WPP Investor Day Presentation Deck

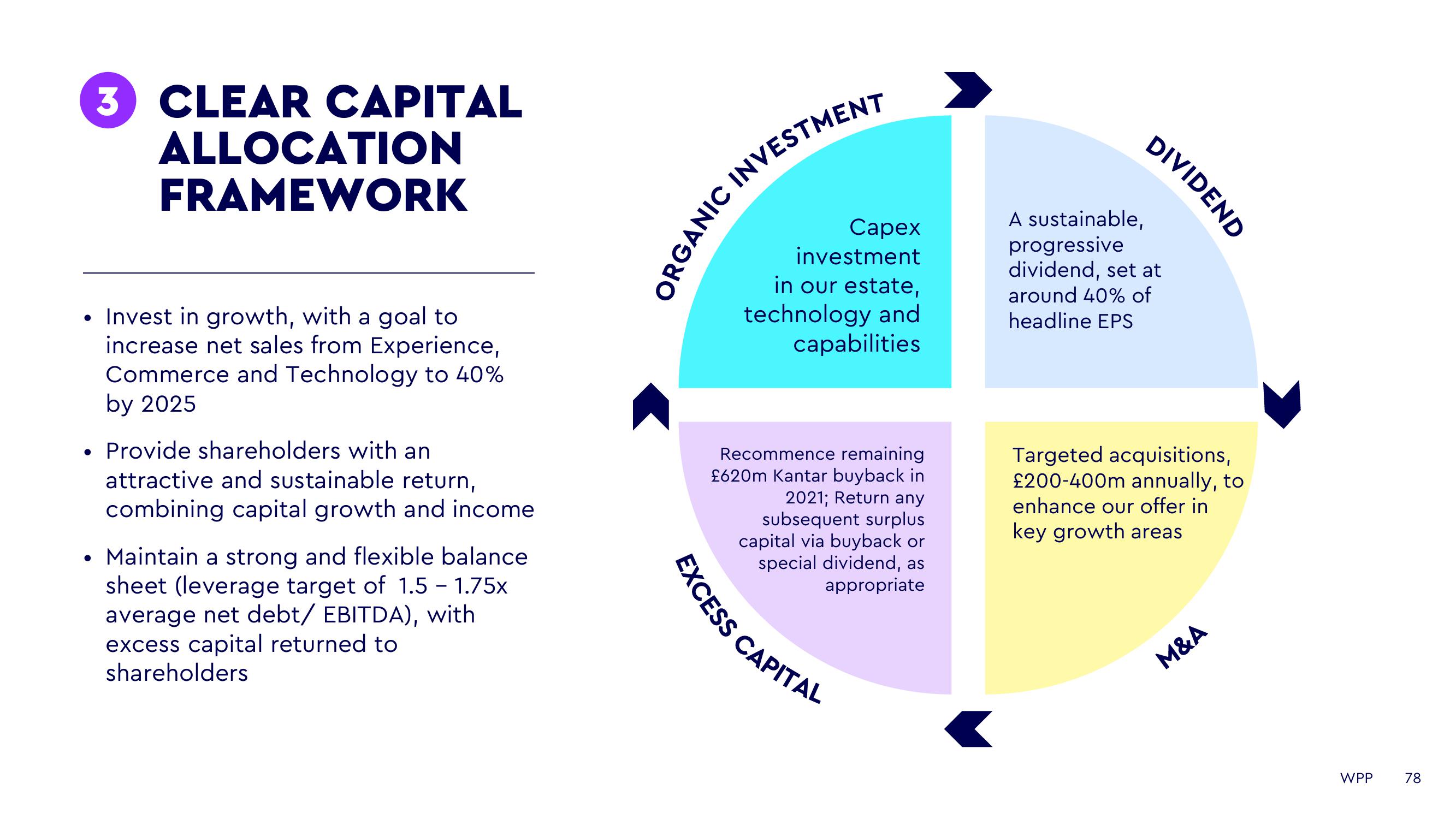

3 CLEAR CAPITAL

ALLOCATION

FRAMEWORK

• Invest in growth, with a goal to

increase net sales from Experience,

Commerce and Technology to 40%

by 2025

• Provide shareholders with an

attractive and sustainable return,

combining capital growth and income.

• Maintain a strong and flexible balance

sheet (leverage target of 1.5 - 1.75x

average net debt/ EBITDA), with

excess capital returned to

shareholders

GANIC INVESTMENT

O

Capex

investment

in our estate,

technology and

capabilities

EXCESS CAPITAL

Recommence remaining

£620m Kantar buyback in

2021; Return any

subsequent surplus

capital via buyback or

special dividend, as

appropriate

DIVIDEND

A sustainable,

progressive

dividend, set at

around 40% of

headline EPS

Targeted acquisitions,

£200-400m annually, to

enhance our offer in

key growth areas

M&A

WPP

78View entire presentation