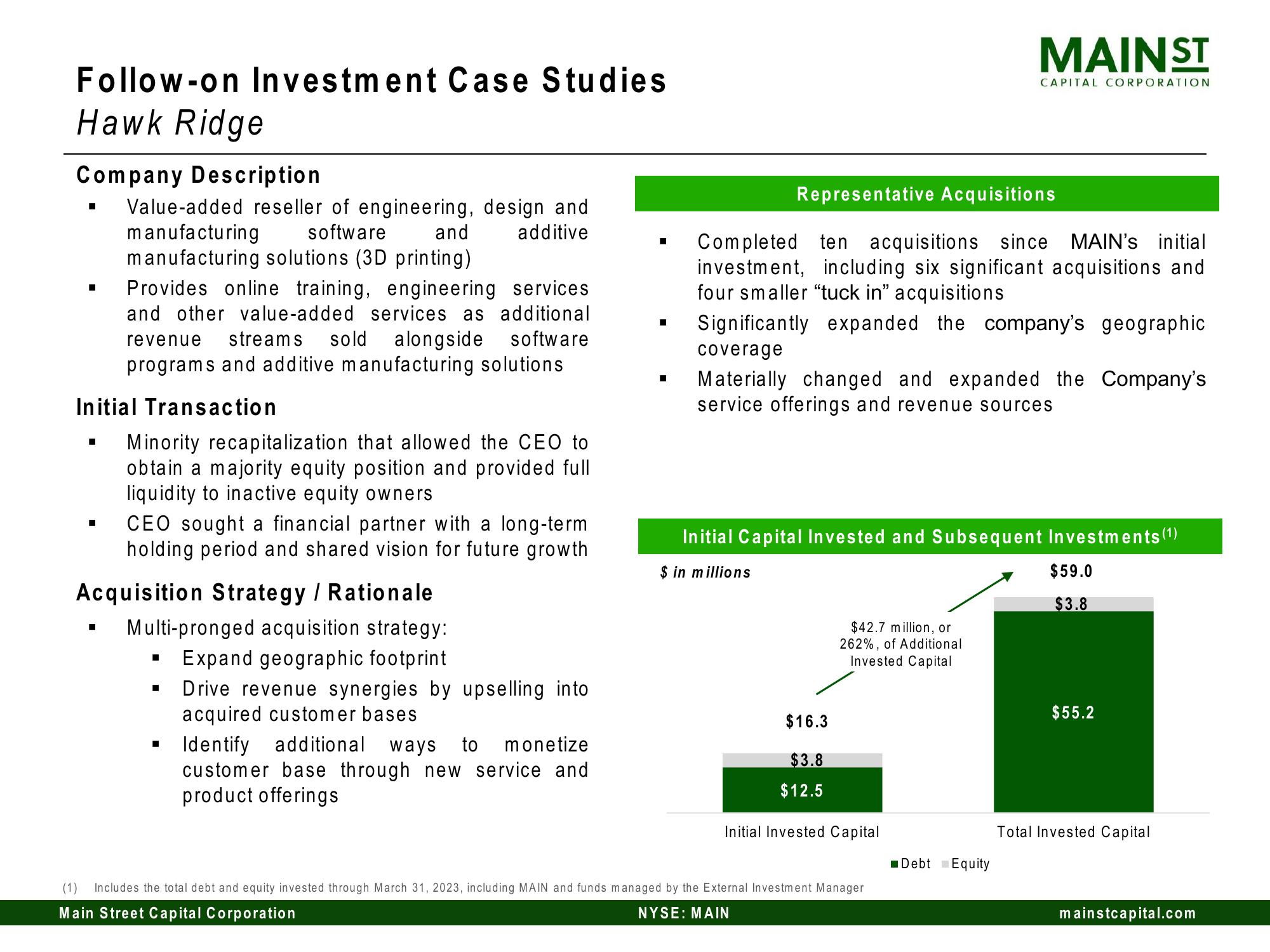

$42.7 million, or

262%, of Additional

Invested Capital

MAIN ST

Initial Capital Invested and Subsequent Investments (¹)

$ in millions

$16.3

$3.8

$12.5

Initial Invested Capital

CAPITAL CORPORATION

(1) Includes the total debt and equity invested through March 31, 2023, including MAIN and funds managed by the External Investment Manager

Main Street Capital Corporation

NYSE: MAIN

■Debt Equity

$59.0

$3.8

$55.2

Total Invested Capital

mainstcapital.comView entire presentation