Hanmi Financial Results Presentation Deck

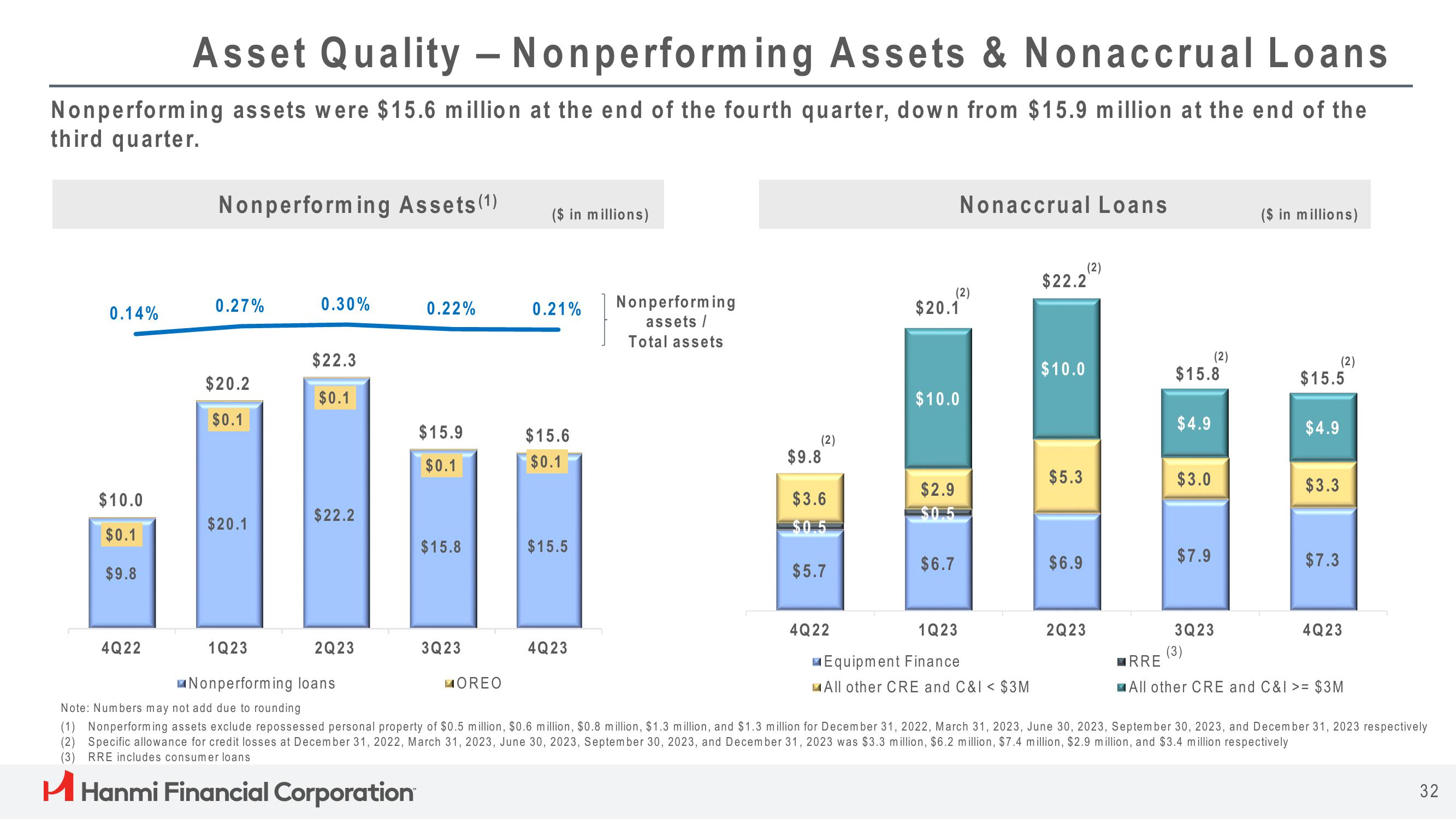

Asset Quality - Nonperforming Assets & Nonaccrual Loans

Nonperforming assets were $15.6 million at the end of the fourth quarter, down from $15.9 million at the end of the

third quarter.

0.14%

$10.0

$0.1

$9.8

Nonperforming Assets (1)

4Q22

0.27%

$20.2

$0.1

$20.1

0.30%

$22.3

$0.1

$22.2

0.22%

2Q23

$15.9

$0.1

$15.8

3Q23

($ in millions)

MOREO

0.21%

$15.6

$0.1

$15.5

Nonperforming

assets/

Total assets

4Q23

(2)

$9.8

$3.6

$5.7

4Q22

(2)

$20.1²

$10.0

$2.9

Nonaccrual Loans

$6.7

1Q23

M Equipment Finance

All other CRE and C&I < $3M

$22.2

$10.0

$5.3

(2)

$6.9

2Q23

$15.8

$4.9

$3.0

$7.9

(2)

3Q23

(3)

($ in millions)

1Q23

Nonperforming loans

Note: Numbers may not add due to rounding

(1) Nonperforming assets exclude repossessed personal property of $0.5 million, $0.6 million, $0.8 million, $1.3 million, and $1.3 million for December 31, 2022, March 31, 2023, June 30, 2023, September 30, 2023, and December 31, 2023 respectively

(2) Specific allowance for credit losses at December 31, 2022, March 31, 2023, June 30, 2023, September 30, 2023, and December 31, 2023 was $3.3 million, $6.2 million, $7.4 million, $2.9 million, and $3.4 million respectively

(3) RRE includes consumer loans

H Hanmi Financial Corporation

(2)

$15.5

$4.9

$3.3

$7.3

4Q23

RRE

All other CRE and C&I >= $3M

32View entire presentation