Apollo Global Management Mergers and Acquisitions Presentation Deck

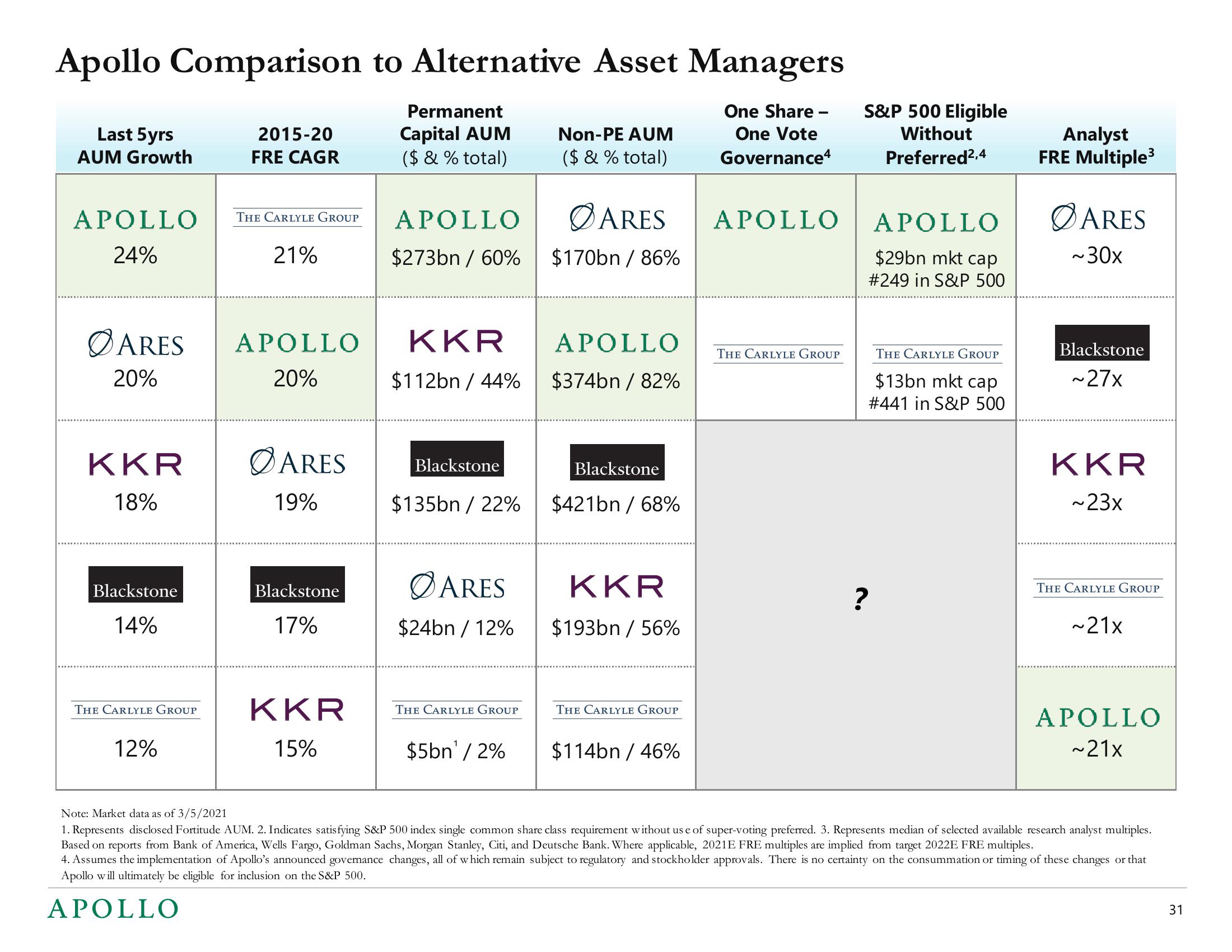

Apollo Comparison to Alternative Asset Managers

One Share -

One Vote

Governance4

Last 5yrs

AUM Growth

APOLLO

24%

ARES

20%

KKR

18%

Blackstone

14%

THE CARLYLE GROUP

12%

2015-20

FRE CAGR

THE CARLYLE GROUP

21%

APOLLO

20%

ARES

19%

Blackstone

17%

KKR

15%

Permanent

Capital AUM

($ & % total)

APOLLO

$273bn / 60%

KKR

$112bn / 44%

Blackstone

$135bn / 22%

ARES

$24bn / 12%

THE CARLYLE GROUP

$5bn¹ / 2%

Non-PE AUM

($ & % total)

ØARES

$170bn / 86%

APOLLO

$374bn / 82%

Blackstone

$421bn / 68%

KKR

$193bn / 56%

THE CARLYLE GROUP

$114bn / 46%

APOLLO

THE CARLYLE GROUP

S&P 500 Eligible

Without

Preferred²,4

?

APOLLO

$29bn mkt cap

# 249 in S&P 500

THE CARLYLE GROUP

$13bn mkt cap

# 441 in S&P 500

Analyst

FRE Multiple³

ARES

~30x

Blackstone

~27x

KKR

~23x

THE CARLYLE GROUP

~21x

APOLLO

~21x

Note: Market data as of 3/5/2021

1. Represents disclosed Fortitude AUM. 2. Indicates satisfying S&P 500 index single common share class requirement without us e of super-voting preferred. 3. Represents median of selected available research analyst multiples.

Based on reports from Bank of America, Wells Fargo, Goldman Sachs, Morgan Stanley, Citi, and Deutsche Bank. Where applicable, 2021E FRE multiples are implied from target 2022E FRE multiples.

4. Assumes the implementation of Apollo's announced governance changes, all of which remain subject to regulatory and stockholder approvals. There is no certainty on the consummation or timing of these changes or that

Apollo will ultimately be eligible for inclusion on the S&P 500.

APOLLO

31View entire presentation