Snap Inc Results Presentation Deck

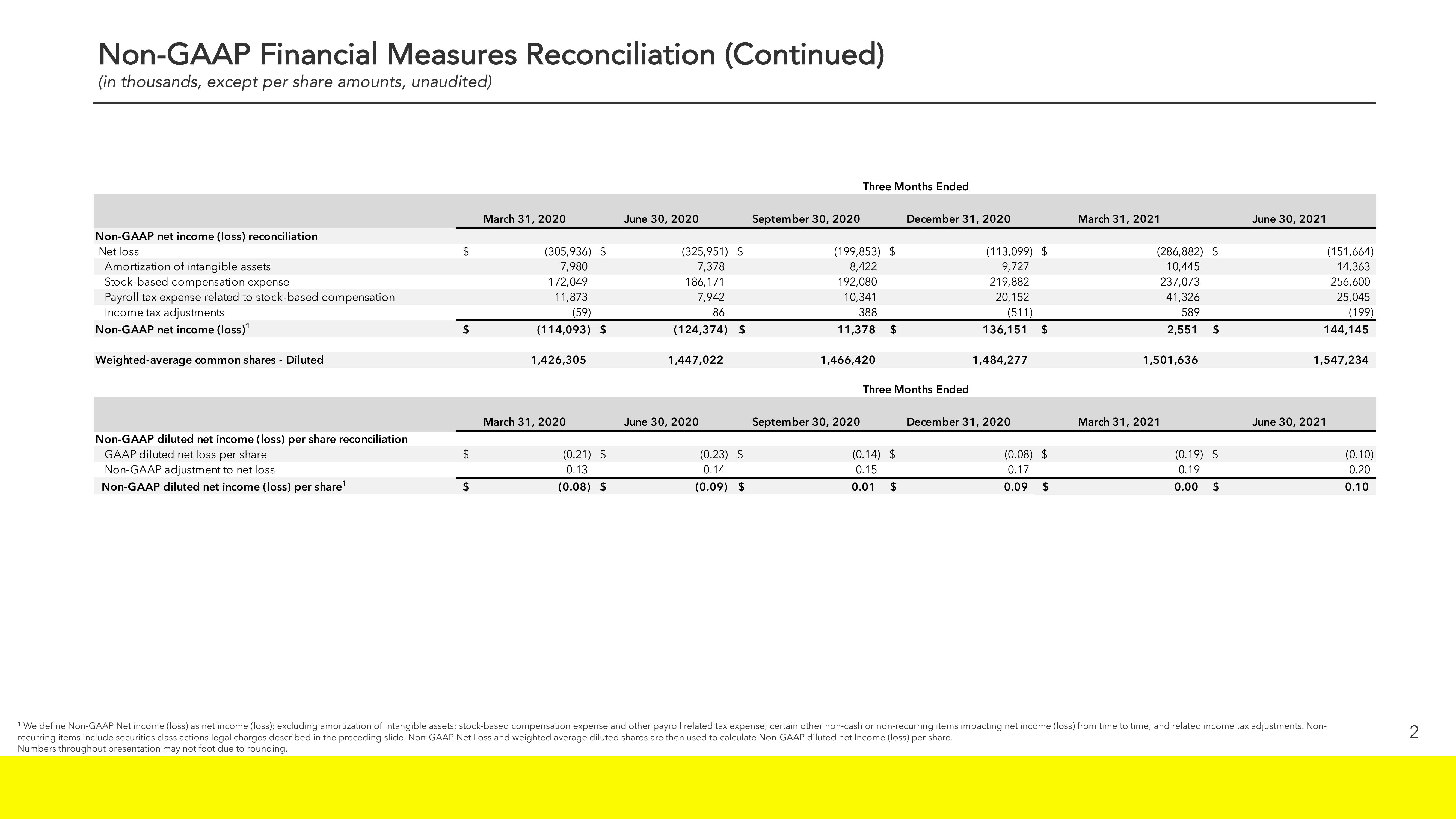

Non-GAAP Financial Measures Reconciliation (Continued)

(in thousands, except per share amounts, unaudited)

Non-GAAP net income (loss) reconciliation

Net loss

Amortization of intangible assets

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Income tax adjustments

Non-GAAP net income (loss)¹

Weighted-average common shares - Diluted

Non-GAAP diluted net income (loss) per share reconciliation

GAAP diluted net loss per share

Non-GAAP adjustment to net loss

Non-GAAP diluted net income (loss) per share¹

$

S

$

$

March 31, 2020

(305,936) $

7,980

172,049

11,873

(59)

(114,093) $

1,426,305

March 31, 2020

(0.21) $

0.13

(0.08) $

June 30, 2020

(325,951) $

7,378

186,171

7,942

86

(124,374) $

1,447,022

June 30, 2020

(0.23) $

0.14

(0.09) $

September 30, 2020

Three Months Ended

(199,853) $

8,422

192,080

10,341

388

11,378

1,466,420

September 30, 2020

$

Three Months Ended

(0.14) $

0.15

0.01

December 31, 2020

$

(113,099) $

9,727

219,882

20,152

(511)

136,151

1,484,277

December 31, 2020

$

(0.08) $

0.17

0.09 $

March 31, 2021

(286,882) $

10,445

237,073

41,326

589

2,551

1,501,636

March 31, 2021

$

(0.19) $

0.19

0.00 $

June 30, 2021

(151,664)

14,363

256,600

25,045

(199)

144,145

1,547,234

June 30, 2021

¹ We define Non-GAAP Net income (loss) as net income (loss); excluding amortization of intangible assets; stock-based compensation expense and other payroll related tax expense; certain other non-cash or non-recurring items impacting net income (loss) from time to time; and related income tax adjustments. Non-

recurring items include securities class actions legal charges described in the preceding slide. Non-GAAP Net Loss and weighted average diluted shares are then used to calculate Non-GAAP diluted net Income (loss) per share.

Numbers throughout presentation may not foot due to rounding.

(0.10)

0.20

0.10

2View entire presentation