Waldencast 2Q22 Investor Results

(in thousands)

Net income/(loss)

Cumulative Pro Forma Adjustments

China carve-out

Pro Forma Net Income

Adjusted For:

Interest expense, net

Income tax benefit

Depreciation and amortization

Transaction costs

Loss on extinguishment of debt

Gain on PPP loan forgiveness

Stock-based compensation expense

Inventory fair value adjustment

Change in fair value of warrant liabilities

Restructuring costs

Loss on disposal of assets

Foreign currency transaction loss

Pro Forma Adjusted EBITDA

MX

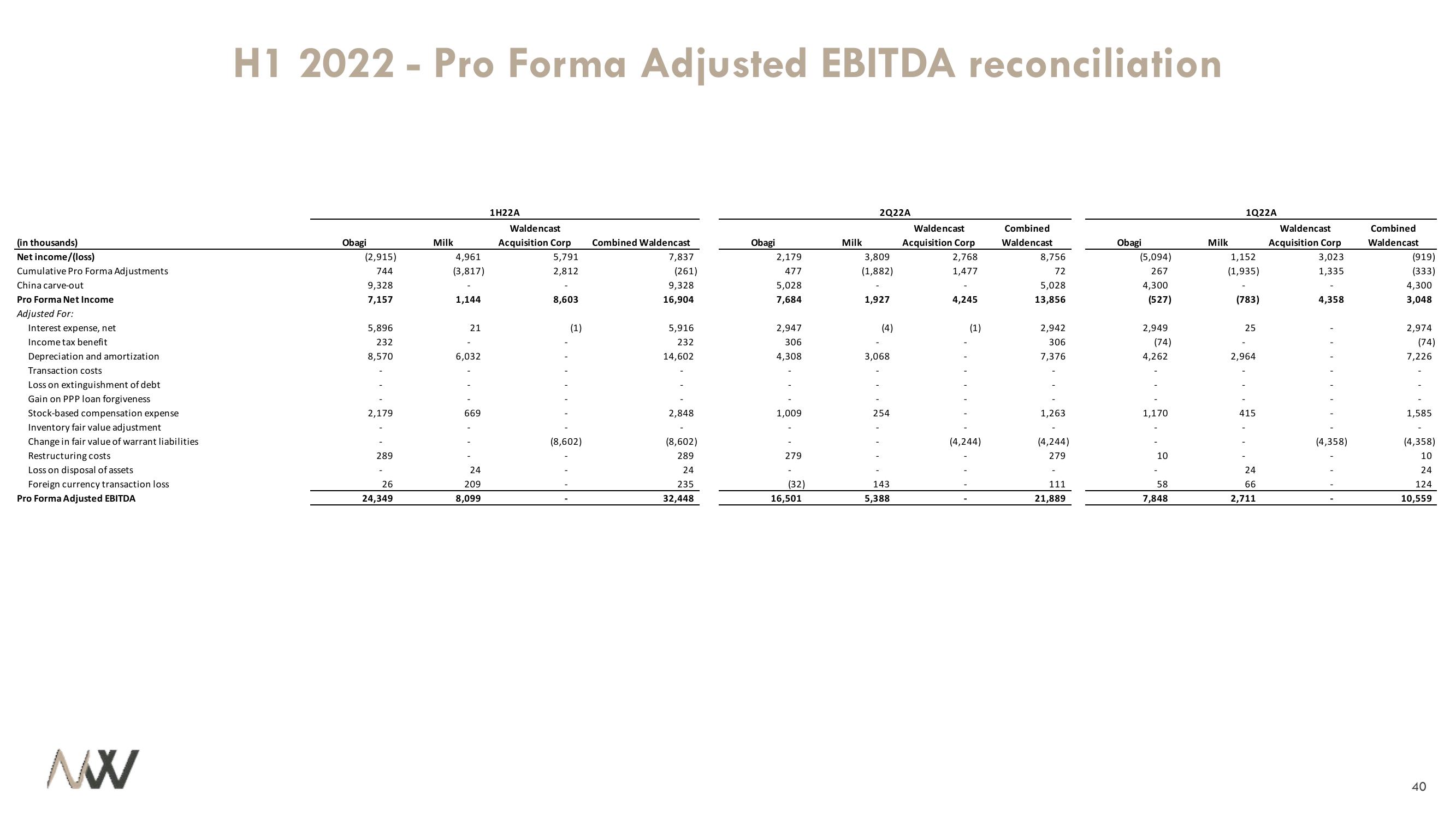

H1 2022 - Pro Forma Adjusted EBITDA reconciliation

Obagi

(2,915)

744

9,328

7,157

5,896

232

8,570

2,179

289

26

24,349

Milk

4,961

(3,817)

1,144

21

6,032

669

24

209

8,099

1H22A

Waldencast

Acquisition Corp

5,791

2,812

8,603

(1)

(8,602)

Combined Waldencast

7,837

(261)

9,328

16,904

5,916

232

14,602

2,848

(8,602)

289

24

235

32,448

Obagi

2,179

477

5,028

7,684

2,947

306

4,308

1,009

279

(32)

16,501

Milk

2Q22A

3,809

(1,882)

1,927

(4)

3,068

254

143

5,388

Waldencast

Acquisition Corp

2,768

1,477

4,245

(1)

(4,244)

Combined

Waldencast

8,756

72

5,028

13,856

2,942

306

7,376

1,263

(4,244)

279

111

21,889

Obagi

(5,094)

267

4,300

(527)

2,949

(74)

4,262

1,170

10

58

7,848

Milk

1Q22A

1,152

(1,935)

(783)

25

2,964

415

24

66

2,711

Waldencast

Acquisition Corp

3,023

1,335

4,358

(4,358)

Combined

Waldencast

(919)

(333)

4,300

3,048

2,974

(74)

7,226

1,585

(4,358)

10

24

124

10,559

40View entire presentation