Apollo Global Management Investor Day Presentation Deck

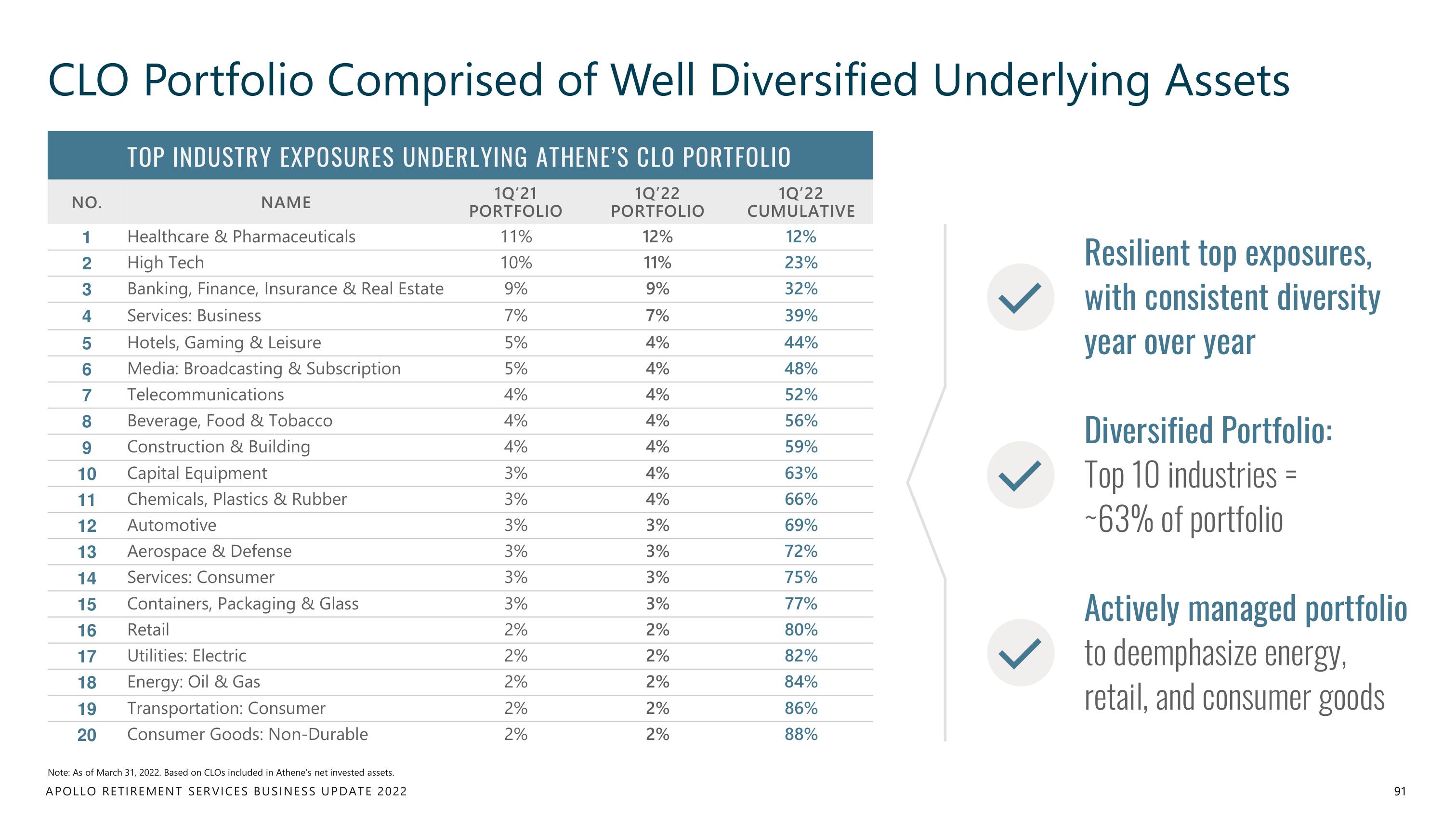

CLO Portfolio Comprised of Well Diversified Underlying Assets

TOP INDUSTRY EXPOSURES UNDERLYING ATHENE'S CLO PORTFOLIO

1Q'22

PORTFOLIO

12%

11%

9%

7%

4%

4%

4%

4%

4%

4%

4%

3%

3%

3%

3%

2%

2%

2%

2%

2%

NO.

NAME

1

Healthcare & Pharmaceuticals

2

High Tech

3 Banking, Finance, Insurance & Real Estate

4

Services: Business

5

Hotels, Gaming & Leisure

6 Media: Broadcasting & Subscription

7

8

9

10 Capital Equipment

11

12

13

14

15

16

17

18

19

20

Telecommunications

Beverage, Food & Tobacco

Construction & Building

Chemicals, Plastics & Rubber

Automotive

Aerospace & Defense

Services: Consumer

Containers, Packaging & Glass

Retail

Utilities: Electric

Energy: Oil & Gas

Transportation: Consumer

Consumer Goods: Non-Durable

Note: As of March 31, 2022. Based on CLOs included in Athene's net invested assets.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

1Q'21

PORTFOLIO

11%

10%

9%

7%

5%

5%

4%

4%

4%

3%

3%

3%

3%

3%

3%

2%

2%

2%

2%

2%

1Q'22

CUMULATIVE

12%

23%

32%

39%

44%

48%

52%

56%

59%

63%

66%

69%

72%

75%

77%

80%

82%

84%

86%

88%

Resilient top exposures,

with consistent diversity

year over year

Diversified Portfolio:

Top 10 industries =

~63% of portfolio

Actively managed portfolio

to deemphasize energy,

retail, and consumer goods

91View entire presentation